One Million Air Travelers Is a Good Sign for the Economy

Abstract:If passenger flight traffic can avoid backsliding as the virus surges, then a winter recession might be avoidable, too.

Conor Sen is a Bloomberg Opinion columnist. He has been a contributor to the Atlantic and Business Insider.

Read more opinion

Follow @conorsen on Twitter

COMMENTS

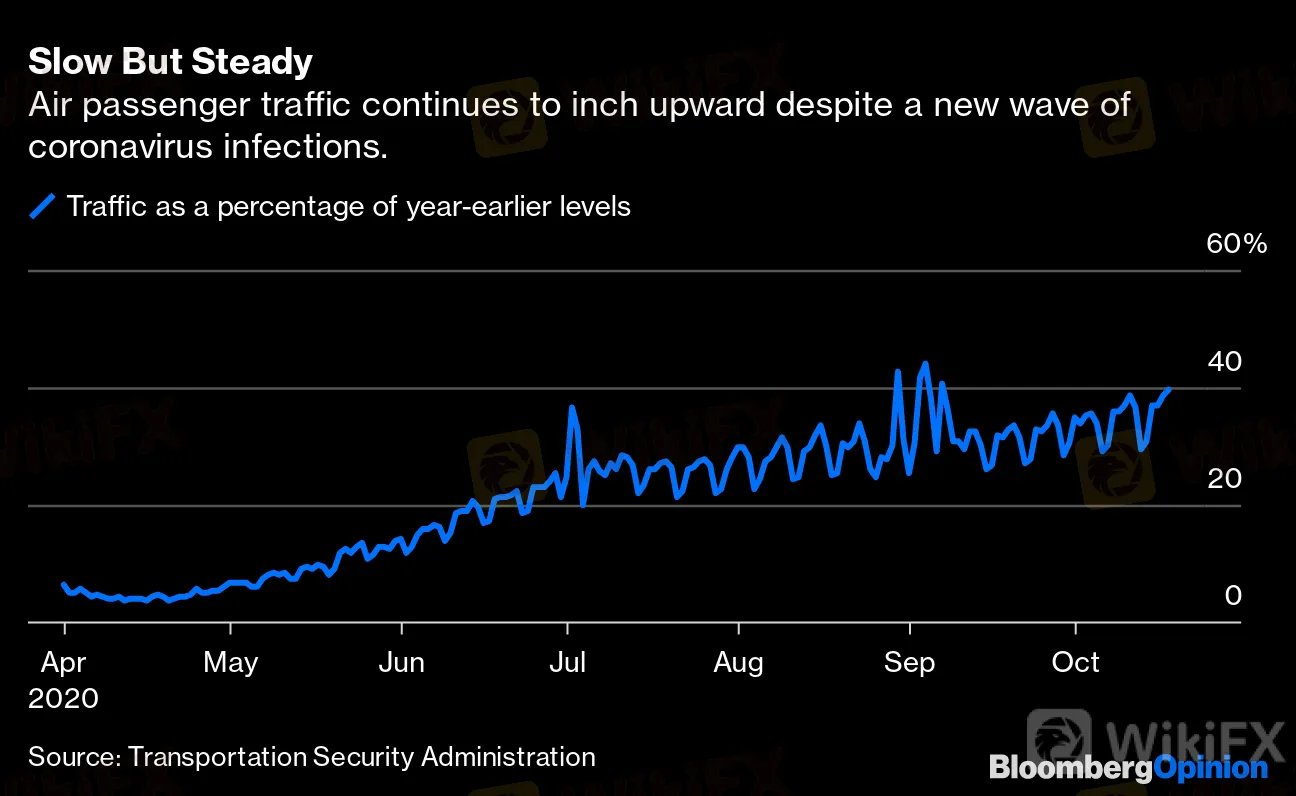

The latest spike in coronavirus cases and hospitalizations has people worried about more than just the public health impacts. There's also the threat that renewed constraints on activity could drag the economy backward as we head into colder winter months.

Air travel is one kind of in-person economic activity that's been hard-hit by the pandemic. It suffered another setback during the summer virus wave, so it's noteworthy that in the latest surge, the industry hasn't yet seen a negative impact. In fact, this past Sunday it recorded the first day with 1 million passengers since the onset of the pandemic.

{18}

While demand for flights is likely to remain significantly impaired at least until the public health situation improves, the uptick shows that the airline industry is convincing growing numbers of would-be passengers that traveling on a plane is safe. And that makes it less likely that subsequent virus waves will reduce air travel and related economic activity beyond their current depressed levels.

{18}

Air travel virtually disappeared in March as the pandemic took hold in the U.S. and shelter-in-place orders went into effect. Then the industry experienced the equivalent of a dead-cat bounce from mid-April through the early part of July. Passenger checkpoint data published by the Transportation Security Administration bottomed at 4% of normal levels, and by mid-July it had recovered to 27%.

More from

Morgan Stanley Sounds the WFH Conduct Alarm

Google Case Shows Antitrust Gone Wild

Herd Immunity or Social Distancing? A Combination, Actually

Could a Stimulus Bill Pass By Accident?

{24}

That's when the flare-up of the virus in Southern states dealt the industry a setback. As virus case counts surged in places like Arizona, Texas, Florida and Georgia, and states like New York began requiring passengers coming in from hot spots to quarantine themselves, the TSA data was backsliding. By the end of July, traffic had fallen to more like 25% of normal levels. While only a minor setback, it derailed a theory put forth by optimists in early June that air travel could normalize by August based on the pace of the recovery seen in April and May. By the end of July, airline stocks had fallen to two-month lows even as the S&P 500 Index had recovered to post-pandemic highs.

{24}

Now, after months of messaging from airlines and the Centers for Disease Control and Prevention about mask requirements and frequent air circulation and filtration during flights, instead of seeing air travel backsliding with the latest virus wave, it continues to normalize somewhat.

{27}

In late August before Labor Day, passenger traffic was around 29% of normal levels, and through Sunday it rose to north of 35%. That still isn't enough to stop airlines from burning cash, particularly given heavily discounted fares and weak business travel, but it shows that virus flare-ups may no longer be enough to lead to further backsliding in passenger traffic.

{27}

Slow But Steady

Air passenger traffic continues to inch upward despite a new wave of coronavirus infections.

Source: Transportation Security Administration

To the extent people are convinced that sharing airspace with fellow passengers is safe so long as everyone is masked, the main headwind for further normalization may be what happens once you've left the plane. Disneyland in California remains closed, as do the theaters on Manhattan's Broadway. Dining inside restaurants is still a high-risk activity nationwide — to the extent it's even allowed — and there still isn't much in the way of sports games, business conferences or concerts to attend.

Trips to the beaches of Hawaii might be lovely, particularly if taking a rapid test pre-flight eliminates the need to quarantine upon arrival, but many of the reasons to travel have been eliminated even if the plane trip itself is seen as lower risk than it was a few months ago.

So as we look ahead to the colder winter months and think about air travel's impact on the economy, the risk might be more about limitations on future improvement than backsliding.

The TSA data suggests we can now get modest improvements in flight demand even while seeing spikes in virus cases. Hotel data gathered by industry researcher STR showed that hotel occupancy last week reached 50% for only the second time since the onset of the pandemic, suggesting hotel demand is stablilizing at depressed levels as well.

Perhaps some leisure travelers will become more willing to take important trips during the winter months if they grow more comfortable with the health risk of flying. TSA Administrator David Pekoske said Tuesday that the industry is seeing a rise in travel to vacation destinations, especially across the Sunbelt states. But until there's a vaccine, it's unlikely that we see business travel, public events or widespread indoor dining — key reasons for flying for many — come back in a significant way.

{40}

It'll be important to track the real-time data to see if things change, but for now it seems more likely that we'll see an economic recovery held back over the next few months by a rebound of the virus, rather than a double-dip recession.

{40}

JUST IN: @TSA_Pekoske told @FoxNews this morning that TSA is seeing a higher proportion of leisure travelers during the pandemic. How does he know? They are not typically enrolled in trusted traveler programs such as @TSA PreCheck; they are flying on ultra low cost carriers; 1/2

— Lisa Farbstein, TSA Spokesperson (@TSA_Northeast) October 20, 2020

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

{48}

To contact the author of this story:

{48}

Conor Sen at csen9@bloomberg.net

To contact the editor responsible for this story:

Susan Warren at susanwarren@bloomberg.net

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator