FxPro-Some Important Points about This Broker

Abstract:Founded in 2006, FxPro is a reputable UK-based forex broker that provides online trading services to a global audience. With over 70 financial instruments available for trading, FxPro offers its clients a diverse range of products, including forex, shares, indices, futures, and spot metals. The broker provides clients with access to multiple trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary platform, FxPro trading platform, FxPro trading App, and cTrader.

| FxPro | Basic Information |

| Company Name | FXPRO UK Limited |

| Founded | 2006 |

| Headquarters | London, UK |

| Regulations | FCA, CySEC |

| Tradable Assets | Forex, Stocks, Futures, Indices, Metals, Energies, Cryptocurrencies |

| Account Types | Demo Account, Live Account |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:200 |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, China UnionPay, mPay, FasaPay, Webmoney |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, FxPro Trading Platform |

| Customer Support | Multilingual customer support through Phone, Email, Live Chat |

| Education Resources | Webinars, Articles, Videos, eBooks, Tutorials |

| Bonus Offerings | None |

Overview of FxPro

Founded in 2006, FxPro is a reputable UK-based forex broker that provides online trading services to a global audience. With over 70 financial instruments available for trading, FxPro offers its clients a diverse range of products, including forex, shares, indices, futures, and spot metals. The broker provides clients with access to multiple trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary platform, FxPro trading platform, FxPro trading App, and cTrader.

In addition to its trading services, FxPro provides clients with a range of educational resources, including webinars, video tutorials, and market analysis tools. The broker offers 24/5 customer support in over 20 languages, ensuring that clients can receive assistance in their preferred language at any time of the day or night. FxPro also provides its clients with a range of payment options, including credit/debit cards, bank transfers, and various e-wallets, making it easy to deposit and withdraw funds from their trading accounts.

Is Fxpro Legit?

Yes, FxPro is regulated by several reputable financial regulatory bodies in different jurisdictions where it operates. These regulatory bodies ensure that FxPro adheres to strict standards of financial stability, security, transparency, and fair trading practices.

FxPro UK Limited is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, with registration number 509956.

FxPro Financial Services Limited is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 078/07.

Pros and Cons

| Pros | Cons |

| Regulated by FCA and CYSEC | Limited account types and trading instruments |

| Multiple choices of trading platforms to choose from | Limited educational resources for beginners |

| Multiple account funding and withdrawal options | Inactivity fee charged after 6 months of inactivity |

| Negative balance protection for retail clients | Limited availability in certain countries |

| Multiple base currencies available for accounts | No fixed spread accounts |

| Limited customer support availability on weekends |

Market Intruments

FXPro offers a diverse range of trading instruments to its clients, including Forex currency pairs, indices, commodities, shares, and futures. The broker offers over 70 currency pairs, including majors, minors, and exotic pairs, with competitive spreads starting from 0 pips. In addition, FXPro provides traders with access to a variety of indices, such as S&P 500, NASDAQ, DAX, and FTSE 100, among others. The broker also offers commodities such as gold, silver, oil, and gas, along with futures contracts on indices, energies, and metals. Lastly, FXPro provides traders with access to more than 150 stocks of some of the largest companies globally, such as Apple, Amazon, Google, and Facebook, among others. Overall, FXPro offers its clients a broad range of instruments to trade with, making it a suitable broker for traders of all levels and preferences.

| Pros | Cons |

| Diverse range of markets including forex, commodities, stocks, indices, and cryptocurrencies | Limited selection of exotic currency pairs |

| Access to advanced trading platforms including MT4, MT5, and cTrader and its proprietary trading platform | Overnight swap fees can be high on certain assets |

| Multiple account types to suit different trading needs | Limited educational resources for traders |

| Negative balance protection for all account types | No guaranteed stop-loss orders |

| No social trading platform | |

| Limited selection of cryptocurrency assets compared to some competitors |

Account Types

FXPRO offers two types of accounts: a live trading account and a demo account. The live trading account offers instant execution with no requotes, negative balance protection, and a variety of trading platforms to choose from.

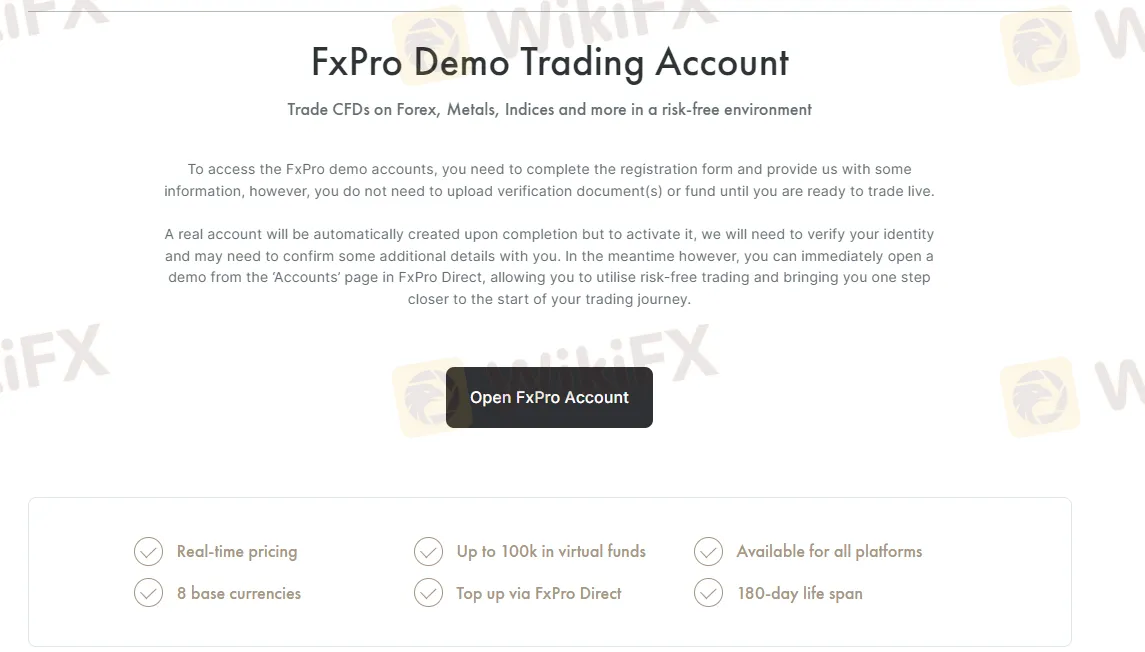

FXPro offers a free and 180-day life span demo account that enables traders to test their trading strategies and get a feel for the platform's features and functionality without risking any real money. The demo account comes with virtual funds that can be used to trade various financial instruments, including forex, commodities, indices, and shares.

With FXPro's demo account, traders can familiarize themselves with the platform's trading tools and resources, such as the advanced charting package, market news and analysis, and risk management tools. Traders can also practice their trading skills and test out new trading strategies in a risk-free environment.

How to Open an Account?

The process of opening an account with FXPro is a streamlined and uncomplicated endeavor, which aims to provide a smooth onboarding experience for traders.

First, you need to visit the broker's website and click on the 'Register' button.

Then, you will then be directed to a page where you need to fill out a registration form with your personal information, including your full name, email address, phone number, and country of residence. You will also need to create a unique username and password.

Once you have submitted your registration form, you will be prompted to verify your email address by clicking on a verification link that will be sent to your inbox. After verifying your email, you can then proceed to complete the verification process by providing additional information, such as your ID and proof of address.

Once your account has been verified, you can then proceed to fund it with the minimum required deposit. FXPro offers a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. You can choose the payment method that best suits your needs and preferences.

After funding your account, you can then start trading by logging into the FXPro trading platform with your account credentials. If you are new to trading, it is recommended that you first practice on the demo account to get a feel of how the platform works before risking your real money.

Leverage

FXPro offers competitive leverage ratios for different trading instruments to help traders maximize their trading potential. For forex majors, gold, and futures spot, as well as futures of energy (UK Oil, Natural Oil), the broker offers a high leverage of up to 1:200. This means that traders can control a large amount of capital with a relatively small deposit. However, traders should be aware that high leverage also increases the risk of potential losses.

For other instruments such as indices and shares, the leverage ranges from 1:20 to 1:50, depending on the specific instrument.

Here's a table comparing the maximum leverage offered by FXPro, IC Markets, Exness, FP Markets, and FBS across various asset classes:

| roker | Forex majors & Gold | Forex minors & exotics | Futures Spot & Futures Energy | Indices & Metals | Stocks & ETFs | Cryptocurrencies |

| FXPro | 1:200 | 1:50 | 1:200 | 1:100 | 1:05 | 1:05 |

| IC Markets | 1:500 | 1:500 | 1:200 | 1:100 | 1:20 | 1:05 |

| Exness | 1:2000 | 1:2000 | 1:200 | 1:200 | 1:20 | 1:02 |

| FP Markets | 1:500 | 1:500 | 1:100 | 1:100 | 1:20 | 1:05 |

| FBS | 1:3000 | 1:3000 | 1:100 | 1:500 | 1:20 | 1:03 |

Spreads & Commissions (Trading Fees)

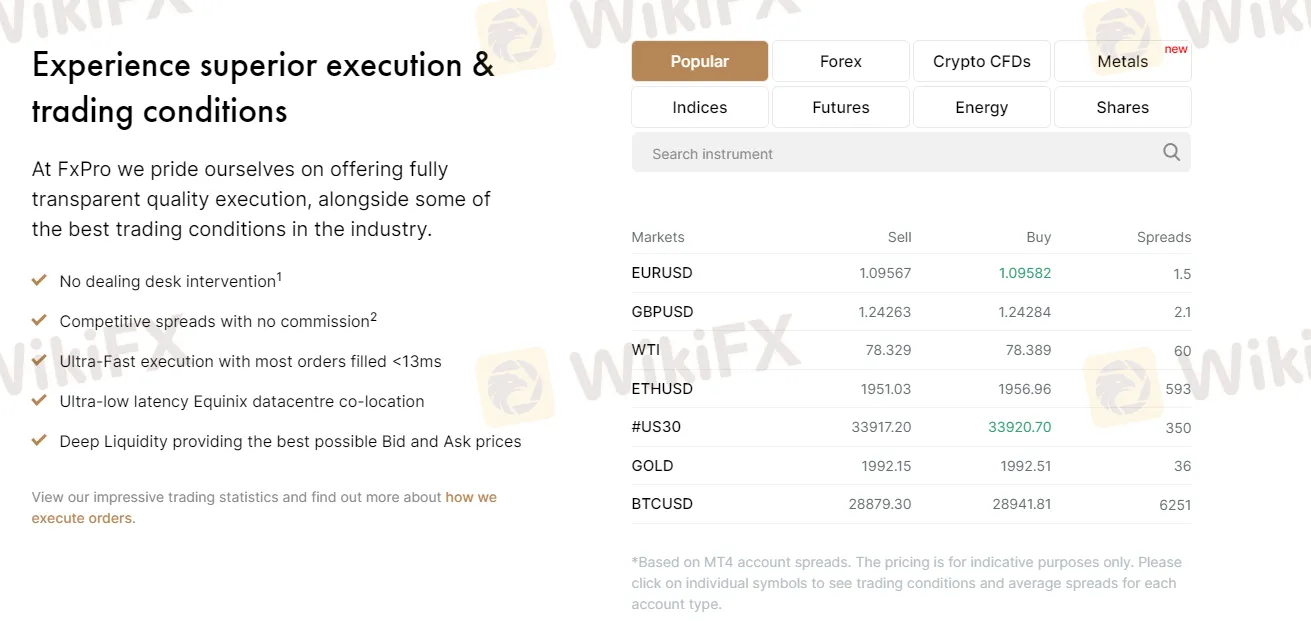

FXPRO offers variable spreads that can vary depending on the market conditions and the asset being traded. The spreads offered by FXPRO may appear to be on the higher side, with the EUR/USD pair starting from 1.5 pips, GBP/USD from 2.1 pips, WTI spreads from 60 pips, Gold from 36 pips, and BTC from 6251 pips. However, it's important to note that different brokers may offer different spreads depending on their business model, and it's always essential to compare the spreads of different brokers before deciding on one.

In terms of commissions, FXPRO offers commission-free trading for most instruments, except for share CFDs, which are subject to a commission of 0.05% of the transaction value.

Here's a table that compares the spread on some of the most popular trading instruments provided by FXPRO with other well-known brokers in the market.

| Broker | EUR/USD Spread | GBP/USD Spread | WTI Spread | ETHUSD Spread | Gold Spread |

| FXPRO | 1.5 pips | 2.1 pips | 60 pips | 1.5 pips | 36 pips |

| XM | 0.8 pips | 1.7 pips | 3.0 pips | 8.0 pips | 34 pips |

| AvaTrade | 1.3 pips | 1.6 pips | 2.2 pips | 4.0 pips | 40 pips |

| FXTM | 1.3 pips | 1.9 pips | 2.0 pips | 12.0 pips | 35 pips |

| HF Markets | 1.1 pips | 1.4 pips | 4.0 pips | 3.0 pips | 38 |

Non-Trading Fees

In addition to trading fees, FXPRO also charges non-trading fees that traders should be aware of. These fees include overnight interest fees, inactivity fees, and withdrawal fees.

Overnight interest fee, also known as swap rates. This fee is charged when traders hold positions overnight and can be either positive or negative, depending on the currency pair and the direction of the trade.

The inactivity fee is charged when a trader does not place any trades for a certain period of time. This fee is typically charged on a monthly basis and is deducted from the trader's account balance.

FXPRO also charges withdrawal fees, which vary depending on the withdrawal method used. Withdrawals via bank transfer are typically subject to a fee, while withdrawals via e-wallets may be free of charge.

Overall, while the non-trading fees of FXPRO are not excessive, traders should be aware of them and factor them into their trading costs.

Trading Platform

FXPro provides traders with a variety of robust and user-friendly trading platforms to choose from, including the popular MetaTrader 4 and 5 (MT4 and MT5) platforms, as well as their proprietary FXPro Trading Platform and the advanced cTrader platform. Each platform offers different features and advantages, allowing traders to choose the platform that best suits their individual trading needs and preferences.

MT4 and MT5 are widely recognized as the industry standard in forex trading platforms, providing traders with a comprehensive range of analytical tools, customizable indicators, and automated trading capabilities. FXPro's proprietary trading platform, on the other hand, offers a user-friendly interface with advanced charting capabilities and built-in risk management tools.

For traders looking for a more advanced trading experience, cTrader offers a range of sophisticated features such as level 2 pricing, advanced order types, and algorithmic trading capabilities.

| Broker | Trading Platforms Offered |

| FXPro | MT4, MT5, FXPro Trading Platform, FXPro cTrader |

| FXTM | MT4, MT5 |

| Exness | MT4, MT5 |

| FP Markets | MT4, MT5, IRESS |

| Pepperstone | MT4, MT5, cTrader |

Deposit & Withdrawal

The minimum deposit is $100. FXPro UK Ltd provides its clients with a diverse range of deposit and withdrawal options to facilitate seamless transactions. Clients can deposit funds through various methods, including bank transfer, broker-to-broker transfer, VISA, MasterCard, Maestro, and MasterCard Secure Code. Withdrawals can also be made using the same methods.

It is important to note that while deposits are free of charge, some withdrawal methods may incur fees. For instance, bank transfers may attract fees from the bank or intermediary bank, and credit card withdrawals may incur a 2% fee on the withdrawal amount.

FXPro Financial Services Ltd accepts the payment methods mentioned previously, such as Bank Transfer, Broker to Broker, VISA, MasterCard, and Maestro. Additionally, FXPro Financial Services Ltd also supports e-wallet payment methods including PayPal, Neteller, and Skrill.

| Pros | Cons |

| Multiple deposit and withdrawal options available, including bank transfer, credit/debit cards, and e-wallets such as PayPal, Neteller, and Skrill. | Some deposit methods may incur fees charged by third-party providers. |

| No deposit fees charged by FXPro. | Withdrawal fees may apply depending on the withdrawal method and currency. |

| Fast and efficient deposit and withdrawal processing times, with most deposits and withdrawals processed within 1 business day. | Withdrawals may take longer for bank transfers and some other methods, particularly for international transactions. |

| Secure and reliable payment processing, with advanced encryption technology used to protect sensitive financial information. | Some e-wallets may not be available in certain countries or regions. |

| High minimum deposit | The maximum deposit and withdrawal amounts may be subject to limitations depending on the payment method and account type. |

Customer Support

FXPRO offers customer support to its clients through various channels, including email, phone, and live chat. The customer support team is available 24/5 and can assist clients with any questions or issues they may have regarding their trading accounts, trading platforms, or other services offered by the broker.

Clients can contact the customer support team via email, and they can expect to receive a response within 24 hours. Phone support is available in multiple languages, and clients can find phone numbers for their respective countries on the broker's website.

FXPRO also offers a live chat feature on its website, which allows clients to connect with a customer support representative in real-time. Live chat is available in multiple languages and is a quick and convenient way for clients to get their questions answered or issues resolved.

In addition to the above channels, FXPRO has an extensive FAQ section on its website that covers a wide range of topics related to trading, account management, and other services provided by the broker. Clients can access the FAQ section by clicking on the “Support” tab on the broker's website.

| Pros | Cons |

| Multilingual customer support available via live chat, email, and phone | No 24/7 customer support |

| Customer support available in over 20 languages | No social media support |

| A FAQ section supported |

Educational Resources

Video tutorials: FXPro offers a wide range of video tutorials covering various topics such as trading strategies, technical analysis, and market news.

Webinars: The broker hosts webinars featuring expert traders, covering a wide range of topics and providing clients with the opportunity to ask questions and interact with other traders.

Trading tools: FXPro provides its clients with a range of trading tools, including economic calendars, market analysis, and trading calculators.

Ebooks: The broker offers a range of ebooks covering topics such as trading psychology, technical analysis, and trading strategies.

Glossary: FXPro has a comprehensive glossary of trading terms, providing clients with definitions of commonly used terms and concepts.

Trading academy: The broker has a trading academy that offers a range of courses covering beginner, intermediate, and advanced topics. These courses are designed to help traders improve their skills and knowledge.

Market insights: FXPro provides clients with daily market insights, covering the latest market news, analysis, and commentary.

Conclusion

Overall, FXPro is a well-regulated and reputable online forex broker with several advantages and disadvantages. The broker offers a wide range of trading instruments and allows trading on multiple platforms, including MT4, MT5, cTrader, and its proprietary platform.

While the broker's leverage is relatively high, its trading fees, including spreads and commissions, may be considered somewhat expensive. The broker also offers a variety of deposit and withdrawal options, with a minimum deposit of $100.

FXPro's customer support is reliable and efficient, with several contact options, including email, phone, and live chat. Additionally, the broker offers various educational resources, including webinars, articles, and tutorials, to help traders enhance their trading skills and knowledge.

FAQs

Question: Is FXPro a regulated broker?

Answer: Yes, FXPro is a regulated broker. It is authorized and regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

Question: What trading instruments are available at FXPro?

Answer: FXPro offers a wide range of trading instruments, including forex, commodities, indices, futures, and shares. Clients can trade over 70 currency pairs, as well as gold, silver, crude oil, and other popular commodities.

Question: Does FXPro offer a demo account?

Answer: Yes, FXPro offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Question: What payment methods does FXPro accept?

Answer: FXPro accepts a wide range of payment methods, including bank transfers, credit/debit cards, and e-wallets such as PayPal, Skrill, and Neteller.

Question: What trading platforms does FXPro offer?

Answer: FXPro offers several trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its own proprietary trading platform. Clients can choose the platform that best suits their trading needs and preferences.

Question: Does FXPro offer educational resources for traders?

Answer: Yes, FXPro offers a range of educational resources for traders, including video tutorials, webinars, and articles.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australia's $41 Million Crypto Scheme Meltdown

The collapse of a major cryptocurrency investment program in Australia, affecting over 450 investors and involving approximately US$41 million, has led to swift regulatory action by the Australian Securities and Investments Commission (ASIC), including the filing of a lawsuit against three crypto mining companies and their directors.

JPMorgan Signals Risks Ahead for Crypto Markets

JPMorgan highlights risks in crypto markets due to low VC investment and the SEC's hesitancy on Ethereum ETFs.

Axi Renews Partnership with Brazilian Club Bahia for 2024 Season

The Australian online trading platform Axi has secured a renewed sponsorship deal with Esporte Clube Bahia, a prominent Brazilian football club. This extension, announced today, solidifies their collaboration for the upcoming 2024 season.

WHEN IMPORT DUTY FX EXCEEDS THE OFFICIAL MARKET RATE, OPERATORS RAISE DUST.

As the official foreign exchange market rates of the US dollar and the naira increased in accordance to the Customs exchange rate on Wednesday, clearance agents at the nation's seaports created dust.

WikiFX Broker

Latest News

FOREX TODAY: THE US DOLLAR IS HAVING TROUBLE RECOVERING, AND THERE WILL BE MORE FEDSPEAK.

India's Forex Rules Shake-Up Stuns Traders and Markets

Maunto Review: Imp. Things to Know!!

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

WARNING!! They are Fraud Brokers

Italy's CONSOB Shuts Down 7 Rogue Financial Sites

Australia's $41 Million Crypto Scheme Meltdown

FX MARKET ROARS BACK INTO LIFE WITH $1 BILLION SINGLE-DAY DEAL.

WikiFX Broker Assessment Series | Is ZFX Reliable?

Currency Calculator