Markets Week Ahead: Dow Jones, Gold, US Dollar, US Election Aftermath, Where to?

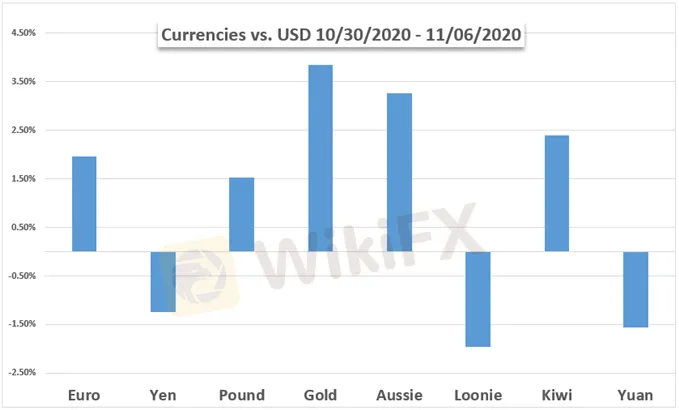

Abstract:The Dow Jones, S&P 500 and Nasdaq 100 experienced their best week since early April as the United States went to the polls to vote on a new government composition. Anti-risk currencies like the US Dollar and Japanese Yen declined as growth-linked ones like the Australian and New Zealand Dollars outperformed. Anti-fiat gold prices gained as crude oil rose cautiously.

The Dow Jones, S&P 500 and Nasdaq 100 experienced their best week since early April as the United States went to the polls to vote on a new government composition. Anti-risk currencies like the US Dollar and Japanese Yen declined as growth-linked ones like the Australian and New Zealand Dollars outperformed. Anti-fiat gold prices gained as crude oil rose cautiously.

Markets were initially thrown off by what was appearing to be a contested election. But as the counts came in, Democratic nominee Joe Biden began closing in on incumbent Donald Trump. On Friday, Mr Biden appeared to take the lead in key swing states Georgia and Pennsylvania. Some certainty likely boosted markets, overlooking what may be a smaller-than-expected fiscal package.

A confirmed win for Joe Biden will likely be a major foreign policy shift compared to the current administration, and emerging market assets are rallying. This is as the European Union is approaching the November 10th target date to impose WTO-approved tariffs against the United States worth about $4 billion.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

End of USD Dominance Amid Escalating Geopolitical Risks

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

WikiFX Forex Rights Protection Day has received extensive attention!

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator