01/26 Market reprot

Abstract:USA30 / XAUUSD / GBPUSD / USOIL

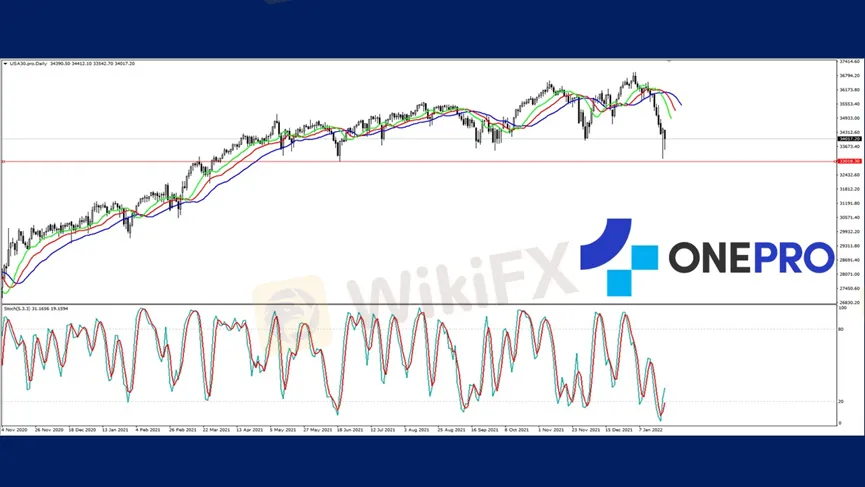

【Dow Jones Index USA30】

The Dow Jones plunged 1,000 points during yesterdays session. After that, it was pulled all the way up to form a long lower shadow line. From the perspective of technical analysis, the long lower shadow line indicates that there is buying power.

The Fed's meetings are underway these two days and the market is waiting for the Fed to provide a good rhythm by improving the inflation at this stage.

At present, the long, medium and short three moving averages are death crosses. The KD has just left from the low-end figure area to form a golden cross. After a few days of downward trend, there is finally a technical indicator that is different from the downwards. Investors must observe whether there will be lower shadow lines as this indicates that there are funds buying the Dow cheap.

USA30 –D1

Resistance 1: 33800 / Resistance 2: 34161 / Resistance 3: 34659

Support 1: 33018 / Support 2: 32069 / Support 3: 29625

【XAUUSD】

GLD-US, the world's largest gold exchange-traded fund, net inflows of $1.63 billion in one day. That is the equivalent of buying 27 tonnes of gold. This is the largest net inflow in 17 years and that shows that the mood of investors in the market for risk aversion is still quite high.

The technical analysis of gold is currently quite strong. Alligator shows a golden cross while KD high-end figure. The price has also not broken the daily low and the momentum of the upward trend is very strong.

XAUUSD – D1

Resistance 1: 1865.50 / Resistance 2: 1875.80

Support 1: 1832.20 / Support 2: 1814.50 / Support 3: 1789.50

【GBPUSD】

The recent pound sterling movement shows a correction from the high-end retracement. The main reason is due to the recent appreciation of the dollar. Even though there are no special news on the pound, the market believes that the UKs policy of tightening funds will be more active.

After the pound pulled back from a wave of correction, Alligator became tangled. From the line chart, the long-term trend pattern is still bullish.

GBPUSD – D1

Resistance 1: 1.35200 / Resistance 2: 1.35800

Support 1: 1.34780 / Support 2: 1.33750 / Support 3: 1.32780

【USOIL】

The United Arab Emirates (UAE) said on Monday it had successfully intercepted two missiles fired at its capital, Abu Dhabi. They condemned Yemeni Houthi rebels for brewing clashes in the region.

In addition to the recent geopolitical complexity, the US crude oil futures will also affect the price of the US dollar. This is because crude oil is denominated in US dollars and is able to make the price of crude oil fluctuate. Crude oil is currently oscillating at a high level.

USOIL – D1

Resistance 1: 87.180 / Resistance 2: 87.800

Support 1: 85.120 / Support 2: 82.800 / Support 3: 81.820

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs atwww.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FOREX TODAY: THE US DOLLAR IS HAVING TROUBLE RECOVERING, AND THERE WILL BE MORE FEDSPEAK.

India's Forex Rules Shake-Up Stuns Traders and Markets

Maunto Review: Imp. Things to Know!!

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

WARNING!! They are Fraud Brokers

Italy's CONSOB Shuts Down 7 Rogue Financial Sites

Australia's $41 Million Crypto Scheme Meltdown

FX MARKET ROARS BACK INTO LIFE WITH $1 BILLION SINGLE-DAY DEAL.

Currency Calculator