Euro May Fall on ECB Minutes, Jackson Hole and Eurozone PMIs

Abstract:The Euro may fall against the US Dollar if ECB minutes carry ultra-dovish undertones and commentary from Jackson Hole spooks markets against the backdrop of Eurozone PMI data.

US Dollar, Euro, Jackson Hole, Eurozone PMIs – TALKING POINTS

Euro may fall vs. US Dollar if ECB minutes evoke ultra-dovish expectations

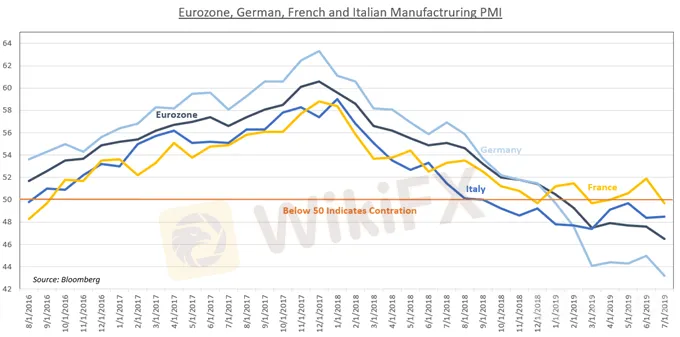

Eurozone PMIs may exacerbate regional growth fears and undermine Euro

Official commentary on growth outlook at Jackson Hole may spook markets

The Euro may suffer against the US Dollar if the release of the ECB minutes reveal stronger-than-expected dovish inclinations against the backdrop of Eurozone PMI publications. Regional growth concerns have been mounting as Germany – Europes largest economy – is expected to show a contraction in Q2. Comments from officials at the Jackson Hole symposium may also stoke growth fears and boost the anti-risk USD vs the Euro.

Jackson Hole Symposium

Markets will be closely watching the Jackson Hole symposium for comments from officials regarding the growth outlook. The release of the FOMC meeting minutes revealed that trade war concerns remain a “persistent headwind” and low inflation remain key obstacles along with corporate debt and leveraged lending. The latter has begun to sound the alarm as the collateralized loan obligation market stirs familiar fears.

European Growth Concerns, Political Instability

If comments from the Jackson Hole symposium carry overwhelming undertones of uncertainty, the Euro may fall against its US Dollar counterparts. EURUSDs decline may be amplified if Eurozone PMI data reinforces the fear that the Eurozone is significantly decelerating in its growth prospects. As it stands, Germany is planning on implementing stimulative policies as a contingency for a crisis ahead.

Europe is also dealing with chronic political upset in both the mainland and overseas. The latter is referring to the ongoing Brexit negotiations that remain unclear despite the October 31 deadline approaching. Italian political volatility and another possible budget dispute in the same month may magnify market volatility. During times of economic uncertainty, the capacity for political shocks to disrupt markets is notably increased.

CHART OF THE DAY: Weak European Manufacturing PMI May Spill Over into Services Soon

FX TRADING RESOURCES

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

US Dollar Soars on Higher Yields and Bank of England No-Go. Where to for USD?

US Dollar, Bank of England, Treasuries, OPEC+, Crude Oil, Japan - Talking Points

Euro Overview

Euro Jumps to 1-Month High as ECB's Lagarde Fails to Calm Rate Hike Bets.

Markets Q4 Outlook: Dow Jones, US Dollar, Gold, Fed, Euro, ECB, Oil, Volatility Returns?

As investors head into the fourth quarter, the VIX Volatility Index - often referred to as the market‘s ’fear gauge - is in an uptrend. In September, US benchmark stock indices saw some of the worst monthly performance since March 2020. In fact, the S&P 500 and Nasdaq 100 finished the third quarter little changed. More importantly, they trimmed most of their gains. The Dow Jones declined.

WikiFX Broker

Latest News

FOREX TODAY: THE US DOLLAR IS HAVING TROUBLE RECOVERING, AND THERE WILL BE MORE FEDSPEAK.

India's Forex Rules Shake-Up Stuns Traders and Markets

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Maunto Review: Imp. Things to Know!!

WARNING!! They are Fraud Brokers

Italy's CONSOB Shuts Down 7 Rogue Financial Sites

Australia's $41 Million Crypto Scheme Meltdown

WikiFX Broker Assessment Series | Is Tradon Reliable?

Currency Calculator