Why is India's car industry in breakdown mode?

Zusammenfassung:Media playback is unsupported on your device Media captionWhat cars and underwear say about India's

Media playback is unsupported on your device

Media captionWhat cars and underwear say about India's slowdown

India's second-biggest manufacturer of commercial vehicles, Ashok Leyland, is suspending production at several units from five to 18 days in September, triggering fears that the slump in the automotive sector shows no sign of letting up. The BBC's Nitin Srivastava reports.

Ram Mardi is worried he may lose his job. He works for a company that makes spare parts for cars and heavy vehicles in Jamshedpur, an industrial city in eastern India. But he has worked only 14 days in August.

“We had a comfortable life until recently. Now, it's hard to arrange food or pay for the children's education,” Mr Mardi says.

The factory he works at temporarily suspended production for half of the month to reduce inventory in the face of shrinking demand.

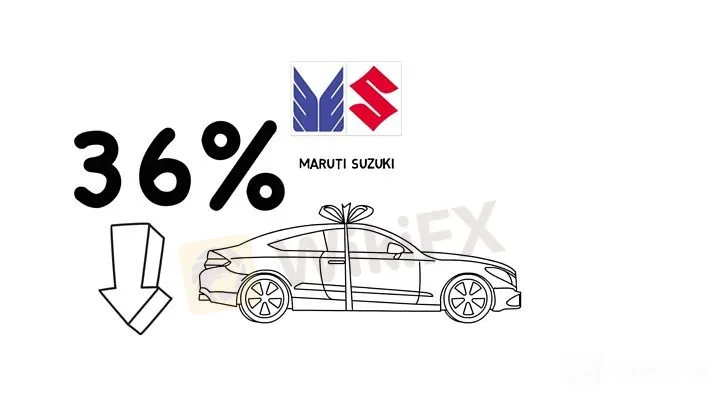

Industry heavyweights such as Maruti, Tata Motors and Mahindra & Mahindra have all announced production cuts over the past several months.

Image copyrightGetty ImagesImage caption

India's automotive industry employs some 35 million people

India's economy is facing a slowdown. It grew at 5% in the quarter ending June 2019 - its lowest in five years. This - along with a drop in private investment and a banking crisis that has made it hard to access credit - has weakened consumer demand.

The Indian government is also pushing for a transition to electric vehicles over the next decade, which some experts believe, has contributed to falling vehicle sales.

As the automotive industry declined for the 10th month in a row in August, car sales dropped by 41% - the steepest fall in two decades.

The industry is one of India's biggest, considering it employs some 35 million people, directly or indirectly, and contributes more than 7% to the country's GDP.

By some estimates, more than 100,000 workers, many of them contractual, have lost their jobs so far. Now fears are rising that if demand continues to fall, forcing lower production, more jobs could disappear.

Viewpoint: How serious is India's economic slowdown?

What is really happening with India's economy?

India's next government will have a growth problem

Small and medium businesses - thousands of ancillary units that supply to the big manufacturers - have been hit the hardest. And daily wage labourers such as Mr Mardi are the most vulnerable.

And employers are also concerned. “I have never had so much trouble keeping my factory up and running”, says Sameer Singh, who heads a family-owned business in Jamshedpur that makes spare parts for vehicles.

“My employees are jobless for a few weeks and I feel for them. If this continues they may move out, perhaps find another job. But I can't even look out for a job. My life starts and ends here”.

Mr Singh says its also been hard for business owners, companies and consumers to borrow money because banks have tightened credit lines after a spike in bad loans in recent years dented their balance sheets.

Image copyrightGetty ImagesImage caption

Car sales in India have dropped to their lowest in 20 years

“The fall [in production] is so large and so dramatic that it has affected every single product - two-wheelers, car, commercial vehicles,” says Sanjay Sabherwal, member of the Automotive Component Manufacturers Association of India, an industry body.

Auto executives have been demanding tax cuts and easier access to financing for manufacturers, sellers and consumers. The government recently announced a slew of measures - this includes a delay in increasing the registration fees for new vehicles and asking banks to lower interest rates on loans for cars and two-wheelers.

But, will that be enough? That is hard to say with experts calling this the worst downturn to ever hit India's automotive industry.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Immer mehr Menschen heben Geld an der Supermarktkasse ab – zum Nachteil der Unternehmen

CEO von JustETF entlarvt 5 Börsen-Mythen – darum hält er nichts vom Hype um die „Buy the dip-Strategie

Händler, die Long-Positionen anstreben, könnten bald ihre Rallye haben, da die Finanzierungssätze ins Negative drehen

Diese Kupfermine in Panama liegt still – und ist mit der Grund, warum der Preis des Rohstoffs weltweit in die Höhe schnellt

XRP konsolidiert den sechsten Tag in Folge um die wichtige Marke von $0,50

Dogwifhat-Preis steigt um 5% vor möglichem Coinbase-Effekt

Bitcoin hat in diesem Jahr 50 Prozent an Wert gewonnen – geht das so weiter?

OMNI mit fast 50% Verlust nach Airdrop und Börsengang

Maschmeyer-Startup sammelt über 50 Millionen Euro ein – hier seht ihr das Pitchdeck

Zugreifen? Diese 8 Luxusuhr-Marken sind im Preis gefallen

Wechselkursberechnung