FX Week Ahead - Top 5 Events: August Canada Inflation Report & USD/CAD Rate Forecast

Abstract:The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT.

Canada Inflation Report Preview:

The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT, and the data will likely show a softening in price pressures.

The lack of upside in oil prices in recent weeks may be the culprit for declining inflation readings; the energy sector constitutes roughly 11% of the Canadian economy.

Recent changes in retail trader positioninggive us a stronger USDCAD-bullish contrarian trading bias

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

09/18 WEDNESDAY | 12:30 GMT | CAD Consumer Price Index (AUG)

Volatility in energy markets during August likely can be blamed for any near-term downswing in price pressures, as the upcoming Canada inflation report will show. At approximately 11% of GDP, the energy sector and therefore the performance of oil prices tend to have outsized influences on Canadian economic data.

Acordingly, a Bloomberg News surveys consensus forecasts suggest a softening in price pressures. Headline August Canada inflation due in at 1.9% from 2.0% (y/y), while the monthly reading is due in at -0.2% from 0.5% (m/m). It still holds that movement in energy markets will guide the Canadian Dollar and inflation all the same.

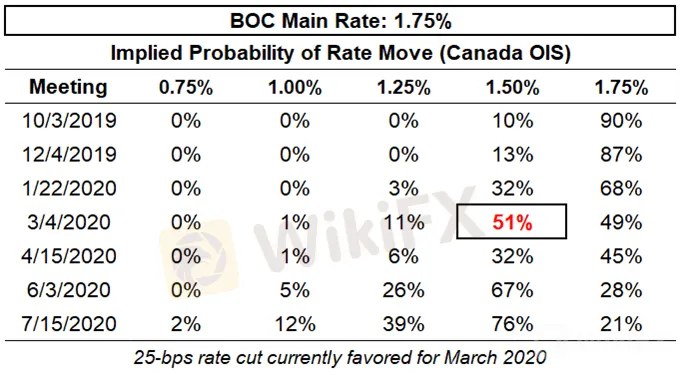

BANK OF CANADA INTEREST RATE EXPECTATIONS (SEPTEMBER 13, 2019) (TABLE 1)

Pairs to Watch: EURCAD, CADJPY, USDCAD

USDCAD TECHNICAL ANALYSIS: WEEKLY RATE CHART (DECEMBER 2016 TO SEPTEMBER 2019) (CHART 1)

The bearish outside engulfing bar at recent trend highs marked a bearish key reversal last week, but USDCAD rates did not follow through to the downside. As a result, weekly MACD has turned higher once again just below its signal line, while Slow Stochastics continue to grind higher above the median line. Bullish momentum is slowly reasserting itself.

USDCAD Rate Technical Forecast: Daily Chart (September 2018 to September 2019) (Chart 2)

As noted in the last USDCAD technical forecast update, “USDCADs bearish outlook may be curtailed unless there is a decisive shift in retail trader positioning, which currently takes the opposite perspective on recent price action.” The bearish outlook was indeed curtailed; and the shifts in retail trader positioning provided the proper clues for a bullish reversal coming into this week.

It remains the case that USDCAD is below the rising trendline from the July and August 2019 swing lows, even if price action has started to reestablish itself above 1.3250. The daily 8-, 13-, and 21-EMA envelope is shifting back into bullish sequential order. Slow Stochastics have risen out of oversold territory, while daily MACD has started to turn higher prior at its signal line. Further gains may eye the 38.2% retracement of the 2018 high/low range at 1.3328 in the short-term.

IG CLIENT SENTIMENT INDEX: USDCAD RATE FORECAST (SEPTEMBER 6, 2019) (CHART 3)

USDCAD: Retail trader data shows 41.2% of traders are net-long with the ratio of traders short to long at 1.43 to 1. The number of traders net-long is 24.3% lower than yesterday and 18.1% lower from last week, while the number of traders net-short is 5.7% higher than yesterday and 17.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias.

FX TRADING RESOURCES

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

Gold, Crude Oil Prices at Risk if ECB, US CPI Cool Stimulus Hopes

Gold and crude oil prices may be pressured if the ECB underwhelms investors dovish hopes while higher US core inflation cools Fed rate cut expectations.

Gold, Crude Oil Prices at Risk if US Jobs Data Cools Rate Cut Bets

Gold and crude oil prices may be pressured if upbeat US employment figures cool Fed interest rate cut prospects, souring sentiment across markets pining for stimulus.

US Dollar Reversal Continues: EUR/USD, GBP/USD, USD/CAD

The US Dollar came into the holiday-shortened week with a full head of steam. But that's been soundly reversed. Tomorrow brings NFP and Canadian employment.

WikiFX Broker

Latest News

CySEC withdraws license of Forex broker AAA Trade

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

eToro Added 509 Fresh Stocks and ETFs

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Currency Calculator