Introduction of CIFCO

Abstract:China International Futures Co., Ltd. (CIFCO) was formally established on December 28, 1992. China International Futures (Hong Kong) Company Limited (CIFCO HK) is a wholly-owned subsidiary of CIFCO. In 2015, CIFCO HK established China CIFCO Securities Co., Ltd. to provide customers with securities trading and related consulting services.

| Aspect | Information |

| Registered Country | Hong Kong |

| Founded Year | 15-20 years ago |

| Company Name | China CIFCO Securities Co., Limited |

| Regulation | Regulated by Hong Kong Securities and Futures Commission (SFC) |

| Minimum Deposit | N/A |

| Maximum Leverage | Up to 1:1000 on currencies, varies for other products |

| Spreads | N/A |

| Trading Platforms | Yisheng Jixing 9.3 Intelligent Platform, Yixing Mobile App |

| Tradable Assets | Futures, financial futures, investment funds, etc. |

| Account Types | Personal/joint accounts, corporate accounts |

| Customer Support | Contact via phone, fax, QQ, and email |

| Payment Methods | Various methods including online banking, telephone banking, and bank counters |

General Information

China International Futures Co., Ltd. (CIFCO) was formally established on December 28, 1992. China International Futures (Hong Kong) Company Limited (CIFCO HK) is a wholly-owned subsidiary of CIFCO. In 2015, CIFCO HK established China CIFCO Securities Co., Ltd. to provide customers with securities trading and related consulting services.

CIFCO offers a range of products and services, including futures trading across various asset classes, financial futures, investment consultation, asset management, and fund sales. They cater to both personal/joint account holders and corporate clients, with different account options available. The leverage offered by CIFCO varies depending on the product and account type, with varying levels of leverage provided.

The company charges various fees and commissions for its services, including transaction fees, stamp duty, trading levy, exchange fees, and other charges related to account maintenance and services. Customers can deposit funds into CIFCO's client account through different methods and must ensure currency matching during deposits. Withdrawal requests have a cutoff time on business days.

CIFCO provides two trading platforms, Yisheng Jixing 9.3 Intelligent Platform and Yixing Mobile App, both designed to offer market data and trading capabilities with user-friendly interfaces. Customer support is available through multiple contact options.

Pros and Cons

CIFCO presents several advantages, including being regulated by the SFC in Hong Kong, offering diverse futures trading options, providing multiple deposit methods, featuring comprehensive high-speed trading platforms, and offering a range of contact options for customer support. However, it also comes with its share of drawbacks, such as exceeding its licensed business scope, imposing numerous fees and charges, not accepting third-party deposits, lacking specific information on products, and not specifying leverage ratios.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Is CIFCO Legit?

China CIFCO Securities Co., Limited, operating under the license number BEX660, is currently regulated by the Securities and Futures Commission of Hong Kong (SFC) for dealing in securities. Please be aware of the regulatory status and scope of this institution, as it has exceeded its licensed business scope, which may pose certain risks.

Business

CIFCO HK and CIFCO Securities provide domestic and foreign investors with various types of trading services such as global futures, options, Hong Kong stocks, funds, and derivative warrants. The main business of CIFCO is commodity futures, financial futures, futures investment consulting business and asset management. CIFCO Securities is mainly engaged in securities trading, custody, settlement, agency and margin financing services.

FUTURES: CIFCO provides futures trading opportunities across a broad spectrum of asset classes. Examples of these assets include commodities like crude oil and gold, financial instruments like stock index futures (e.g., Hang Seng Index futures), and interest rate futures (e.g., USD/HKD futures).

FINANCIAL FUTURES: In addition to standard futures, CIFCO specializes in financial futures, enabling clients to trade derivatives tied to financial products. These may include options and futures contracts on financial instruments such as stock indices (e.g., Hang Seng Index) and currency futures (e.g., USD/HKD).

FUTURES INVESTMENT CONSULTATION: CIFCO offers advisory services to clients seeking insights and guidance on their futures investments. Their consultation services cover a wide range of topics, including market analysis, risk management strategies, and portfolio optimization, ensuring clients make informed trading decisions.

ASSET MANAGEMENT: CIFCO engages in asset management, helping clients manage their investment portfolios. They may invest in a diverse array of assets, including stocks, bonds, and other financial instruments, tailoring portfolios to meet individual client goals and risk preferences.

FUND SALES: CIFCO facilitates access to various investment funds, offering clients opportunities to diversify their portfolios. These funds encompass different asset classes, such as equity funds, fixed-income funds, and mixed-asset funds, allowing clients to choose investments aligned with their financial objectives.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

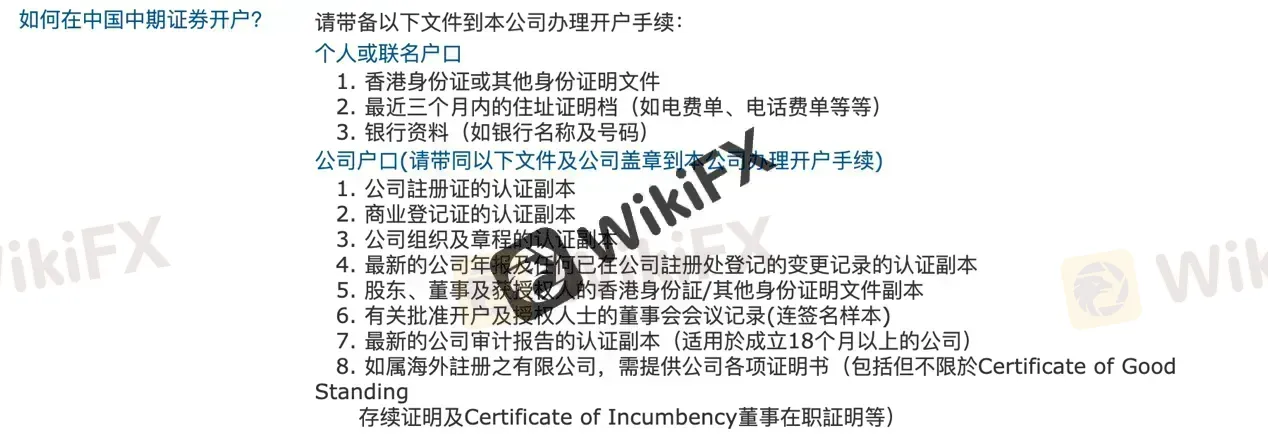

Account Types

CIFCO offers two types of account options: personal or joint accounts and corporate accounts. For corporate accounts, clients are required to provide the necessary documents along with the company's official seal during the account opening process.

Leverage

The amount of leverage offered by CIFCO varies depending on the product and the trader's account type. For example, CIFCO offers up to1:100 leverage on equities, up to 1:50 leverage on bonds, and up to 1:1000 leverage on currencies.

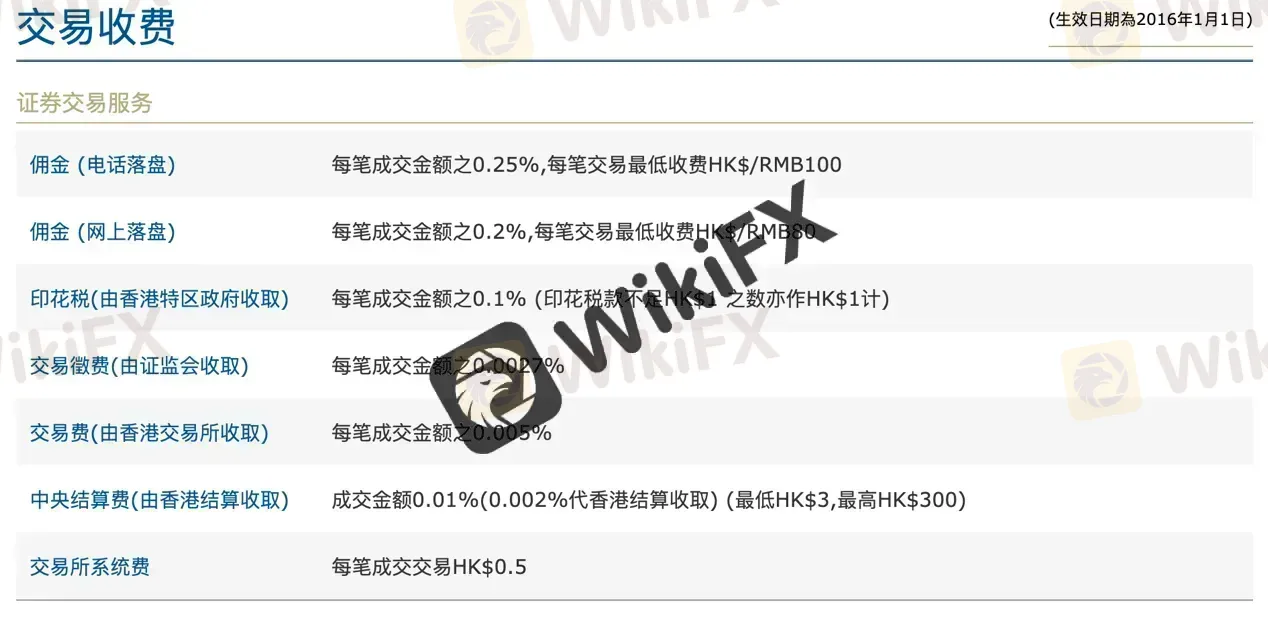

Commission

For securities trading services, the commission (for placing orders over the phone) is 0.25% of the transaction amount, and the minimum charge for each transaction is HK$/RMB100; the commission (for online orders) is 0.2% of the transaction amount, and the minimum charge for each transaction is HK$/RMB80.

Trading Software

易盛极星9.3智能化平台 (Yisheng Jixing 9.3 Intelligent Platform): The Yisheng Jixing 9.3 Intelligent Platform is a comprehensive platform that combines market data and trading capabilities. It is known for its small size, high-speed performance, and robust functionality. This platform covers trading on major international exchanges and offers advanced technical analysis features and various order placement methods. It boasts a interface layout that allows users to customize their trading systems and enables investors to participate in domestic and international derivative markets quickly, securely, and comprehensively. It is suitable for both domestic and international clients, offering easy multi-account access and simple simultaneous operations.

易星软体(手机版) (Yixing Mobile App): Yixing is the next-generation mobile futures software developed by Yisheng Information, integrating market data and trading functions. It sources its international market data from premium providers, ensuring timely and stable information. The user-friendly and streamlined interface offers fast operation. The main menu is categorized for quick access to relevant settings. The installation package is compact and does not consume excessive phone memory. Users can even switch to a night mode to reduce brightness and protect their eyes. The visual interface allows users to easily access the most professional and fastest market information and quotes, enabling faster and more precise trading experiences. This mobile app empowers users to stay ahead in the market and execute trades with speed and accuracy.

| Pros | Cons |

| Comprehensive platform with advanced features | No popular trading platforms available, such as MT4 |

| High-speed performance and robust functionality | |

| User-friendly mobile app for on-the-go trading |

Deposit & Withdrawal

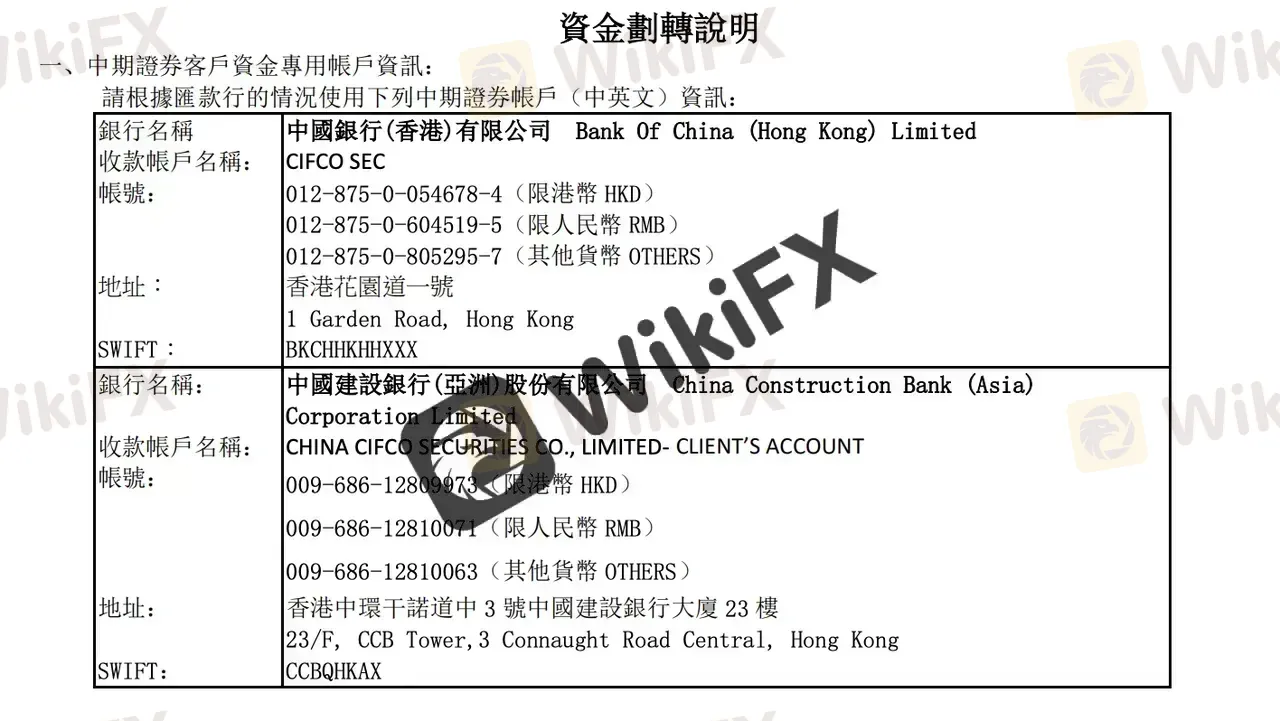

Deposit:

Customers can deposit funds into China CIFCO Securities Co., Limited's client account through various methods, including online banking, telephone banking, or at bank counters, using the same-name bank account as specified in the contract. After completing the transfer, customers are required to provide the bank's confirmation or online banking transfer records via fax (852-22509065) or email (help.sec@cifcohk.com). Customers should also call the customer service hotline (852-3700 1300 or 4001208718) to inform them for timely confirmation of the receipt. It's important to note that deposits must be made by the account holder, and any third-party deposit instructions will be rejected, with customers responsible for associated fees and losses. Additionally, customers should ensure that the deposited currency matches the corresponding bank account. The company is not liable for any exchange losses incurred due to depositing into different currency accounts. Deposit receipts must include transfer amount and currency, sender's name and bank account, recipient's name and bank account, transfer reference (bank transaction number, bank reference number), and transfer date.

Withdrawal:

Customers can request withdrawals from China CIFCO Securities Co., Limited after confirming the availability of sufficient funds. The cutoff time for withdrawal requests on business days is 11:00 AM, and any withdrawal requests received after this cutoff time will be processed on the following business day.

| Pros | Cons |

| Multiple deposit methods available | Third-party deposit instructions rejected |

| Clear instructions for deposit process | Exchange losses possible due to currency mismatch |

| Timely processing of withdrawal requests | Withdrawal cutoff time on business days |

Trading Hours

The continuous trading hours of Hong Kong stocks are Monday to Friday (except public holidays) 9:30am–12:00pm in the morning and 1:00pm–4:00pm in the afternoon.

Customer Support

For customer support, China International Futures (Hong Kong) Company Limited can be reached at TEL: (852) 2573 9868 or 4001 200 939, FAX: (852) 2573 9123, QQ: 2122879733, and via email at help@cifcohk.com. China CIFCO Securities Co., Limited's customer support is available at TEL: (852) 2573 9868 or 4001 200 939, FAX: (852) 2573 9123, QQ: 2824453450, and via email at help.sec@cifcohk.com. They are located at 香港铜锣湾告士打道255-257号信和广场29楼2903室 in Hong Kong and provide various contact options for client inquiries and assistance.

Conclusion

In conclusion, CIFCO offers a range of financial products and services, including futures trading, financial futures, investment consultation, asset management, and fund sales. It provides options for both personal/joint and corporate accounts, offering varying levels of leverage depending on the product and account type. However, clients should be aware of the associated fees and commissions, which can accumulate quickly with numerous charges for transactions, services, and miscellaneous activities. The deposit and withdrawal processes are outlined with specific requirements and cutoff times. CIFCO offers two trading platforms, known for their functionality and accessibility. Customer support is available through various channels. It's worth noting that there are regulatory concerns regarding CIFCO's licensed business scope, potentially posing risks.

FAQs

Q: Is CIFCO a legitimate company?

A: Yes, China CIFCO Securities Co., Limited is a legitimate company regulated by the Securities and Futures Commission of Hong Kong (SFC) for dealing in securities. However, please be aware of its licensed business scope, as it has certain limitations.

Q: What types of products and services does CIFCO offer?

A: CIFCO provides futures trading opportunities across various asset classes, including commodities, financial instruments, and interest rate futures. They also specialize in financial futures, offer futures investment consultation, asset management, and access to investment funds.

Q: What are the account options at CIFCO?

A: CIFCO offers two types of account options: personal or joint accounts and corporate accounts. Corporate account applicants need to provide specific documents along with the company's official seal during the account opening process.

Q: What is the leverage offered by CIFCO?

A: CIFCO offers varying leverage ratios depending on the product and account type. For instance, leverage can go up to 1:100 for equities, 1:50 for bonds, and even up to 1:1000 for currencies.

Q: What are the fees and commissions associated with CIFCO?

A: CIFCO charges fees and commissions for transactions, including a 0.25% fee per transaction, minimum charges, stamp duty, trading levy, exchange fee, and more. Various charges also apply to services like IPO application and account maintenance.

Q: How can I deposit and withdraw funds with CIFCO?

A: To deposit, you can use online banking, telephone banking, or bank counters, following specific instructions. For withdrawals, ensure sufficient funds are available, and make requests before the cutoff time on business days.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Is This the Beacon of Light for MYR?

The article suggests positive prospects for Malaysia's Ringgit (MYR) based on projections by BMI, indicating potential strengthening trends in the latter half of 2024 and early 2025. Factors such as anticipated policy relaxation, stability in yield differentials, and favourable external conditions contribute to this outlook. However, whether this constitutes "good news" for the MYR ultimately depends on various factors, including economic performance, policy decisions, and external developments, which may impact currency movements.

Best Futures Trading Platforms of 2024 Overall

As a type of financial derivative, futures hold a critical position in the global financial markets. Offering benefits such as hedging against price volatility and high leverage, futures trading brings significant advantages. This article aims to define futures and explain their function, highlight the benefits of trading futures, and provide a comprehensive review of leading futures brokers such as Interactive Brokers, TradeStation, E*TRADE, and Charles Schwab.

WTI hovers around $77.00 with a positive momentum, focus shifts to US PCE, Oil Rig Count

West Texas Intermediate (WTI) oil price pauses its two-day winning streak but is anticipated to conclude the week on a positive note, trading near $77.00 per barrel during the Asian session on Friday.

FCA Warns an Unauthorized Broker Named 'Sapphire Markets'

On December 7, the UK's Financial Conduct Authority (FCA) regulator warned against an unauthorized broker called Sapphire Markets, reminding the public to be aware of financial safety.

WikiFX Broker

Latest News

EXPERTS SAY NIGERIA CAN INCREASE FOREIGN EXCHANGE REMITTANCES BY LOWERING TRANSACTION COSTS.

End of USD Dominance Amid Escalating Geopolitical Risks

Caution in Online Trading: Intersphere Enterprises Alleged Scam

WikiFX Forex Rights Protection Day has received extensive attention!

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

CLONE FIRM ALERT

Currency Calculator