US Dollar Outlook Hinges on Fed Rate Decision & Forward Guidance

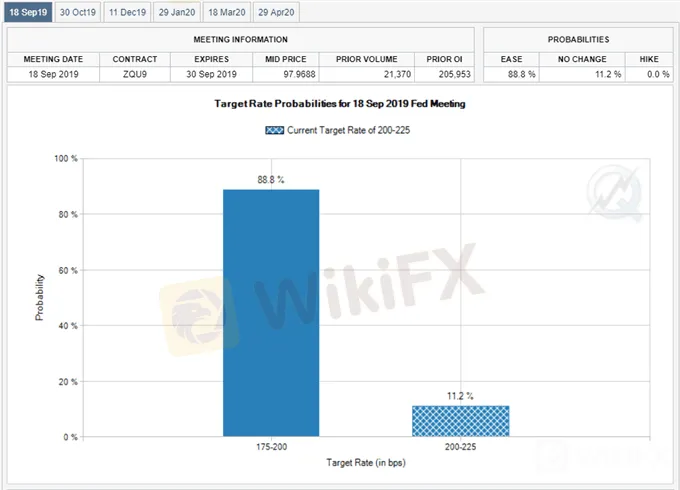

Abstract:The Federal Reserve meeting is likely to influence the near-term outlook for the US Dollar as the central bank is widely expected to deliver another 25bp rate cut.

US Dollar Rate Talking Points

The Federal Reserve interest rate decision on September 18 is likely to influence the near-term outlook for the US Dollar as the central bank is widely expected to deliver another 25bp rate cut.

Fundamental Forecast for US Dollar: Neutral

The US Dollar struggles to hold its ground ahead of the Federal Reserve meeting, with DXY paring the rebound from the monthly-low (97.86), and fresh updates from Chairman Jerome Powell and Co. may drag on the greenback as the central bank comes under pressure to establish a rate easing cycle.

Fed Fund futures continue to highlight overwhelming expectations for another 25bp reduction on September 18, and the Federal Open Market Committee (FOMC) may keep the door open to further insulate the US economy as President Donald Trump argues that the “the Federal Reserve should get our interest rates down to zero or less.”

As a result, the FOMC may utilize the Summary of Economic Projections (SEP) to advocate a dovish forward guidance, and a growing number of Fed officials may forecast a lower trajectory for the benchmark interest rate as the shift in US trade policy clouds the economic outlook.

A material adjustment to the dot-plot is likely to produce headwinds for the greenback as market participants prepare for lower interest rates, but little evidence of a looming recession may spur a growing dissent within the FOMC as Boston Fed President Eric Rosengren, a 2019-voting member on the FOMC, argues that “if the consumer continues to spend, and global conditions do not deteriorate further, the economy is likely to continue to grow around 2%.”

In fact, the FOMC may find it difficult to justify a rate easing cycle as the Atlanta Fed GDPNow model projects the US economy to expand 1.9% in the third quarter of 2019 compared to 1.5% on September 4.

With that said, more of the same from the FOMC may trigger a bullish reaction in the greenback, but the US Dollar stands at risk of facing a more bearish fate over if the Fed delivers back-to-back rate cuts along with a downward revision in the interest rate dot-plot.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

GEMFOREX - weekly analysis

The week ahead: 5 things to watch.

WikiFX Broker

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator