What is IB?

IB, or Interactive Brokers, is a discount brokerage firm founded in the United States in 1978. It is headquartered in Greenwich, Connecticut, and has offices in several other countries, including the United Kingdom, Hong Kong, and Australia. The company provides electronic brokerage services to individual and institutional clients, offering a range of financial products, including stocks, options, futures, forex, bonds, and funds. Interactive Brokers is regulated by several financial authorities, including the US Securities and Exchange Commission (SEC), the UK Financial Conduct Authority (FCA), etc.

What Type of Broker is IB?

IB is primarily known as a direct access broker, which means they enable traders to directly access various financial markets through a proprietary trading platform, rather than relying on intermediaries such as brokers or dealers. IB is also known for providing advanced trading tools and technologies to both individual and institutional clients.

Pros & Cons

Interactive Brokers (IB) has many advantages, including low commissions, access to a wide range of financial products, and a highly customizable trading platform. Additionally, IB is known for its advanced research tools and competitive pricing.

However, some potential downsides to consider include high minimum balance requirements and complex pricing structures that may not be suitable for all investors. It is also worth noting that customer support may not be as robust as some other brokers.

Overall, IB is a solid choice for experienced traders looking for a powerful trading platform with a range of options for investing in the financial markets.

Here is a table outlining the pros and cons of Interactive Brokers (IB):

Note: This table is based on general observations and may not represent the experience of every individual user.

IB Alternative Brokers

Some popular alternative brokers to Interactive Brokers (IB) include:

TD Ameritrade: A US-based broker that offers a range of trading instruments and platforms, including a powerful desktop platform for active traders.

E*TRADE: Another US-based broker that offers a variety of investment options, including stocks, bonds, and mutual funds. It also has a user-friendly trading platform.

Charles Schwab: A well-known US-based broker that offers a wide range of investment products and services, including a robust trading platform and research tools.

Robinhood: A popular US-based broker that allows commission-free trading of stocks, options, and cryptocurrencies through a user-friendly mobile app.

Fidelity: A US-based broker that offers a wide range of investment options and research tools, as well as a comprehensive trading platform.

It's important to note that each broker has its own strengths and weaknesses, and it's important to do your research and choose the one that best fits your trading needs and preferences.

Is IB Safe or Scam?

Interactive Brokers is a well-established and reputable broker. The company is publicly traded and regulated by multiple top-tier financial authorities around the world, including the SEC in the United States and the FCA in the UK. Furthermore, the broker has a long history of providing high-quality services to its clients, with a track record of financial stability and reliability. Therefore, based on these factors, it can be concluded that IB is a legitimate broker, not a scam.

How are you protected?

Interactive Brokers (IB) provides a range of security measures to protect its clients' funds and personal information. Some of the key security measures include:

It's important to note that while no investment platform can completely eliminate risk, IB's measures are designed to mitigate risk and protect its clients as much as possible.

Our Conclusion on IB Reliability:

Based on the information provided, Interactive Brokers appears to be a reliable broker with a strong focus on client protection and security measures. It is regulated by multiple authorities and has a history of being in the industry for several decades. It also offers a wide range of trading instruments and a variety of trading platforms to choose from.

However, some of the drawbacks include a higher minimum deposit requirement compared to some other brokers and a less user-friendly trading platform for beginners. Overall, IB seems to be a solid choice for experienced traders looking for advanced trading tools and access to a wide range of markets.

Market Instruments

IB offers a wide range of trading instruments across multiple asset classes, including:

Stocks: IB provides access to over 135 markets and 35 countries, with more than 9,000 stocks available to trade.

Options: IB offers options trading across a variety of markets, including stocks, indices, and futures.

Futures: IB offers futures trading on over 70 global markets, including indices, commodities, and currencies.

Forex: IB provides access to forex trading in over 100 currency pairs.

Bonds: IB offers trading in bonds, including corporate, municipal, and government bonds.

ETFs: IB provides access to more than 8,000 ETFs from over 80 providers.

Mutual funds: IB offers trading in mutual funds from over 250 fund families.

Metals: IB offers trading in precious metals such as gold, silver, platinum, and palladium.

CFDs: IB offers CFD trading in a variety of markets, including stocks, indices, forex, and commodities.

Cryptocurrencies: IB offers trading in select cryptocurrencies, including Bitcoin and Ethereum.

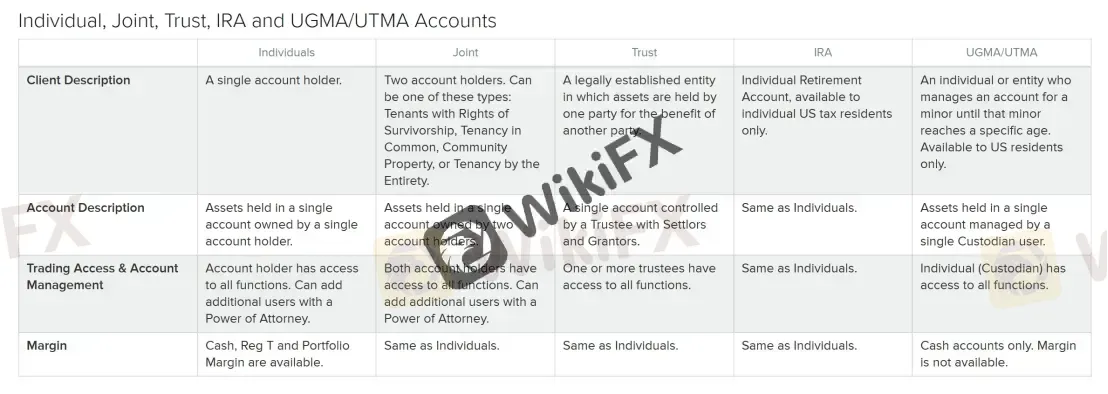

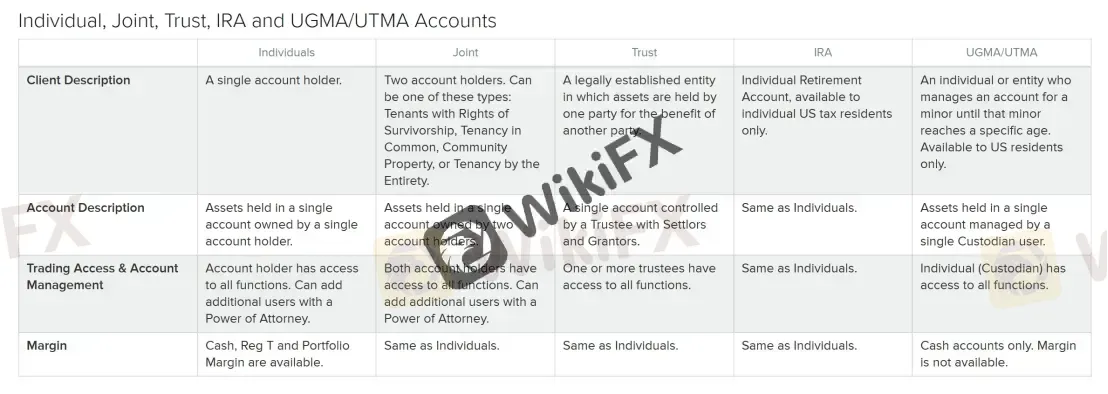

Accounts

Interactive Brokers (IB) offers various types of accounts for different trading needs, including individual, joint, corporate, and trust accounts. The following is a brief overview of the main IB account types:

Individual: A standard account for individual traders that allows access to all trading products and services provided by IB.

Joint: An account for two or more individuals who share ownership of the account and have equal rights to trade and manage the account.

Corporate: An account for corporations, partnerships, LLCs, and other business entities that require a tax ID number to establish an account.

Trust: An account for trusts and estates, which must be established with proper documentation and verification of the trustee's authority.

Advisor: An account for registered investment advisors (RIAs) who manage assets for clients and require tools for managing multiple accounts.

Friends and Family: An account for multiple individuals who are related or known to each other, and who want to trade together while maintaining separate account ownership.

Proprietary Trading Group: An account for proprietary trading firms that require multiple sub-accounts, customizable risk management tools, and other advanced trading features.

Each account type has its own requirements and features, so it's important to review them carefully and choose the one that best suits your trading needs.

Margin & Leverage

While the margin rates that IB offers are the same for all customers, local regulators may impose different or higher rates. Regulatory requirements for margin deposits in a given jurisdiction will take precedence over those set by the IB if they are greater.

And since high-risk leverage is regulated differently in different countries, your ability to use it will vary based on the trading instrument you use and the law where you live. As a result, IB provides a convenient online tool to let you quickly and easily view all applicable margins, allowing you to select the optimal trading conditions.

For customers who come under the jurisdiction of the Australian Securities and Investments Commission (ASIC), the maximum leverage available on Forex trades is 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads:

Forex: IB offers competitive spreads on major forex pairs, with typical spreads ranging from 0.1 to 0.3 pips for EUR/USD, 0.1 to 0.6 pips for USD/JPY, and 0.3 to 0.7 pips for GBP/USD.

Stocks: IB offers tiered pricing for stocks, with spreads ranging from $0.0035 to $0.01 per share, depending on monthly volume. For example, the spread for a trade of 100 shares of Apple (AAPL) would be $0.35 to $1.00, depending on the monthly volume.

Options: IB offers competitive spreads on options, with typical spreads ranging from $0.10 to $0.30 per contract for major options.

Commissions:

A tiered commission of $0.0035 per share for a monthly volume of fewer than 300,000 shares, $0.002 per share for a monthly volume of 300,001-3,000,000 shares, $0.0015 per share for a monthly volume of 3,000,001-20,000,000 shares, and $0.0015 per share for a monthly volume of 20,000,000 shares. $0.001 per share for a monthly volume of 20,000,001-100,000,000 shares and $0.0005 per share for a monthly volume of 100,000,000 shares or more. The minimum commission is $0.35, and the maximum commission is 1% of the trading volume. The commission for metals trading is 0.15 basic points of the volume, with a minimum of $2.

Below is a comparison table about spreads and commissions charged by different brokers:

Note that the spreads and commissions listed above are subject to change and may vary depending on market conditions and account type. It's important to do your own research and compare different brokers before making a decision.

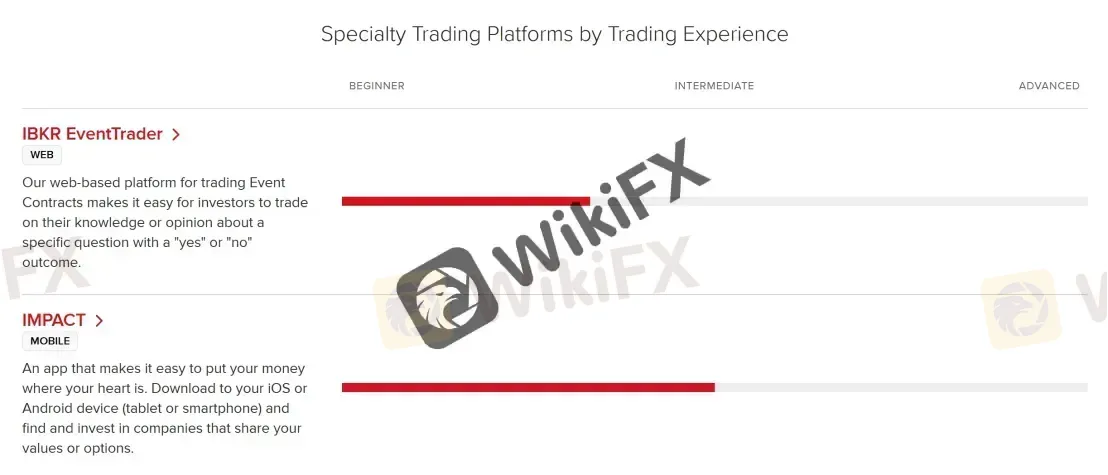

Trading Platforms

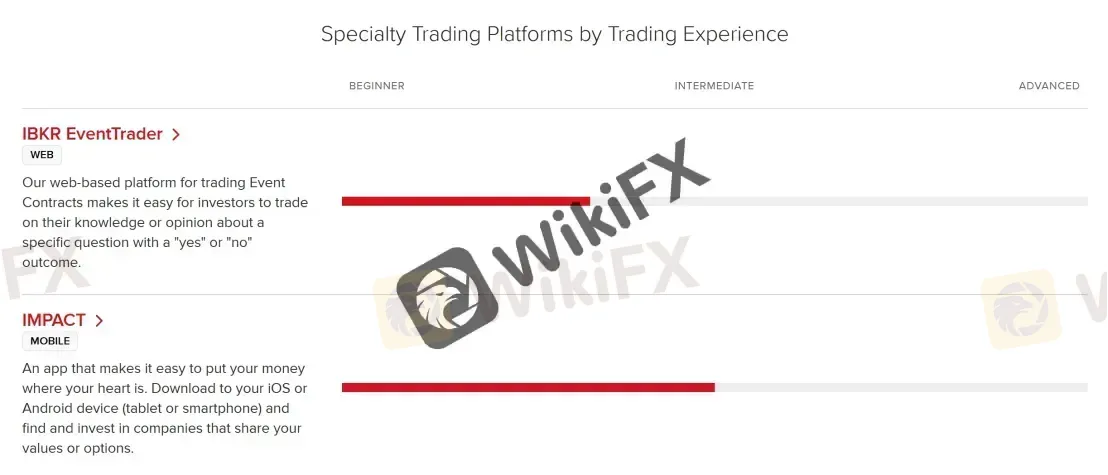

IBKR GlobalTrader, Client Portal, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR Event Trader, and IMPACT are different trading platforms and tools offered by Interactive Brokers (IB) to its clients.

IBKR GlobalTrader is a web-based platform designed for trading and managing international accounts. It provides access to 125 global markets and 31 countries. It also allows clients to trade in multiple currencies and offers currency conversion at competitive rates.

Client Portal is a web-based platform that enables clients to manage their accounts, view balances and positions, access research and news, and monitor trading activity. It also provides account management tools such as funding, withdrawals, and statements.

IBKR Mobile is a mobile application that allows clients to manage their accounts, place trades, and access real-time market data. It is available for both iOS and Android devices.

Trader Workstation (TWS) is a desktop trading platform that provides advanced trading tools, real-time market data, and research. It is designed for professional traders and investors who require advanced trading capabilities.

IBKR APIs are a set of programming interfaces that allow clients to integrate their own software and applications with IB's trading systems. This enables clients to automate their trading strategies and access real-time market data.

IBKR Event Trader is a platform that allows clients to place orders based on real-time news events. It provides access to a wide range of news sources and allows clients to set up custom alerts and filters.

IMPACT (Interactive Brokers Market Place and Corporate Technology) is an online marketplace that offers a range of third-party applications and services to clients. These include trading tools, research, analytics, and other resources to enhance trading capabilities.

Overall, IB offers a variety of trading platforms and tools that cater to the needs of different types of traders and investors. These platforms provide access to a wide range of markets and instruments, advanced trading tools, real-time market data, and research resources. Additionally, the IBKR APIs enable clients to customize and automate their trading strategies.

Deposits & Withdrawals

There are several major options for traders to deposit and withdraw funds from their accounts, including bank wire transfers, ACH, BPAY, EFT, online bill payment and more.

Note that the availability of deposit and withdrawal methods may vary depending on your location and account type.

Minimum deposit requirement

The minimum deposit requirement for Interactive Brokers (IB) varies depending on the account type and the location of the account holder. For example, the minimum deposit for a US-based individual account is $0 for IBKR Lite and $0 for IBKR Pro, while for a non-US-based individual account, the minimum deposit is $0 for IBKR Lite and $10,000 for IBKR Pro. However, the minimum deposit for other account types, such as institutional accounts or margin accounts, may be higher.

It's important to note that while there may be no minimum deposit requirement, there may be other fees associated with maintaining an account, such as inactivity fees or market data fees.

IB minimum deposit vs other brokers

IB Money Withdrawal

To withdraw funds from an Interactive Brokers (IB) account, you can follow these steps:

Step 1: Log in to your account on the IB website.

Step 2: Click on the “Transfer & Pay” menu and select “Transfer Funds”.

Step 3: Select the account you want to withdraw funds from and the destination account.

Step 4: Enter the amount you want to withdraw and select the currency.

Step 5: Choose the withdrawal method you prefer and follow the instructions provided.

Step 6: Confirm the details of the withdrawal and submit the request.

The withdrawal methods available may vary depending on your location and account type. Keep in mind that withdrawal requests may take a few business days to process, and additional fees may apply depending on the method chosen.

Fees

IB charges a variety of fees to its clients, including account fees, and market data fees. Account fees include a monthly activity fee of $10, which is charged to clients who do not generate a minimum monthly commission of $10 in trades or who do not maintain a minimum account balance of $100,000. There are also fees for certain types of account transfers and for paper statements.

Market data fees are charged by exchanges and other data providers for real-time and delayed market data. IB offers a variety of market data packages to suit different trading needs, with fees ranging from free to several hundred dollars per month depending on the package and the markets covered.

Overall, while IB's fee structure may seem complex at first, it is generally transparent and competitive compared to other brokers. Clients can use IB's fee calculator tool on its website to estimate their total trading costs.

See the fee comparison table below:

Customer Service

Interactive Brokers (IB) provides customer service to its clients through various channels, including phone, email, live chat, and a knowledge base. Here is some information about IB's customer service:

Phone support: IB offers 24/7 customer service through phone support. Clients can call IB's toll-free numbers from their registered phone number to receive assistance in several languages.

Email support: Clients can send an email to IB's customer service team at any time. IB aims to respond to emails within one business day.

Live chat: IB offers live chat support through its website and trading platforms. Clients can chat with IB's customer service representatives in real-time to receive assistance with their account.

Knowledge base: IB has an extensive knowledge base that includes frequently asked questions, user guides, and tutorials. Clients can search the knowledge base for answers to their questions or to learn more about IB's products and services.

You can also follow IB on some social networks such as Facebook, Instagram, LinkedIn, Twitter and YouTube.

Overall, IB's customer service is well-regarded by clients and industry experts. The company's 24/7 phone support and live chat options are particularly appreciated by clients who need immediate assistance.

Note: These pros and cons are subjective and may vary depending on the individual's experience with IB's customer service.

Education

Interactive Brokers offers a variety of educational resources for traders, including webinars, courses, videos, and articles.

The education section of their website includes topics such as trading basics, options trading, technical analysis, and trading strategies. They also offer a wide range of educational videos on their YouTube channel.

In addition, Interactive Brokers offers a simulated trading account that allows traders to practice trading with virtual funds before risking real money. This is a useful tool for beginners who are learning to trade.

Overall, Interactive Brokers provides a comprehensive range of educational resources for traders of all skill levels.

Conclusion

In conclusion, Interactive Brokers is a reputable and reliable broker that offers a wide range of investment products and trading platforms to its clients. The broker is known for its low commission rates and competitive pricing structure, making it a good choice for active traders and investors.

IB also provides a high level of security and protection to its clients, through various measures such as SIPC and excess SIPC insurance, and two-factor authentication. The broker also offers educational resources, customer support, and a variety of account types to meet the needs of different traders.

However, IB may not be the best fit for beginners due to its complex trading platforms and sophisticated tools. Additionally, the broker's account minimums and inactivity fees may not be suitable for all traders.

Overall, Interactive Brokers is a good choice for experienced traders and investors who are looking for a reliable broker with low commissions and a wide range of investment products.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX