AUD/USD May Suffer Deeper Losses

Abstract:Recently, AUD/USD traded to a fresh monthly low of 0.7128 with sharp gains in the US dollar and a decline in global stocks.

WikiFX News (24 Sept) -Recently, AUD/USD traded to a fresh monthly low of 0.7128 with sharp gains in the US dollar and a decline in global stocks. The exchange rate may test the August low of 0.7076 as the Reserve Bank of Australia (RBA) was determined to provide additional policy stimulus.

The RBA warned that “under the central scenario, it would be more than three years before sufficient progress was being made towards full employment to be confident that inflation will be sustainably within the target band.” The RBA will take further steps to support the economy, which includes expanding the yield target program, intervening in forex markets, and launching a negative interest rate policy. A further shift in risk sentiment may keep the exchange rate under pressure.

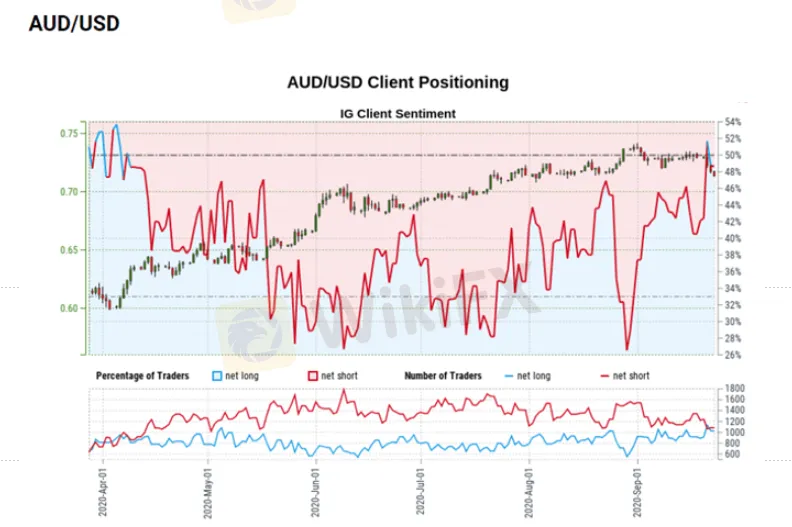

The IG Client Sentiment Report shows the number of net-long and net-short AUD/USD traders is 2.93% and 12.48% lower from last week, respectively. But the selloff of AUD/USD looks poised to persist as retail traders have been net-short the pair since April. The exchange rate appears to be on track to test the August low of 0.7076, considering the losses in the exchange rate deepened from earlier this week.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

Chart: IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUD/USD Clings to Support After Chinese CPI and PPI Surge Higher

AUSTRALIAN DOLLAR, AUD/USD, CHINESE INFLATION – TALKING POINTS

AUD/JPY snaps five-day uptrend above 81.00 as covid woes renew in Australia

● AUD/JPY bounces off intraday low but prints daily loss for the first time in six days. ● NSW refreshes highest covid infections since March 2020, Victoria ends lockdown. ● Bears also cheer US Senators’ jostling over President Joe Biden’s infrastructure spending proposal, cautious mood ahead of the key data/events. ● BOJ’s Kuroda, RBA’s Debelle and risk catalysts will be crucial for fresh impulse.

Australian Dollar Analysis, More Losses Next? AUD/USD, AUD/JPY, AUD/CAD, GBP/AUD

Australian Dollar Analysis, More Losses Next? AUD/USD, AUD/JPY, AUD/CAD, GBP/AUD

AUD/USD Expected to Extend Uptrend

Lately, AUD/USD registered a new weekly high of 0.7343. According to the Reserve Bank of Australia (RBA) Minutes, AUD/USD may continue reclaiming the ground lost from the 2020 high of 0.7414 as the central bank will back the economic recovery by its current tools.

WikiFX Broker

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator