Is Forex Made for a Long Term?

요약:A large part of the experienced traders started trading on the forex spot first. But when their time horizon grew longer, they preferred to invest in stocks.

A large part of the experienced traders started trading on the forex spot first.

But when their time horizon grew longer, they preferred to invest in stocks.

Is it incompatible with the medium/long term investment in the currencies? This is what we see in this article.

Some disadvantages of a long-term forex strategy

Amateur traders (not to be confused with beginners) who just start to make profits from the forex are sometimes afraid of going into stocks later.

Instead, they think that in order to make more profits, they can change the time horizon and switch to a long-term investment in the currencies.

Then they will find themselves confronted with several problems.

A long-term strategy surely requires much more capital and it makes sense: the stop will be very far then, and if they want to keep a satisfactory position size, they will need much more money.

Also, once they start to have a little experience, they may not have the patience to wait for an appearing signal and have the risk of entering at the wrong time.

But that's not all: beyond a certain period of time, the trend is irreparably reversed, making it impossible to hold the positions for more than one or two years at most.

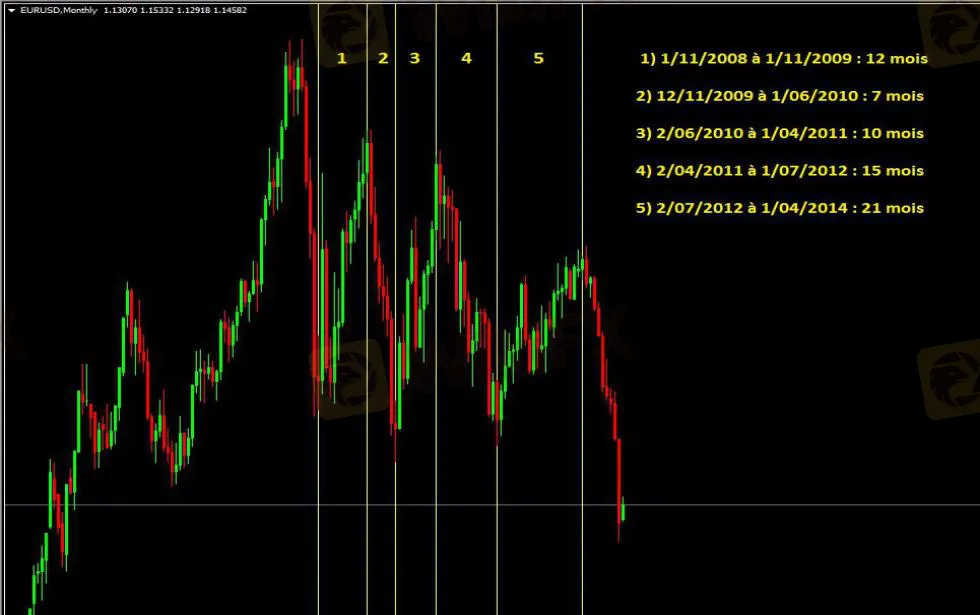

To convince yourself of this, just take a closer look at the chart of the EUR/USD pair since 2008:

We have a long way from investing in equities, which allows us to hold well the stocks after 5 years and which, in addition, allows us to benefit from dividends.

How about the medium term?

If the long term is not a possible option, on the other hand, the medium term is quite possible, for its part.

Nevertheless, forex is a market that has many qualities.

The volume of trade remains very high, which allows it to offer good liquidity to traders.

We also see in the example chart that the price movement remains very clean (at least for EUR/USD, but this also concerns most of the major pairs).

All of this makes it easier to take positions at the right time for those who look for medium-term investing, a way to get a higher return.

Not to mention that at such a level, stress becomes almost nonexistent, unlike short-term trading, since there is no need to follow the price movement hour by hour (or worse: minute by minute).

It will still be necessary to pay more attention to the economic situations of the countries (or economic zones) to which the currencies that make up the pairs traded on the market belong.

Last tips

Changing the time horizon should not be done lightly.

Wanting to hold onto forex for a longer time is commendable, but don't just do it anyhow.

Before taking a position, you can, for example, observe where the historical levels were as they have constituted psychological benchmarks on which other investors may react more or less violently.

However, if you really want to get a good return in the medium/long term, I would like to advise you to give priority to stocks.

(Source: https://www.en-bourse.fr/le-forex-est-il-fait-pour-le-long-terme/?gclid=EAIaIQobChMImdjgsIS96wIVk6yWCh3NgQW5EAAYASAAEgKDjfD_BwE )

부인 성명:

본 문서의 견해는 저자의 개인적인 견해를 나타낼 뿐이며 본 플랫폼에 대한 투자 자문을 구성하지 않습니다.본 플랫폼은 기사 정보의 정확성, 완전성 및 적시성을 보장하지 않으며, 기사 정보의 사용 또는 의존으로 인한 손실에 대해서도 책임지지 않습니다.

WikiFX 브로커

요금 계산