U.S. Income Gaps Narrowed in Pre-Covid Years, Fed Survey Shows

Abstract:U.S. income gaps narrowed by some measures in the three years through 2019, as the pre-pandemic expansion delivered more jobs and pay for lower-earning Americans, according to new Federal Reserve data published Monday.

U.S. income gaps narrowed by some measures in the three years through 2019, as the pre-pandemic expansion delivered more jobs and pay for lower-earning Americans, according to new Federal Reserve data published Monday.

Still, the Fed‘s latest Survey of Consumer Finances showed that inequality in the world’s biggest economy remained near record levels even before the coronavirus slump, which has hit poorer Americans hardest.

{6}

Median family income rose 5% in the three years through 2019, to $58,600. Gains were especially strong for groups that had benefited less from the earlier phase of the decade-long U.S. expansion, including Black Americans, those younger than 35, and those without college degrees.

{6}

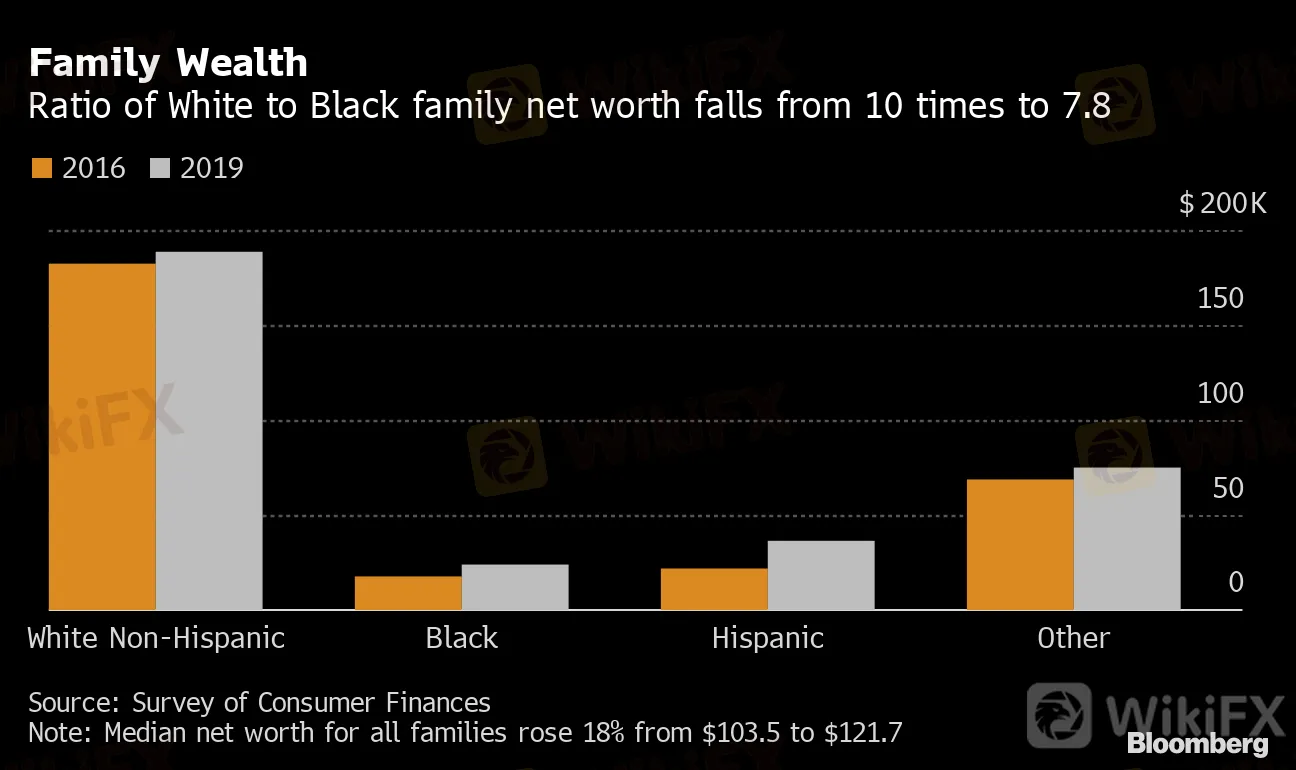

Family Wealth

Ratio of White to Black family net worth falls from 10 times to 7.8

Source: Survey of Consumer Finances

Note: Median net worth for all families rose 18% from $103.5 to $121.7

“Altogether, these changes are consistent with a slight narrowing of the income distribution over this period,” the Fed said in a bulletin summary of the survey findings.

Unemployment hit a half-century low before the pandemic, after a decade of uninterrupted economic growth that brought previously marginalized workers back into the labor force and pushed earnings higher. But this years lockdowns, which saw millions of jobs disappear, have hit Americans of color and women especially hard.

{19}

For the richest 10% of American families the median household income was $283,000, while for the bottom 10% it was $17,700, according to the Fed survey. Among ethnic groups, Latinos were the only one to see median incomes decline in the period, with a 1% drop.

{19}

The survey measured wealth as well as income, and found that increased home-ownership and rising prices helped boost the net worth of low-income families. Median house values rose 19% for the lowest-earning Americans, outpacing the 13% overall gain, and the bottom half of earners saw the first increase in homeownership since 2007.

Net wealth among all Americans rose 18% over the three-year period to $121,700 in 2019, driven by double-digit increases for people in the lowest 40th percentile. The richest 20% of Americans saw their median net worth decline.

Fed economists said on a conference call that the overall pattern of wealth inequality was little changed, remaining near the highest levels in decades.

— With assistance by Alexandre Tanzi

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator