Day trading guide for Friday

Abstract:Due to the sudden jump in the long-term bond yields in the US, we again witnessed a sharp decline in the market on Thursday.

Due to the sudden jump in the long-term bond yields in the US, we again witnessed a sharp decline in the market on Thursday.

Technically, the market recovered from lower levels, but due to the pressure of the weekly expiration of Index contracts, the Nifty/Sensex came back from the highs of 15,200/51,260. On Friday, 15,050/50,750 and 14,950/50,400 levels will be decisive for the market. The Nifty/Sensex could fall to 14,850/50,100 or 14,750/49,800 on a decisive dismissal of 14,950/50,400. On the upside, the 15,250/51,300 level would be a big hurdle for the index.

Tech Picks

Analyst: Shrikant Chouhan, Executive Vice President - Technical Research

Amara Raja NSE 0.53 % Batteries: BUY

CMP: Rs 919

Target: Rs 950

Stop loss: Rs 900

Rounding bottom formation near important support zones with incremental volume activity on daily chart.

Ambuja Cements: BUY

CMP: Rs 292

Target: Rs 305

Stop loss: Rs 285

The stock is trading in a rising channel and with a higher top higher bottom formation, the up move is likely to sustain in the near term.

FSL: BUY

CMP: Rs 107.95

Target: Rs 114

Stop loss: Rs 105

A fresh breakout is evident from an inverse head and ..

Grasim: BUY

CMP: Rs 1,350.4

Target: Rs 1,390

Stop loss: Rs 1,330

Higher high and higher low chart formation indicates bullish momentum in stock to remain in the near term.

F&O Strategy

Analyst: Sahaj Agrawal, Head of Research - Derivatives

Futures: BUY SBI Life Future-March at 915

Stop loss: 886

Target: 960

Descending Triangle breakout seen above 910 on spot.

Options: Nifty Bull Call Spread: 25 Mar-21 SERIES

Buy 15100 CE @ 350 and Sell 15500 CE @ 165

Premium outflow (Cost): 185

Stop loss: 80

Target: 350/400

Nifty continues to trade in an uptrend, after it made a putative swing low of 14,467. A fresh momentum has built up above 15,000 and with market breadth remaining strong, we expect Nifty to retest 15,500 levels.

Forex & Interest Rate Technical

Anindya Banerjee, DVP, Currency Derivatives & Interest Rate Derivatives

USD-INR: Buy 73.00 Put and Sell 74.00 Call option; March 26th expiry @ 22 paise.

Stop loss: Exit strategy if USD-INR March fut trade above 73.55

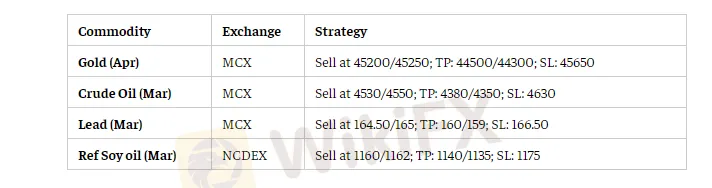

Commodity Calls

Ravindra Rao, VP- Head Commodity Research

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator