Chinas Retail Recovery Still Rests on Richer Consumers

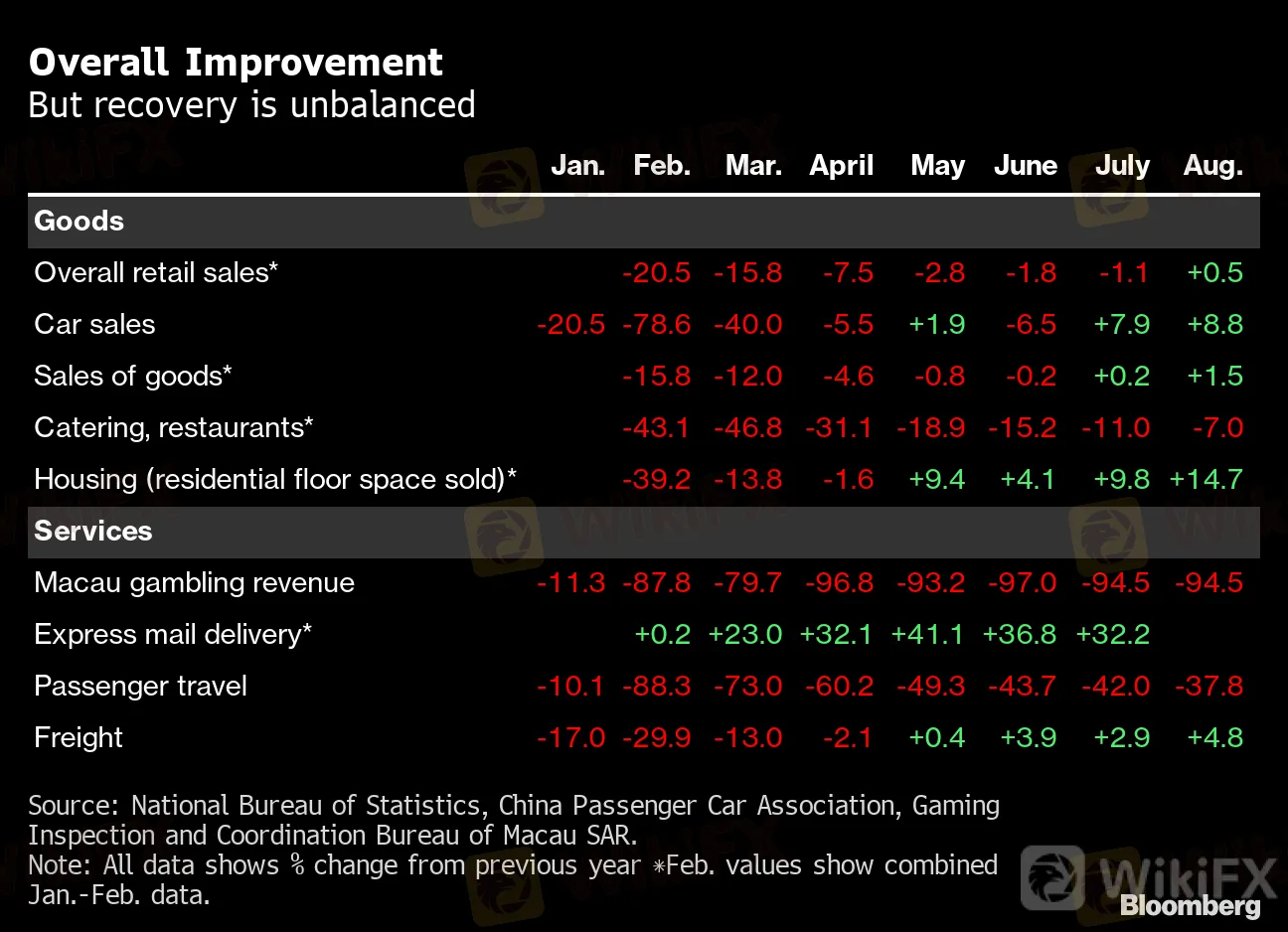

Abstract:Chinese consumers are finally starting to spend again after the pandemic-induced slump, but the recovery is unbalanced and overly reliant on luxury goods, with poorer Chinese still cautious.

Chinese consumers are finally starting to spend again after the pandemic-induced slump, but the recovery is unbalanced and overly reliant on luxury goods, with poorer Chinese still cautious.

Consumption has started to catch up to the much stronger rebound in industrial output, with retail sales growing in August for the first time this year. Spending on luxury goods, cars and electronics is leading the charge, rising faster than food, clothing and other essentials.

{6}

Overall Improvement

{6}

But recovery is unbalanced

Source: National Bureau of Statistics, China Passenger Car Association, Gaming Inspection and Coordination Bureau of Macau SAR.

Note: All data shows % change from previous year*Feb. values show combined Jan.-Feb. data.

While the supply side of Chinas economy has shown resilience, a strong and broad rebound in spending is needed for a more meaningful economic recovery. Even though the virus is under control, income and job losses due to the pandemic have made poorer Chinese unwilling or unable to increase spending, keeping a lid on the rebound.

“Higher-income households have probably built up savings, because of the forced reduction in consumption during lockdown, and could now be ready for a spending spree. It is lower-income households that face a longer slog of normalizing their finances,” He Wei, an analyst at Gavekal Dragonomics, said in a recent report.

What Bloombergs Economists Say...

“Consumer confidence appears to be coming back even without a vaccine. This is reflected in strong pickups in sales of non-essentials, such as cosmetics and jewelry, in recent months. Improved sentiment and spending at home in lieu of overseas trips should help support private consumption.”

-- Chang Shu and David Qu

{18}

Bloomberg Terminal clients can read their latest report HERE

{18}

Luxury Boom

Luxury spending in China will grow 20%-30% this year, according to a report from Boston Consulting Group, but much of that growth is going to come from consumers in the 50 largest and richest cities. People in the other 2,206 cities bought only a quarter of all luxury goods in April-July this year, and their spending was down 4% compared with 2019, according to the report.

Read more: Chinese Shoppers Splash on Luxury Goods, but Still Wont Eat Out

{24}

The lopsided recovery can also be seen in the car market. Sales of luxury vehicles have recovered much quicker than regular cars, and are now almost a fifth of all cars sold.

{24}

{26}

Luxury Car Sales Lead Rebound

{26}{27}

Expensive cars are almost a fifth of auto market this year

{27}

Source: Data compiled by Bloomberg Intelligence

{30}

Luxury defined as Audi, BMW, Cadillac, Hongqi, Lexus, Mercedes-Benz, Porsche, Tesla, Volvo and others

{30}

One luxury where spending hasnt rebounded is gambling in Macau, which is forecast to see an 81% drop in revenue this year, according to Credit Suisse analysts led by Kenneth Fong. Gaming in the city is traditionally a good indicator of discretionary spending in China, but that came to a crashing halt in February.

{34}

Macau Gambling Revenue

{34}

Source: IGamiX

Note: Data shows average revenue for trailing week. Number of days may vary depending on cut-off date of the month.

{39}

Read more: Beach Holidays for Some in China, Belt Tightening for Others

{39}

{41}

Travel is another sector where there‘s still a long way to go to recover from the damage caused by the pandemic. Real-time data from China’s 11-biggest cities shows that people are still somewhat wary about going out via public transport.

{41}

{43}

Subway Usage Recovering

{43}

But still not back at 2019's level

Source: Weibo, data compiled by Bloomberg. Shows seven-day moving average. 11 cities are Beijing, Shanghai, Guangzhou, Shenzhen, Wuhan, Nanjing, Chengdu, Xi'an, Suzhou, Zhengzhou, and Chongqing.

{48}

The week-long national holidays from Oct. 1 will give an indication of whether consumers are becoming more willing and able to spend on discretionary items such tourism.

{48}

State television reported that bookings were rising, but theyre unlikely to reach the levels seen in October 2018 or 2019, when more than 1.5 billion trips were made.

{51}

— With assistance by James Mayger, Jinshan Hong, and Daniela Wei

{51}

(Updates with comment from Bloomberg economists)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator