Australian Dollar Outlook: AUD/USD Revival Hopes Flimsy on Retail Sales Miss

Abstract:AUSTRALIAN DOLLAR, AUD/USD, RETAIL SALES, RBA – TALKING POINTS

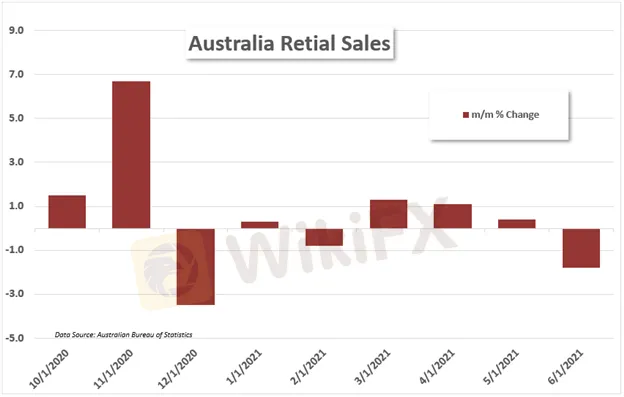

Australian Dollar adds to declines as retail sales for June drop 1.8%

Lockdowns putting pressure on Australian economic recovery

AUD/USD appears set for more downside as new yearly lows seen

Australian Dollar weakness accelerated after June‘s retail sales figure crossed the wires at -1.8% from the prior month. The drop from May also missed the consensus expectation of -0.7% m/m. AUD/USD pushed lower immediately following the weak data print, extending the currency pair’s recent losses. The steep drop-off in retail sales likely reflects a series of lockdown measures put in place to combat the Delta variants spread. The state of Victoria and New South Wales saw increased restrictions through June.

The Westpac leading index – designed to forecast the direction of the economy – also saw a weak print on Wednesday, dropping 0.07% from an upwardly revised 0.05% m/m figure. The deteriorating economic backdrop has pushed Australian government bond yields to fresh monthly lows as traders price in the downbeat outlook. The countrys low vaccination rate will likely see regional lockdowns continue through the year.

The Reserve Bank of Australia announced a plan to scale back its bond-buying program earlier this month to bring weekly purchases down to A$4 billion from A$5 billion. However, given economic conditions, the RBA may see it as appropriate to shelve those plans, or perhaps increasing the pace of purchases. The next board meeting is set for August 3. Inflation data for the second quarter will cross the wires later this month.

The Australian Dollar is breaching below a zone of resistance turned support from September to December trading of last year. Now into fresh 2021 lows, the technical path looks firmly skewed to the downside. A drop to a level of prior support turned resistance near 0.7240 may provide the next zone of support. MACD and RSI are tracking sharply lower, with RSI in oversold territory, highlighting the strong move lower.

AUD/USD DAILY CHART

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator