Crude Oil Prices Eye Chart Barrier as Markets Weigh Fed, ECB Policy

Ikhtisar:Crude oil prices have run into four-month chart resistance as markets await cues from Julys FOMC and ECB meeting minutes as well as the Jackson Hole symposium.

CRUDE OIL & GOLD TALKING POINTS:

Crude oil prices edge up in risk-on trade, but key resistance held

API inventory flow data rounds out barebones economic calendar

Gold prices retreat as markets eye FOMC minutes, Jackson Hole

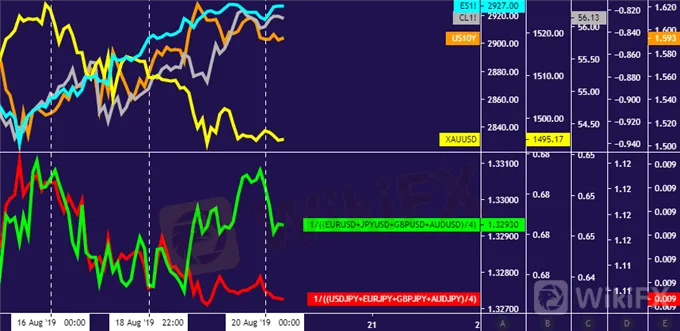

Friday‘s risk-on sentiment tilt carried through Monday’s session, with crude oil prices rising alongside stocks. A parallel rise in bond yields undermined the appeal of non-interest-bearing assets and weighed on gold. Impressively, the US Dollar recovered some lost ground despite its recently anti-risk profile.

All the same, the benchmark commodities made little progress from near-term ranges, as expected. That seems to reflect traders withholding conviction ahead of critical event risk: minutes from Julys FOMC and ECB meetings as well as the Fed-hosted economic symposium in Jackson Hole, Wyoming.

The weekly API inventory flow report rounds out the barebones data docket. It will be sized up against expectations of a 1.22-million-barrel drawdown in US stockpiles expected to be reported in official EIA statistics due Wednesday. Absent dramatic deviation, a strong response from prices seems unlikely.

GOLD TECHNICAL ANALYSIS

Gold prices edged lower toward swing low support at 1480.00. A daily close below that would bolster topping cues hinted in negative RSI divergence, exposing a more substantive barrier in the 1437.70-52.95 zone next. Swing high resistance is at 1535.03, with a weekly chart inflection level at 1563.00 lining up thereafter.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned below resistance capping gains since late April, now at 58.30. A daily close above that targets the 60.04-84 zone. Alternatively, a move below the congestion area running down through 53.95 sets the stage to challenge support near the $50/bbl figure once again.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

WikiFX Broker

Berita Terhangat

Hilang Uang Saya ! Trader Indo Marah Ke Broker Loyal Trust Market

Hari Ketiga! Kontes Tebak Broker WikiFX 2024 Berhadiah USDT

Hari Kedua ! Kontes Tebak Broker WikiFX 2024 Berhadiah USDT

Slogan Broker Forex Baru Broker Ini Sukses Mencuri Perhatian Para Trader!

USD/CHF Menguat di Atas 0,9100 di Tengah Pernyataan Hawkish The Fed

Hari Perlindungan Hak Forex WikiFX Telah Mendapat Liputan Signifikan di Seluruh Dunia

Klarifikasi Tuduhan Fixed Income: Oknum Di Broker PT Menara Mas Futures

Broker Penipu! Regulator Bongkar Si Broker Bermasalahnya

Harga Emas Turun Tajam karena Ketegangan di Timur Tengah Mereda

Broker DIGEPREK Regulator! Untungnya Hak Perlindungan Konsumen Tetap Berjalan

Nilai Tukar