Korea Consumer Confidence Retreats on New Virus Wave, Curbs

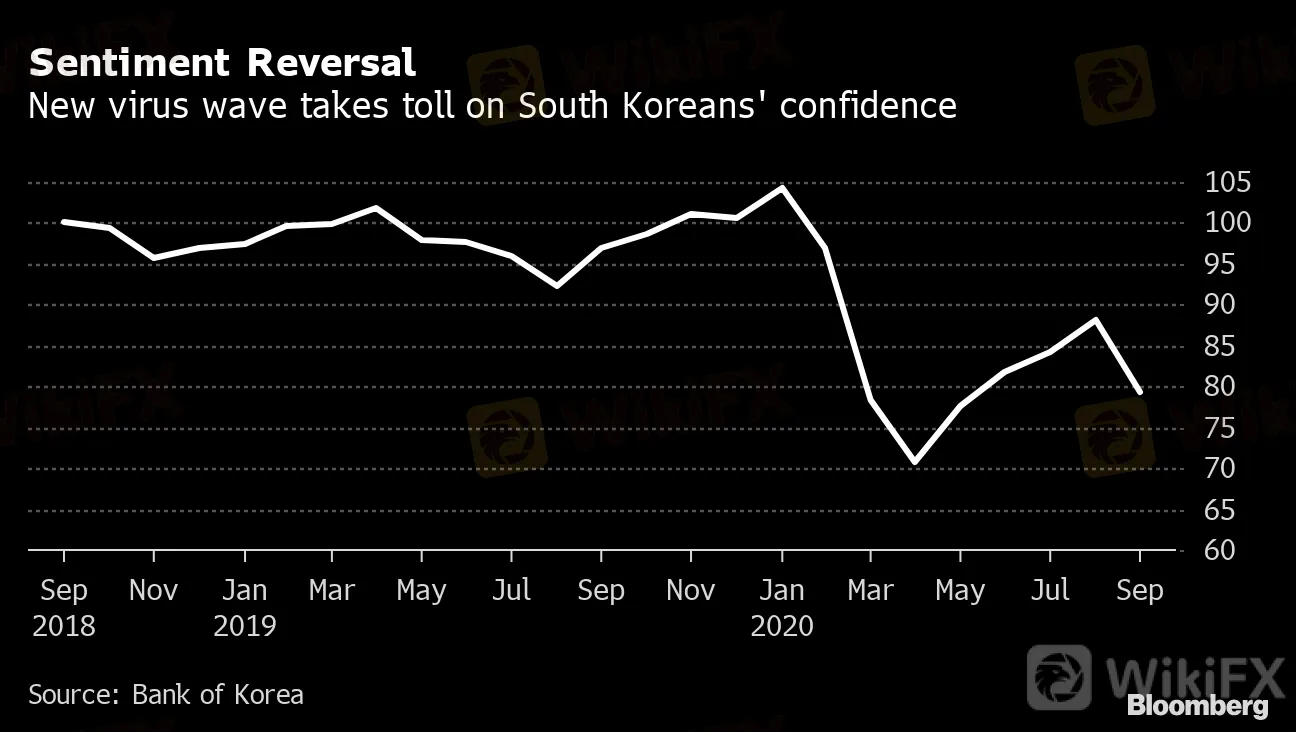

Abstract:Consumer confidence in South Korea slipped for the first time in five months as a jump in virus cases and tighter social restrictions made households more pessimistic about the economys outlook.

Consumer confidence in South Korea slipped for the first time in five months as a jump in virus cases and tighter social restrictions made households more pessimistic about the economys outlook.

The consumer sentiment index fell to 79.4 in September from 88.2 the previous month, the Bank of Korea said in a statement Friday. The 8.8 point decline was the largest since March when the country was reeling from the first wave of the pandemic.

{6}

Sentiment Reversal

{6}

New virus wave takes toll on South Koreans' confidence

Source: Bank of Korea

South Koreas economy showed signs of recovery at the start of the quarter, but the early momentum lost steam as daily virus case counts soared to hundreds in August. While the government has avoided imposing an economy-wide lockdown and instead opted for targeted restrictions, the flareup is still expected to have a significant impact on consumption and services.

The virus resurgence was a key factor when the central bank slashed its economic outlook for this year to a 1.3% contraction in August, from an earlier forecast for a 0.2% decline in May.

While South Korea has since managed to bring down daily caseloads to a little over hundred from the peak of more than 400 in August, health officials warn the upcoming Chuseok holiday could reignite infections with increased gatherings.

Among components of the headline index, households spending projections dragged most, followed by expectations for income and their assessment of the current state of the economy. Inflation expectations for the next year rose 0.1 percentage point to 1.9%.

The BOKs survey of 2,370 households was conducted between Sept. 10- 17.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator