RIS’ Sign of Stopping Declining May Bolster up EUR/USD

Abstract:European Central Bank(ECB) President Christine Lagarde warned that the appreciation of euro may bring negative pressure on commodity prices. At the same time, PRI is expected to stop the declined trend since the end of July.

WikiFX News (5 Oct.) - European Central Bank(ECB) President Christine Lagarde warned that the appreciation of euro may bring negative pressure on commodity prices. At the same time, PRI is expected to stop the declined trend since the end of July. Therefore, it is expected that EUR/USD would continue shooting up in Q4 2020.

The ECB seems to take a wait-and-see attitude in the next meeting held on 29th October, as the governing council stated that the appropriate monetary measures had already been prepared so as to make sure that inflation would move toward the target in a sustainable way.

Given that the EU plan, 750 billion recovery funds, will be released in 2021-2023, the ECB may maintain the current policy for the rest of the year. In addition, the Fed President Powell plans to target 2% average inflation over time. Therefore, more attentions should be paid to whether the Fed decision would lead to a volatile EUR/USD in the short run.

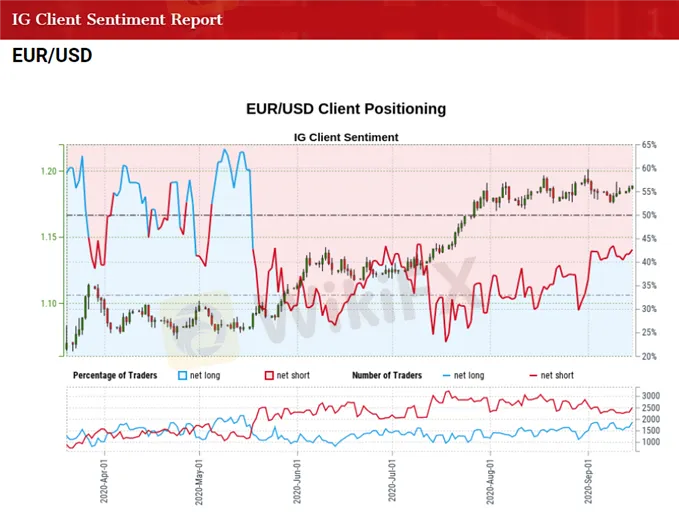

Although the exchange rate bounces off from the month-low level of 1.1753, retail investors seem to continue selling EUR/USD, as they have held net short EUR/USD positions since mid-May.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

Chart: IG Client Sentiment Report

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EUR/USD Forecast: Why the euro is set to enjoy a (temporary) bounce at the double-bottom

EUR/USD Forecast: Why the euro is set to enjoy a (temporary) bounce at the double-bottom

EUR/USD Forecast: Euro set to rally after weathering two storms, showing its strength

EUR/USD Forecast: Euro set to rally after weathering two storms, showing its strength

EUR/USD Forecast: Only a dead cat bounce? US Retail Sales may trigger a downfall to 1.20

EUR/USD Forecast: Only a dead cat bounce? US Retail Sales may trigger a downfall to 1.20

WikiFX Broker

Latest News

India's Forex Rules Shake-Up Stuns Traders and Markets

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Maunto Review: Imp. Things to Know!!

Webull Canada Unveils Desktop Trading Platform

Currency Calculator