I Ran the Numbers Again. Stocks Are Not the Economy.

Abstract:Even when using an equal-weight measure for the S&P 500 and not adjusting for inflation, there is no correlation between the market and GDP.

Nir Kaissar is a Bloomberg Opinion columnist covering the markets. He is the founder of Unison Advisors, an asset management firm. He has worked as a lawyer at Sullivan & Cromwell and a consultant at Ernst & Young.

{2}

Ever since U.S. stocks began rebounding from their depths of late March, there has been a glaring, and many would say disturbing, disconnect between the devastating impact of Covid-19 on the economy and the celebratory mood of the stock market. Seven months later, that disconnect is as deep as ever. The virus continues to plague the economy and the well-being of millions of Americans while the market marches higher.

{2}

And the truth is, there‘s nothing unusual about it. As I pointed out in June, the market and the economy have rarely moved in tandem, and for good reason: The market is not the economy. Its job is to tabulate investors’ consensus view about the future of publicly traded companies. It pays no attention to private businesses or government or other important parts of the economy.

Judging by the responses I received and the chatter I hear on the subject generally, many people dislike that conclusion. When the economy is in a funk, they seem to want the market to be in one, too. But why? One reason might be that a stock ticker is often the first, and perhaps only, source of financial or economic information people encounter, so they reflexively use it as a gauge of the economy. Another reason might be that President Donald Trump and other politicians ceaselessly point to a rising market as evidence of a strong economy (spoiler: It isnt).

Whatever the reason, it‘s important to distinguish between the two, not only as a matter of basic financial literacy but also because the market often obscures what’s happening in the broader economy. The years since the 2008 financial crisis are just the latest example. The stock market has performed far better than usual since the crisis, mostly because corporate America has enjoyed huge profits. Meanwhile, the economy has struggled to grow, leaving lots of Americans behind and widening the gap between rich and poor. Covid-19 has further deepened that divide. If you looked only at the market, you would hardly know anything was amiss.

More from

Even This Former Elevator Maker Needs Fewer Floors

AMD Is Officially Leaving Intel in the Dust

What the Democratic Playbook Might Look Like in 2021

Stop Waiting on New Covid-19 Treatments. Wear a Mask.

Still, some insist that the current rift between the market and the economy is unusual. In my June column, I compared the historical growth of the market, as measured by the S&P 500 Index, with the economy, as measured by gross domestic product, net of inflation and over various periods. I found no correlation. Some readers objected that adjusting for inflation needlessly adds another variable to the analysis and that a handful of companies dominate the S&P 500, both of which obscure the underlying relationship between the market and the economy.

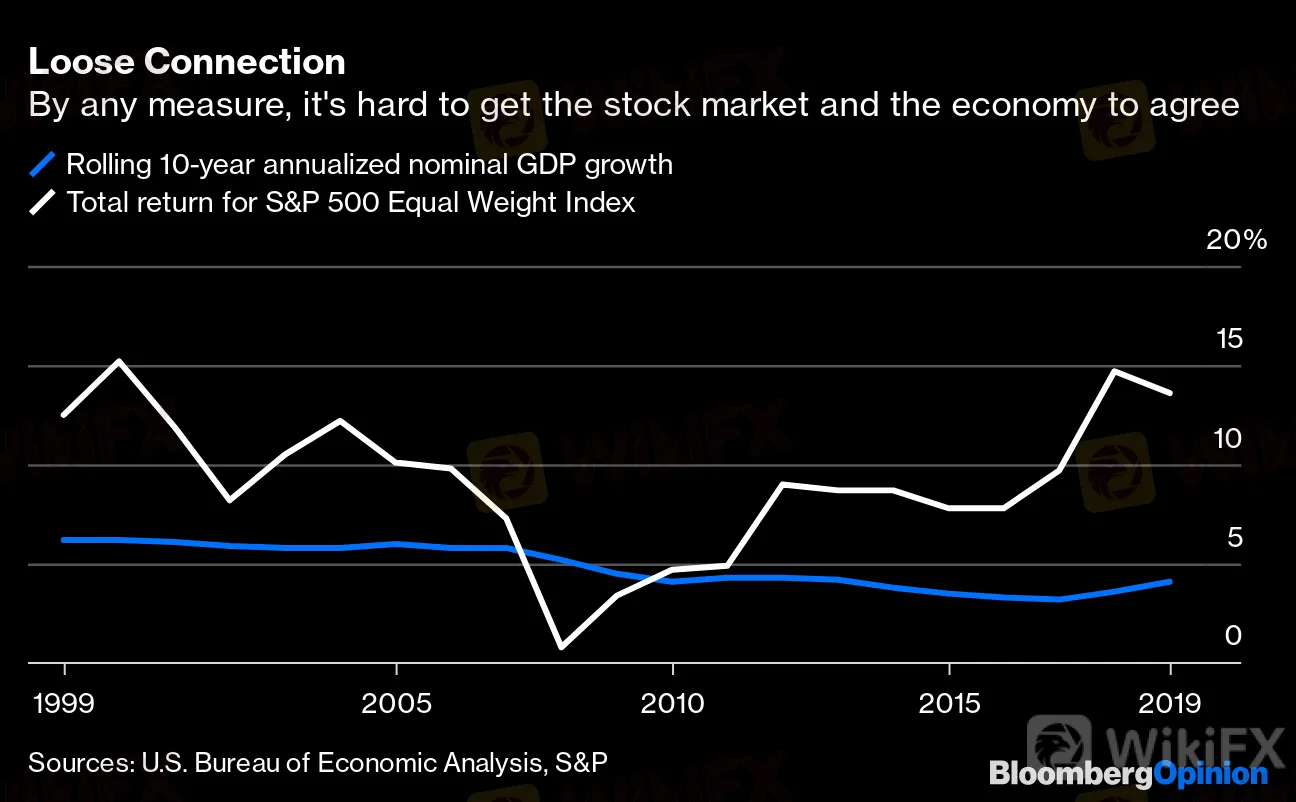

So I ran the numbers again, first comparing the S&P 500 and GDP without adjusting for inflation. The result is the same. The correlation between annual changes in nominal GDP and annual returns for the S&P 500, including dividends, was 0.11 from 1930 to 2019, and the correlation over rolling 10-year periods was 0.04. In other words, there was no correlation. (A correlation of 1 implies that two variables move perfectly in the same direction, whereas a correlation of negative 1 implies that two variables move perfectly in the opposite direction.)

Loose Connection

By any measure, it's hard to get the stock market and the economy to agree

Sources: U.S. Bureau of Economic Analysis, S&P

Then I ran the numbers using the S&P 500 Equal Weight Index, which, as the name suggests, gives each company an equal weighting in the index, roughly 0.2% a piece. The result was the same again. The correlation between annual changes in nominal GDP and annual returns for the equal weight index was a negative 0.02 from 1990 to 2019, the earliest year numbers are available for the index, and 0.22 over rolling 10-year periods. The numbers are roughly the same when adjusting for inflation.

{22}

One commenter, however, suggested a tweak that did move the numbers. “The market and the economy are not entirely disconnected,” Nathan Tankus, who writes a blog tracking the global economic impact of Covid-19, told me. “GDP is not a very clean measure of the economy in this context. A better one is corporate sales.”

{22}

{24}

Never one to let a proposition go untested, I ran the numbers yet again. It turns out that corporate sales and GDP are strongly related. The correlation between annual changes in nominal GDP and annual sales growth for the equal weight index was 0.63 from 1990 to 2019. Its even stronger over rolling 10-year periods, a near perfect 0.89. So corporate sales are a good stand-in for GDP.

{24}

And there is some relationship between sales and stock prices. The correlation between annual sales growth and annual returns for the equal weight index was 0.49 during the period, and 0.4 over rolling 10-year periods. Those numbers support Tankuss view that the market and the economy are not entirely disconnected, although they also reinforce the fact that the two diverge much of the time.

So what can be done to clear up the confusion around the market and the economy? Media outlets, for one, can make economic data as visible as stock tickers, granting that watching stocks bounce around is far more exciting. Economists and financial pundits can be more careful about using the market as a proxy for the economy, and push back when politicians do it. But perhaps the best way is to just say it plainly: The stock market doesnt care about the economy.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Nir Kaissar at nkaissar1@bloomberg.net

To contact the editor responsible for this story:

Daniel Niemi at dniemi1@bloomberg.net

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator