Countries where intergenerational income mobility is better than US - Business Insider

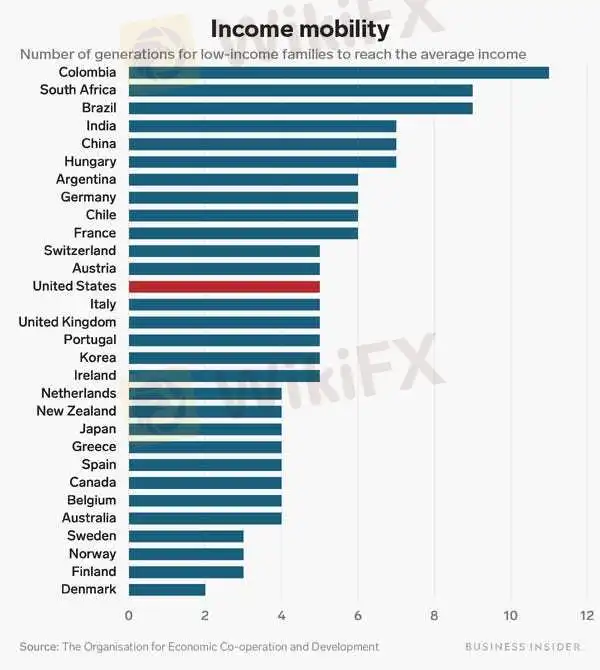

Abstract:It could take five generations for a poor family in the US to work their way up to an average income.

The American Dream might be more obtainable in several countries outside the US. The Organisation for Economic Co-operation and Development released a report in 2018 where it took an in-depth look at social mobility across countries.One of the report's findings was the varying number of generations it would take someone born in a low-income family to reach the country's average income; for the US, it would take about five generations.That was a longer time than several other wealthy countries.Visit Business Insider's homepage for more stories.The American Dream of your children being more successful than you are might be more attainable in other parts of the world than in the US.

The Organisation for Economic Co-operation and Development figured out how long it would take low-income families to get to their country's average income, based on intergenerational income elasticity. That is, it measured how much children's' incomes depended on their parents' incomes. On average among the 30 countries studied by the OECD, it will take four to five generations of children from a low-income family — families part of the bottom 10% of income distribution — to reach the average income in their country, according to the OECD's report on social mobility in 2018. The US is on par with that average, taking five generations for someone born into a low-income family to reach the nation's average income. One of the findings from the OECD's report is that social mobility for earnings, education, and occupation is high in most Nordic countries. In many of those countries, it would take fewer generations for a low-income family to reach their country's average income.These statistics are similar to findings in a 2018 report on economic mobility from the World Bank, which found that there are lots of high-income countries where the American Dream is more attainable than in the US.

Income inequality plays an important factor in intergenerational income mobility. The report said low-income families in low-inequality and high-mobility countries would take almost four generations to reach the average income. In contrast, high-inequality and low-mobility countries, which are typically emerging economies, take at least nine generations — double the average of countries part of the OECD.Interestingly, no countries had both high inequality and high mobility. This correlation between inequality and mobility has been noted as the “Great Gatsby Curve”, and it shows another pernicious effect of inequality.The following chart shows all the countries included in the report and their intergenerational income mobility.

Business Insider/Madison Hoff, data from the Organisation for Economic Co-operation and Development

Here are the 12 countries in the OECD study where it would take fewer generations for someone born in a low-income family to reach their country's average income than someone born into a low-income family in the US to reach the nation's average income, ranked from the shortest to the longest length of time.

The most recent available data for the Gini coefficient, a standard measure of income inequality in a country, is used to separate ties in the ranking, where 0 equals complete equality and 1 equals complete inequality. Figures come from the OECD, and represent years between 2014 and 2017.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

12 people who seemingly predicted the coronavirus pandemic - Business Insider

Bill Gates warned Donald Trump before he took office of the dangers of a pandemic — and urged him to prioritize the US' preparedness efforts.

US jobless claims preview: Economists expect another week of decline - Business Insider

"If the current rate of decline continues, claims will dip below 1M in the second or—more likely—third week of June," said economist Ian Shepherdson.

Here's how much home prices fell in April in 26 of the largest US cities - Business Insider

Of the 100 largest US metro areas, Zillow found that 26 saw a month-over-month decrease in median listing price, ranging from 0.1% to 3.3%.

The coronavirus pandemic has cost LVMH's Bernard Arnault $30 billion - Business Insider

Before the coronavirus, luxury conglomerate LVMH was posting record-breaking revenues and sending Bernard Arnault's net worth soaring.

WikiFX Broker

WikiFX Broker

Latest News

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

As Soaring Gold Prices Spark Enthusiasm,WikiFX Helps You Avoid Illegal Platforms’ Traps

Investor Scammed as Orfinex Withholds Funds and Negligently Trades Accounts

Hedge Funds Boost Gold Investments Amid Inflation Surge

EXPERT-OPTIONTRADE IS A RED FLAG

Currency Calculator