Crude Oil Prices May Fall Further as Global Growth Outlook Dims

概要:Crude oil prices may continue to fall after suffering the largest weekly drawdown in two months as the outlook for global growth – and thereby energy demand – sours.

CRUDE OIL PRICE FORECAST: BEARISH

原油价格预测:熊势

Crude oil prices drop most in two months amid oversupply concerns

由于供过于求的担忧,原油价格在两个月内下跌最多

Slowing global growth to weigh on demand as US output stays brisk

随着美国产量保持旺盛,全球经济增长放缓以应对需求

ECB and IMF guidance, Q2 earnings, US GDP may prolong selloff

欧洲央行和国际货币基金组织的指引,第二季度收益,美国GDP可能会延长抛售

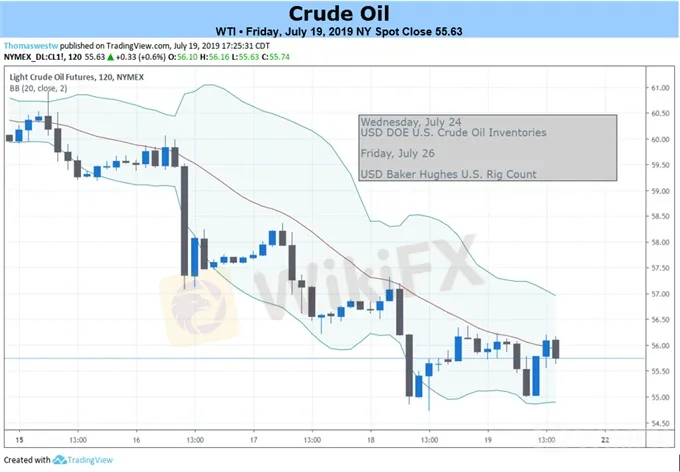

Crude oil prices turned sharply lower last week, suffering the largest drop in two months. Building oversupply concerns appear to be the underlying catalyst for weakness as slowing global growth cools uptake expectations while US output continues to register near record highs.

上周原油价格大幅走低,创下两个月以来的最大跌幅。建筑供过于求的担忧似乎是疲弱的潜在催化剂,因为全球经济增长放缓降低了吸纳预期,而美国产量继续接近历史高位。

Short-term volatility aside, this has been a driving narrative for some time. The JPMorgan PMI gauge of global economic activity growth peaked in February 2018 and has trended lower since. Not surprisingly, an IEA measure of worldwide crude demand topped along with prices a mere seven months thereafter.

短期波动除外,这已经是一段时间的驾驶叙事。摩根大通PMI衡量全球经济活动增长在2018年2月达到顶峰,并且自那以来一直走低。毫不奇怪,国际能源署对全球原油需求的衡量标准在此后仅仅七个月就达到了顶峰。

The recent renewal of an OPEC-led supply cut scheme has not noticeably helped. That is not surprising. Prices were likewise unimpressed when the arrangement was previously refreshed in late 2018 and only began a lasting rebound when growing Fed rate cut speculation buoyed broader risk appetite.

最近石油输出国组织的续约供应减少计划没有明显帮助。这并不奇怪。当该安排在2018年底进行更新并且随着美联储降息预期的增加推动更广泛的风险偏好时,价格同样不受打击。

CRUDE OIL PRICES AT RISK AS GLOBAL GROWTH OUTLOOK SOURS FURTHER

原油价格面临全球增长前景的风险

{10}

The week ahead seemingly offers ample fodder for the selloff to continue. The IMF is likely to downgrade its global economic performance forecasts, an ECB policy announcement is expected to set the stage for easing amid the slowdown, and US GDP growth is seen hitting a three-year low in the second quarter.

{10}

A steady stream of high-profile corporate earnings releases might add to downside pressure. Bottom-line results have topped forecasts by an average of nearly 5 percent thus far in the second-quarter reporting season, with close to 15 percent of the bellwether S&P 500 in the rearview.

源源不断的高调企业盈利发布可能会增加拥有压力。到目前为止,第二季度报告季节的底线结果平均预测值接近5%,而后方的标准普尔500指数接近15%。

Markets have been more taken with decidedly downbeat forward guidance however. Some of the worlds top firms have warned that the latent effects of past Fed tightening, ongoing trade wars and geopolitical jitters like US-Iran saber-rattling and Brexit uncertainty will translate into business cycle downturn.

然而,市场更多地采取了明确的低调前瞻性指引。一些世界顶级公司警告说,过去美联储紧缩,持续的贸易战和地缘政治紧张局势的潜在影响,如美国 - 伊朗的恫吓和英国退欧的不确定性将转化为商业周期的低迷。

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

レート計算