Euro May Fall on ECB Minutes, Jackson Hole and Eurozone PMIs

摘要:The Euro may fall against the US Dollar if ECB minutes carry ultra-dovish undertones and commentary from Jackson Hole spooks markets against the backdrop of Eurozone PMI data.

US Dollar, Euro, Jackson Hole, Eurozone PMIs – TALKING POINTS

Euro may fall vs. US Dollar if ECB minutes evoke ultra-dovish expectations

Eurozone PMIs may exacerbate regional growth fears and undermine Euro

Official commentary on growth outlook at Jackson Hole may spook markets

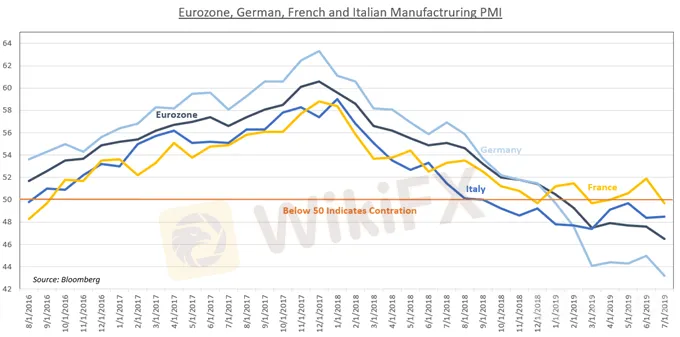

The Euro may suffer against the US Dollar if the release of the ECB minutes reveal stronger-than-expected dovish inclinations against the backdrop of Eurozone PMI publications. Regional growth concerns have been mounting as Germany – Europes largest economy – is expected to show a contraction in Q2. Comments from officials at the Jackson Hole symposium may also stoke growth fears and boost the anti-risk USD vs the Euro.

Jackson Hole Symposium

Markets will be closely watching the Jackson Hole symposium for comments from officials regarding the growth outlook. The release of the FOMC meeting minutes revealed that trade war concerns remain a “persistent headwind” and low inflation remain key obstacles along with corporate debt and leveraged lending. The latter has begun to sound the alarm as the collateralized loan obligation market stirs familiar fears.

European Growth Concerns, Political Instability

If comments from the Jackson Hole symposium carry overwhelming undertones of uncertainty, the Euro may fall against its US Dollar counterparts. EURUSDs decline may be amplified if Eurozone PMI data reinforces the fear that the Eurozone is significantly decelerating in its growth prospects. As it stands, Germany is planning on implementing stimulative policies as a contingency for a crisis ahead.

Europe is also dealing with chronic political upset in both the mainland and overseas. The latter is referring to the ongoing Brexit negotiations that remain unclear despite the October 31 deadline approaching. Italian political volatility and another possible budget dispute in the same month may magnify market volatility. During times of economic uncertainty, the capacity for political shocks to disrupt markets is notably increased.

CHART OF THE DAY: Weak European Manufacturing PMI May Spill Over into Services Soon

FX TRADING RESOURCES

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

澳洲ASIC 宣布高階主管領導層退出

黑平台Hengtuo Finance詐騙手法揭密:誆稱跟單操作黃金輕鬆賺,指控洗錢凍結帳戶拒出金

最近很多人詢問T4Trade的評價,這家經紀商是詐騙嗎?監管情況與平台環境一次看

加密貨幣和外匯市場有什麼區別?

高雄退休婦女遭假理專鼓吹投資369萬,面交前起疑報警逮3車手;金融委員會提醒注意風險平台Lloyds Markets

塞浦路斯CYSEC 對 16 家未經授權的投資公司發出警告

Bell Potter天眼評分滿高的,這家外匯券商好用嗎?

匯率計算