Financial Markets Poised to Reverse As Democrats Secure Control of Both Houses

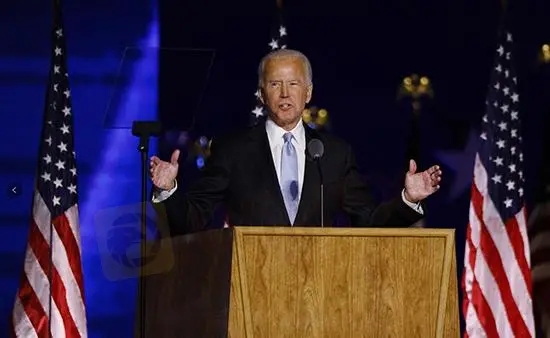

Abstract:The US election, which had been struggling in controversy for over two months, comes to an end eventually.

The US election, which had been struggling in controversy for over two months, comes to an end eventually. With Georgia's two Senate seats narrowly prevailed by the Democratic candidates, Republicans' hopes for capturing control of the Senate have been dashed. The victories put the kibosh on the rumor that Biden would be a lame-duck president. In other words, financial markets will revisit Biden's campaign platform of finance and diplomacy before making the following investment decisions.

The US political system makes different presidential candidates as well as the transition of power the common things when party alternation occurs. In this context, financial markets often see trends reversed after the new president shift policies. Take the forex market as an example, the US dollar eased back when Democrat Carter took office in 1977, but bounced back when the Republican Reagan came to power in 1981. The greenback took out the previous gains three times when Republican George Bush, Democrat Obama, and Republican Trump came to power in 2001, 2009 and 2017, respectively. With that said, a new presidency will commonly spark a reversal in trends of the forex market.

The US stock market in 2001 experienced a tech-stock bubble burst, while in 2009 rebounded sharply from the downturn since the financial crisis. Similar cases happened in commodity markets. Oil prices reversed the rally in 2001 and wiped out earlier losses in 2009. Gold prices staged a rebound in 1977, saw the 20-year bear market turning bullish in 2001, and turned around the previous setback in 2017.

The above records show that, the trends of financial markets vary at different political parties both with respect to presidencies and policies. I believe Biden's narrow victory in both the White House and Congress will pave the way for oil's reversal. Since Biden has been running on the far-left platform, some analysts worried that the dollar would decline amid selling, which could be triggered once the country's budget deficits grow larger under Biden's welfare reform. But here is one thing to keep in mind: Biden plans to raise the top marginal tax rate on income over $400,000 to 39.6%. In this case, chances are budget deficits could shrink instead. What's more, Biden's support in raising the federal minimum wage could spur inflation, mounting pressures on the Fed to increase interest rates. At the same time, conventional energy will see its prices hampered under Biden's environmental policies, which are accepted without controversy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator