How to Beat Inflation with Investments in 2021?

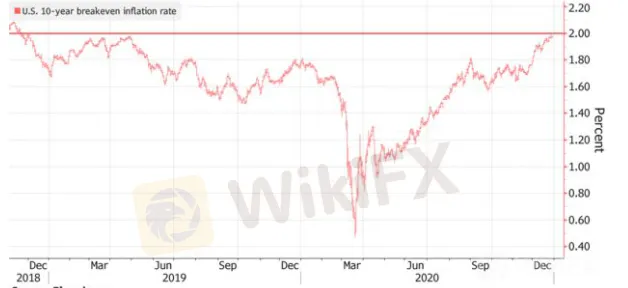

Abstract:Bloomberg data shows that the break-even inflation rate - a measure that draws on inflation-linked expectations - has hit a record high.

WikiFX Strategy (5 Jan.) - Bloomberg data shows that the break-even inflation rate - a measure that draws on inflation-linked expectations - has hit a record high. Since the US election has ended and the relief bill has been passed, inflation trends could be crucial to market performance in 2021 amid the vaccine hopes and the Fed's loosening policy.

Each day get a money-making strategy on WikiFX (bit.ly/wikifxIN)

Now that we've expected future inflation, how to beat it with investments accordingly?

Commodity investing could be one of the best options. Copper, iron ore and soybeans have risen to their highest levels in more than six years, says BlackRock analyst Evy Hambro. Recovering global economic growth and the possibility of higher inflation should be supportive for prices.

Investing with ETFs in a broad basket of commodities is also a good choice, which includes SPDR Gold Trust (the largest gold ETF in the world), USO (an oil ETF), etc.

Potential investments also include commodity currencies that are strongly linked with commodity prices, such as AUD, NZD and CAD. These currencies will embrace a rebound once seeing the economic recovery and the inflation rise.

Another method fighting against inflation is purchasing cyclical stocks (oil, natural gas, coal, steel, non-ferrous metals, etc.)

The US 10-year break-even inflation rates

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How to Pick a Stock?

Basic Best Practices for New Investors: So you've finally decided to start investing. And you know the cardinal rule of the smart investor: A portfolio should be diversified across multiple sectors.

Rich VS Poor Mindset - How to Think Like a Billionaire

No Matter How Much Money You Have, If you truly want to join the ranks of the super rich, you'll need to start thinking like you're already one of them.

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Webull Canada Unveils Desktop Trading Platform

Alert: Beware Unlicensed Trading Broker ProMarkets

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator