Russia Plays It Safe on Rates After Sanctions Threats Hit Ruble

Abstract:Bank of Russia Governor Elvira Nabiullina kept rates on hold for the second policy meeting in a row, taking a cautious stance while leaving the door open to renewed easing once the U.S. presidential vote has passed.

Bank of Russia Governor Elvira Nabiullina kept rates on hold for the second policy meeting in a row, taking a cautious stance while leaving the door open to renewed easing once the U.S. presidential vote has passed.

The benchmark interest rate was left at 4.25%, according to a central bank statement on Friday. The decision was forecast by 34 out of 40 economists in a Bloomberg survey, with the rest expecting a 25 basis-point reduction.

The prospect of fresh sanctions should Democratic candidate Joe Biden win the U.S. presidential race has contributed to the ruble‘s 6.5% slide in the past three months, narrowing Nabiullina’s scope to cut rates and lift the economy from a pandemic-driven slump.

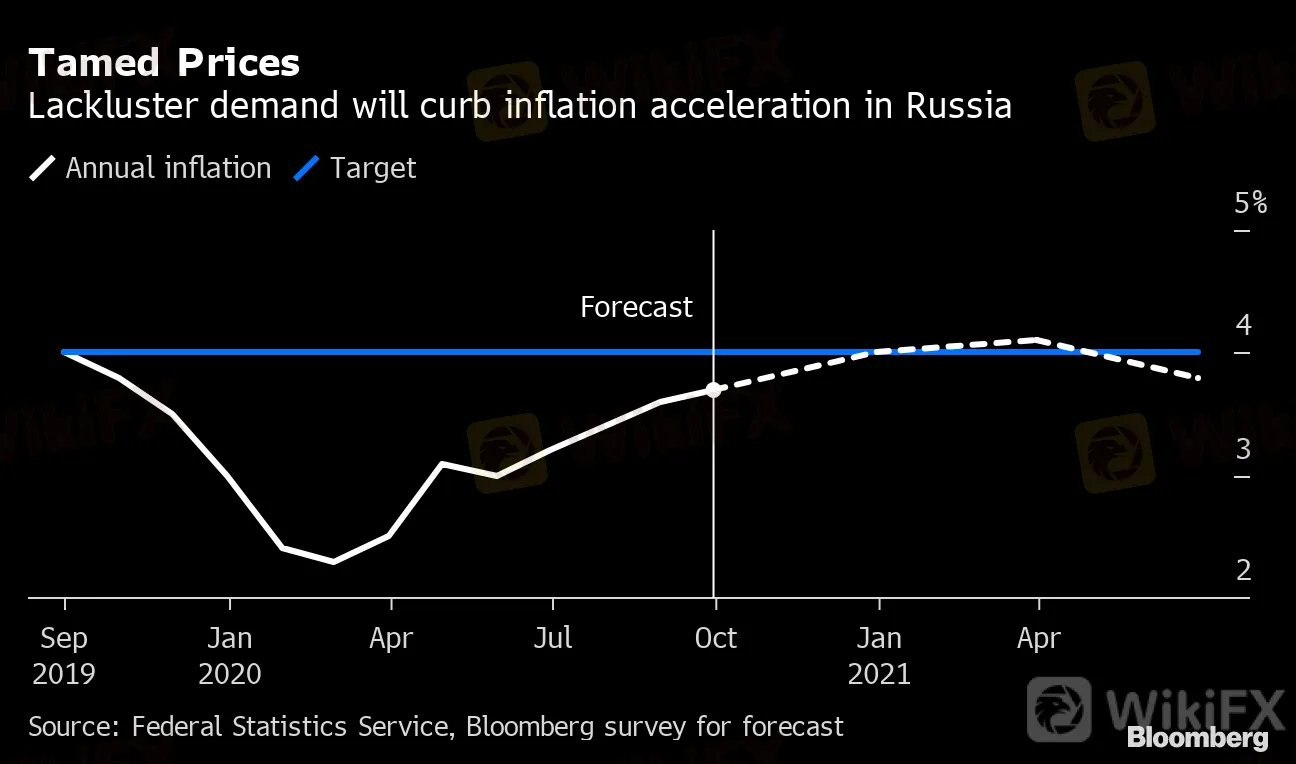

Tamed Prices

Lackluster demand will curb inflation acceleration in Russia

{11}

Source: Federal Statistics Service, Bloomberg survey for forecast

{11}

“Whether the policy rate will be lowered at the last meeting this year on Dec. 18 will to a large degree depend on who wins the U.S. presidential election,” said Piotr Matys, a London-based strategist at Rabobank. A win by Democratic candidate Joe Biden “would limit room for a rate cut in December.”

Speaking in the last debate before the Nov. 3 vote, Biden warned that any country interfering in U.S. elections will “pay a price,” adding that its clear Russia has already been involved.

{18}

Nabiullina said at a news conference after the decision that the risks mean the central bank needs to “use the room for monetary easing carefully.” She added, however, that the worsening virus situation in Russia and elsewhere has clouded the economic outlook, leaving room to extend the 350 basis points of rate cuts Russia has pushed out since June 2019.

{18}

Despite slightly improving its forecast, the central bank still sees a 4% to 5% slump this year and predicts disinflationary factors will prevail in the long term. The weaker ruble meant the regulator raised its inflation forecast for the end of the year slightly to 3.9%-4.2%, compared with the previous estimate of 3.7%-4.2%.

What Our Economists Say:

{21}

“Caution prevailed, but policy makers still see room to cut rates. They may pull the trigger in December, with the recovery losing momentum and underlying price pressure looking soft.”

{21}{22}

--Scott Johnson, Bloomberg Economics

{22}{777}

In its statement, the central bank warned that the situation in external financing and commodity markets remains vulnerable, while “increased volatility” including from geopolitical factors can persist in the near future.

{777}

The ruble held gains after the rate decision, trading 0.4% stronger at 76.2550 per dollar as of 6 p.m. in Moscow. Ten-year bond yields were unchanged at 5.97%.

“Both supply side and geopolitical tensions may push inflation expectations even higher in the next several months,” Evgeny Koshelev, an analyst at Rosbank in Moscow, said. “The room for further policy easing continues to narrow, even as the pandemic continues to spread all around.”

{27}

— With assistance by Zoya Shilova, and Andrey Biryukov

{27}

(Updates with Nabiullina comments from sixth paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator