The Fear of Epidemic Resurgence Caused Gold to Rise

Abstract:Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

WikiFX News (18 June) - Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

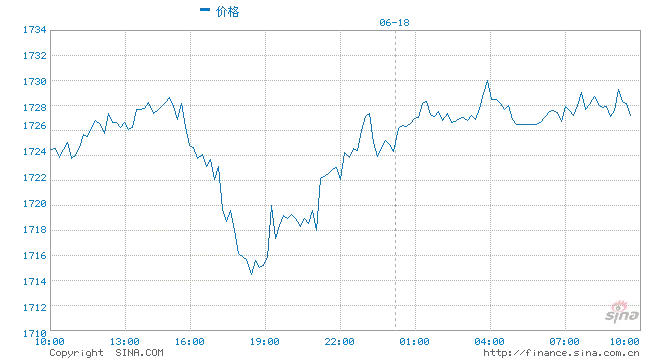

Yesterday, spot gold once rebounded by US$17, refreshing its daily high to US$1730.22 per ounce, but the US dollar later strengthened to suppress golds upward trend.

In terms of gold futures, the price of gold futures delivered on the New York Mercantile Exchange in August has fallen by 90 cents, a decline amount of 0.05%, closing at $1735.60 per ounce. Analysts said that gold prices have performed irregularly in the past few days, and gold futures price is not always negatively related to stock markets and debt yields.

According to Michael Matousek, chief trader of US Global Investors, gold prefers a long-term investment and it should be bought in when there is a slight correction in price. Prott CEO Peter Grosskopf says that it is time to buy gold in a large amount now, because the credit crisis has already broken out.

The above information is provided by WikiFX, a world-renowned foreign exchange information query provider. For more information, please download the WikiFX App. bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex | Gold

Gold trading inside the previous day’s range - investors wait for US PMI

GemForex - Gold

Gold on the front foot this week- consolidates ahead of ECB meeting, US inflation data

GemForex汇评 - Gold

Trade Gold with GemForex

Gold vs Forex Trading: Which Should you Trade?

Gold has been a classic investment option for centuries and is commonly used as a hedge against inflation and a reliable wealth storage medium. Gold offers a good investment opportunity that is often less focused on short-term profits, making it one of the top long-term investment options. On the other hand, forex trading is the speculation on currency prices for potential profits. A forex trader can profit from up and down price movements in both short and long term.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

Leverate Losses ICF Membership & CIF Authorization

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Currency Calculator