Too Early to Short Gold Despite Demand Plunge

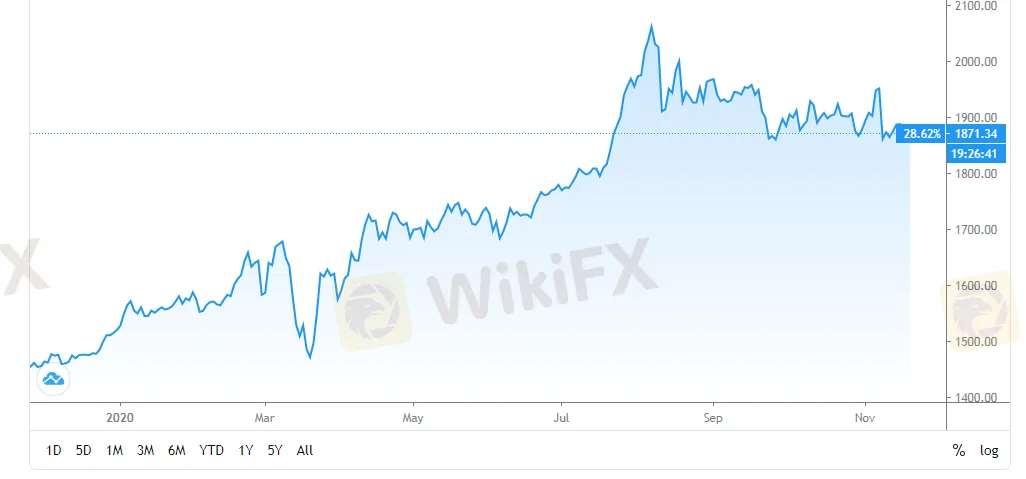

Abstract:The recent positive news on the Covid-19 vaccine has weighed on the gold price, dragging it down to as low as $1,870 on Wednesday.

WikiFX News (19 Nov.) - The recent positive news on the Covid-19 vaccine has weighed on the gold price, dragging it down to as low as $1,870 on Wednesday. But the precious metal still holds upside momentum amid the global low-interest rates and the rising balance sheets.

Moderna announced this week that its vaccine was 94.5% effective against Covid-19. The key progress in the vaccine will lift the economy but punish gold because the yellow metal has been regarded as a hedge asset against the inflation.

According to Singapores non-oil domestic export (NODX) released recently, the country registered a 61% plunge in non-monetary gold shipments in October, reflecting a reduction in demand for investment gold.

Nonetheless, it‘s too early to short gold. Data from the Fed shows that the country’s balance sheet has a size of $7 trillion. Besides the Fed, global central banks have been growing their books rapidly with a potential increase of 30% this year, according to CrossBorder Capital.

The institution also stated that the rise in the gold price was just a matter of time as global governments and central banks continued to launch aggressive fiscal-stimulus packages, increase the money supply, and expand their balance-sheets and deficits.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Gold Trend

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Market Technically Analysis

The trend of gold on the daily chart is in line with technical requirements.

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator