Brussels Blows the Roof Off the Bond Market

Abstract:The EU wanted to issue 17 billion euros of debt, and it got demand for 233 billion euros. The German bund has a serious rival.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.

The European Union, as part of its efforts to provide funding for pandemic recovery, has in one stroke made itself a major force in the euro bond markets. Theres a big new beast on the debt circuit.

The bloc wants to raise up to 100 billion euros ($118 billion) to help pay for job support programs in Europe. It could have raised that twice over on Tuesday. Instead, the European Commission issued 17 billion euros of new social-linked bonds — known as SURE — at 10- and 20-year maturities. Demand was incredible, topping 233 billion euros ($275 billion). Thats a record for any European bond, despite the negative yield on offer for the 10-year debt and the barely positive yield on the 20-year.

{6}

It shows the depth of demand for risk-free assets as this AAA-rated entity provides an excellent alternative to German Bunds, the benchmark for European debt (until now, at least). Foreign demand, particularly from central banks having to invest reserves in euros, will have been strong as these new bonds offer yields that are still 35-50 basis points higher than German debt, which is even deeper into negative territory.

{6}

It won‘t hurt that the European Central Bank can buy up to half of any EU debt in its vast quantitative easing programs. Investors know there’s a backstop.

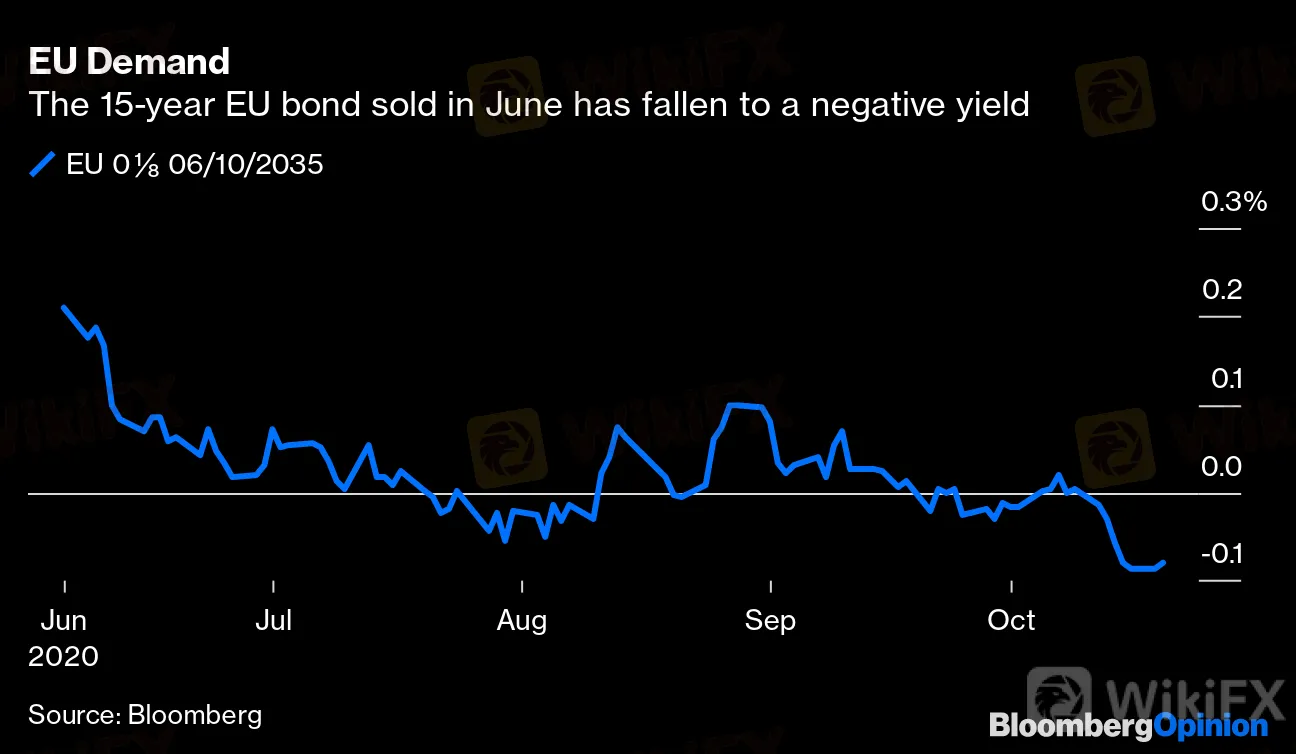

EU Demand

The 15-year EU bond sold in June has fallen to a negative yield

{13}

Source: Bloomberg

{13}

Even though the Commission wanted to make its debut sale of pandemic-linked debt as attractive as possible, the SURE bonds were only priced a couple of basis points above its existing debt. Investors clearly like this issuer, which bodes well for the much bigger sales to come next year to fund the EUs 750-billion euro Pandemic Recovery Fund.

The EU now becomes part of a big five of issuers in Europe, alongside Italy, France, Germany and Spain. It could be the biggest European seller in 2021, with nearly 300 billion euros possible — a third of which will be designated green bonds. It will also become the largest social-linked bond issuer in the world. The SURE program will be nearly double the $72 billion of total social-bond issuance this year so far.

{18}

Turning Negative

{18}

There is close to a record $16.8 trillion of negative-yielding debt globally

Source: Bloomberg Barclays

{777}

It seems staggering that there‘s such keen interest for long-dated debt that will pay back less than the initial amount invested. But negative-yielding debt is close to an all-time high of $16.8 trillion globally, driven by bonds from EU countries offering sub-zero returns. Even Italian debt, the highest yielding of the major EU issuers, offers less than zero out to four year maturities. In this market, you’re onto a winner if your debt is only slightly negative.

{777}

The timing of this weeks sale was perfect, too, as there are 56 billion euros of redemptions of European government debt falling due next week, with relatively little new supply to compete with.

This is a major boost for Europes ability to recover from the pandemic, as it illustrates its hugely expensive fiscal programs can be funded with confidence. Welcome to the EU as an issuer in its own right.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Marcus Ashworth at mashworth4@bloomberg.net

To contact the editor responsible for this story:

James Boxell at jboxell@bloomberg.net

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

IG

FOREX.com

SMART BALANCE

TVR

BBI Trading

FP Markets

IG

FOREX.com

SMART BALANCE

TVR

BBI Trading

FP Markets

WikiFX Broker

IG

FOREX.com

SMART BALANCE

TVR

BBI Trading

FP Markets

IG

FOREX.com

SMART BALANCE

TVR

BBI Trading

FP Markets

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator