RBNZ Rate Decision Buoys NZD/USD

Abstract:On Wednesday, the Reserve Bank of New Zealand (RBNZ) announced its rate decision for November, which held the official cash rate at 0.25%, as expected.

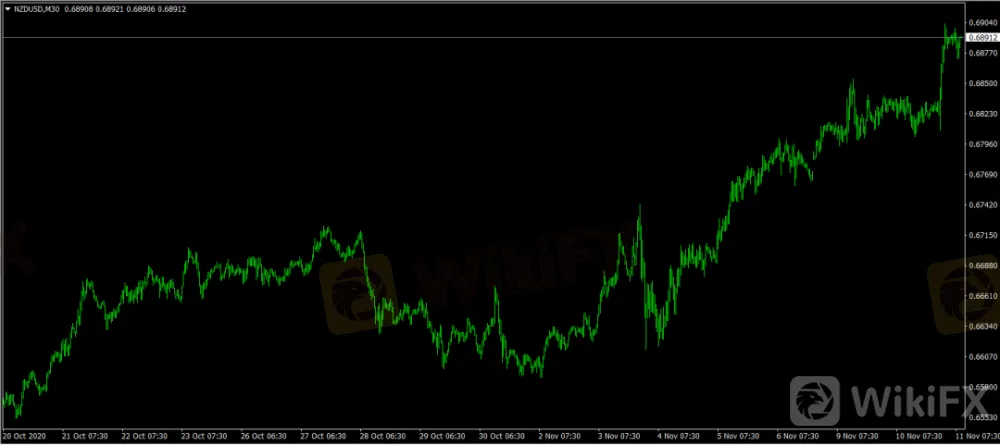

WikiFX News (12 Nov.) - On Wednesday, the Reserve Bank of New Zealand (RBNZ) announced its rate decision for November, which held the official cash rate at 0.25%, as expected. The prices of NZD/USD grew to $0.6904 following the decision, refreshing a new high of more than a year and a half.

The RBNZ stated on Wednesday that in order to bolster the economy, policymakers all decided to launch a new Funding for Lending Programme in December. The RBNZ held the benchmark interest rate at a record low of 0.25% as expected and retained the large scale asset purchase programme at NZ$100 billion ($68 billion), which boosted the New Zealand dollar.

However, the bank reiterated that it was prepared to provide additional support such as negative rates if necessary. It also projected that the economy would slip back into recession in the Q4 of 2020 as inflation and employment would remain below the remit targets for a persistent period.

New Zealand's Covid-19 containment efforts are successful. Currently, the country's economy has seen a strong recovery and its property prices have risen sharply, thus expectations for negative rates may dwindle, further swelling the New Zealand dollar.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Trend of NZD/USD

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

New Products Launch in April

We are pleased to announce that STARTRADER will launch new products on April 22nd, 2024 to provide clients with a broader portfolio of products.

Market Closure in April

Please be advised that the following instruments' trading hours and market session times will be affected by the upcoming April holidays.

Rollover Notification in April

Please be advised that the following CFD instruments will be automatically rolled over as per the dates in the table below. As there can be a pricing difference between old and new futures contracts, we recommend clients to monitor their positions closely and manage positions accordingly.

Market Closure in April

Please be advised that the following instruments' trading hours and market session times will be affected by the upcoming April holidays.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator