Charts That Show Troubles Presented in South Africas Budget

Abstract:South African Finance Minister Tito Mboweni has presented a special adjustment budget after the coronavirus pandemic and measures to curb its spread wreaked havoc on the economy and state finances.

South African Finance Minister Tito Mboweni has presented a special adjustment budget after the coronavirus pandemic and measures to curb its spread wreaked havoc on the economy and state finances.

While the supplementary budget documents released on Wednesday were only half of the more than 200 pages that are usually published in the main budget review, and lacked key forecasts beyond this year, there was enough to show the troubled state of the countrys economy.

The following charts show some of the numbers Mboweni presented to lawmakers.

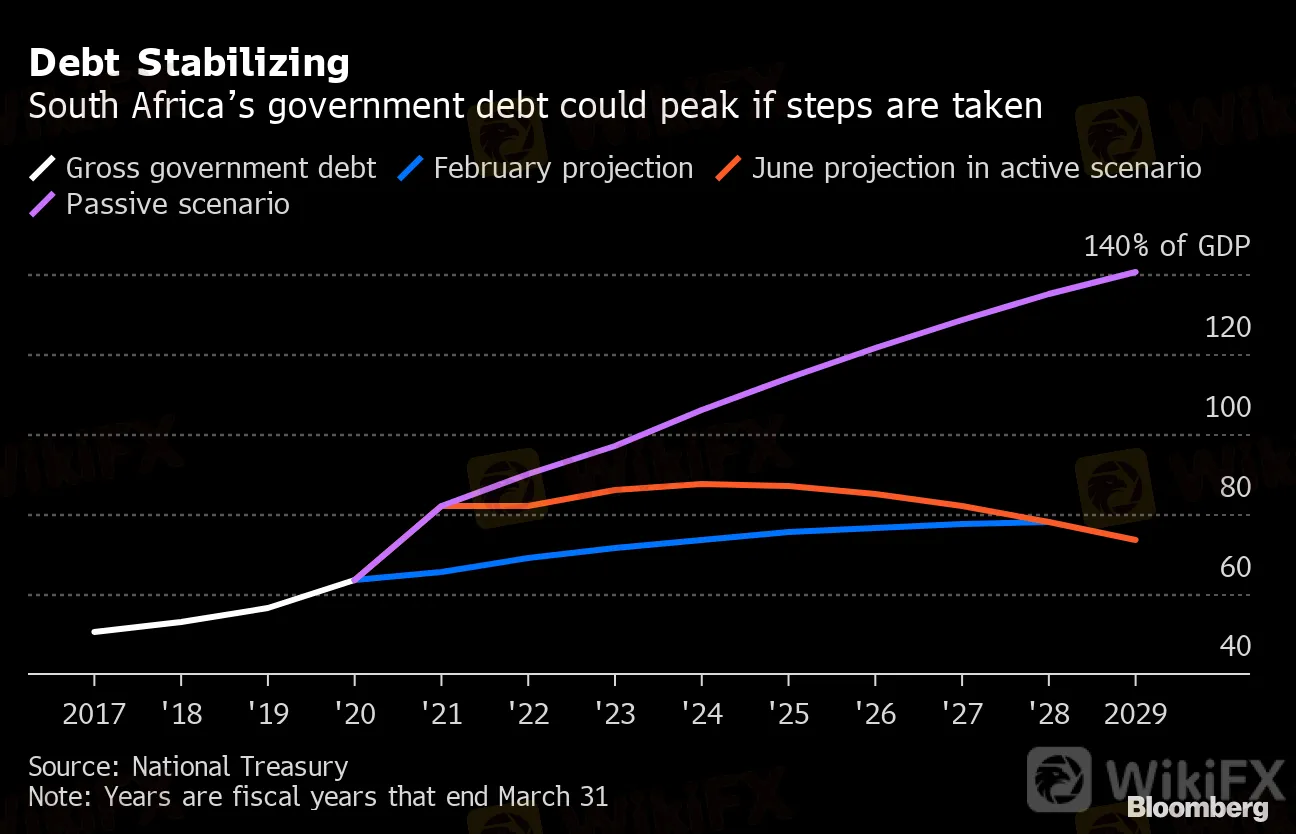

Debt Stabilizing

South Africas government debt could peak if steps are taken

Source: National Treasury

Note: Years are fiscal years that end March 31

While the minister warned last week that the country could slump into a sovereign-debt crisis in four years, he said on Wednesday total debt could stabilize at 87.4% of gross domestic product by 2023-24 -- if the government takes active steps to manage its finances. Failing that, the debt trajectory will keep rising, topping 140% by the end of the decade.

“In the passive scenario, debt continues to rise, and debt-service costs outstrip spending on social and economic priorities,” the Treasury said in the review. “In the active scenario, government acts rapidly to stabilize debt by reducing spending and enacting economic reforms.”

Deficit Blowout

The coronavirus will push South Africa's budget gap over wartime levels

Source: Moody's Investors Service, South African Reserve Bank, S&P Global Ratings, Fitch Ratings, International Monetary Fund

Note: IMF forecast is for 2020 calendar year, others for fiscal year ending March 2021

One of the key numbers Mboweni presented was the updated forecast for the consolidated budget deficit. At 15.7% of GDP for 2020-21, the Treasury‘s projection is now more than double what it forecast in February and is bigger than most other recent estimates. The largest shortfall on record was 11.6% of GDP in 1914, followed by 10.4% in 1940. The document didn’t give the consolidated deficit for 2021-22 and beyond.

The Treasury now projects the economy will contract by 7.2% this year, even worse than during the Great Depression. That will add to inequality and unemployment, which surged to a 17-year high in the first quarter even before a lockdown that shuttered most businesses and led to massive job losses. The International Monetary Fund is even more pessimistic, cutting its forecast for a contraction to 8% from 5.8% in April.

“Borrowing more is not the solution, cutting more is not the solution,” Treasury Director-General Dondo Mogajane told reporters. “The solution lies in us growing the economy, ensuring that our growth agenda is enhanced. Thats the solution: growing, growing, growing the economy.”

More Support

South Africa's government is counting on $7 billion from multilaterals

Source: National Treasury

Note: Only the New Development Bank has approved funding yet

South Africa has softened its opposition to asking for help from institutions such as the IMF and World Bank and will now seek even more from these multilateral lenders than the $5 billion the Treasury initially said it would. The government intends to borrow $7 billion from international finance institutions to support the pandemic response, Mboweni said.

That includes $4.2 billion from the IMF. The lender‘s staff will make a submission about South Africa’s funding early in July and World Bank support is likely to follow approval of the IMF funding, he said.

— With assistance by Zoe Schneeweiss

(Updates with size and scope of deficit in paragraph below deficit chart)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

End of USD Dominance Amid Escalating Geopolitical Risks

Caution in Online Trading: Intersphere Enterprises Alleged Scam

WikiFX Forex Rights Protection Day has received extensive attention!

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator