U.K. House-Price Rebound From Virus Seen Cooling by Years End

Abstract:The U.K. housing market has bounced back from the coronavirus lockdown, but the rising prices arent set to last.

The U.K. housing market has bounced back from the coronavirus lockdown, but the rising prices arent set to last.

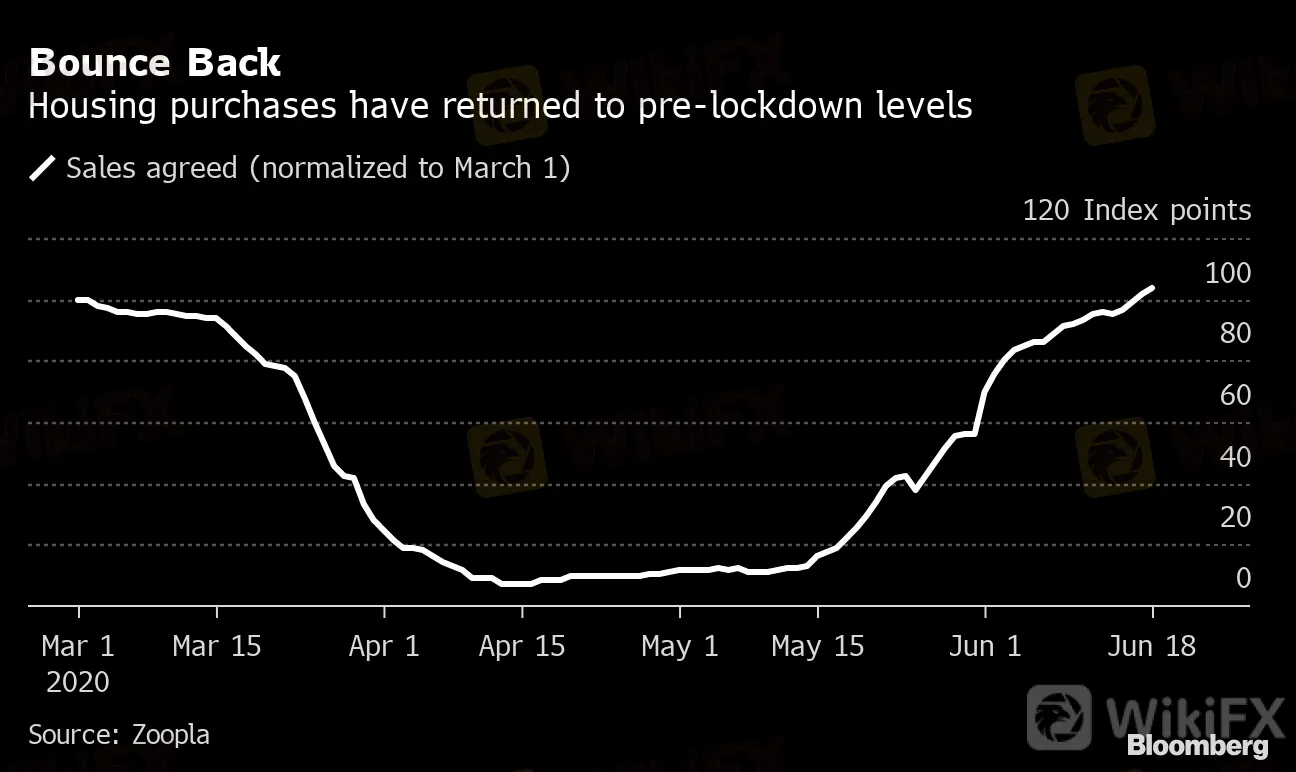

Resurgent demand and tight supply combined to push the prices of homes up by 2.4% in May from a year earlier, faster than the pace seen at the beginning of the year, according to a report on Wednesday from Zoopla Ltd. And agreed sales are higher than before the government imposed restrictions to slow the outbreak, the property portal said.

Prices should continue to grow by as much as 3% through the third quarter before cooling toward the end of the year as the economic impact of the virus intensifies, with unemployment expected to rise and lenders imposing stricter mortgage requirements, according to the report. Lockdown measures have plunged the U.K. into recession and left the government paying the wages of millions of private sector workers.

“House price growth is set to hold up in the near term, and we expect the downward pressure on prices to come in the final months of the year as demand weakens,” Richard Donnell, Zooplas director of research and insight, said in the statement.

Bounce Back

Housing purchases have returned to pre-lockdown levels

Source: Zoopla

The reduced willingness of lenders to offer mortgages equivalent to 90% of the purchase price will push down demand for homes, particularly among first-time buyers, Zoopla said. Nationwide Building Society, the U.K.s largest home-loan provider, said last week it will demand higher deposits from home buyers to protect itself from falls in the value of properties.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator