User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

2

CommentsWrite a review

2022-12-14 17:28

2022-12-14 17:28

2022-10-12 00:17

2022-10-12 00:17

Vanuatu|5-10 years|

Vanuatu|5-10 years| https://en.slgmtk.com/

Website

MT4/5

White Label

SunLongGMTKIntl-Demo

Hong Kong

Hong KongInfluence

D

Influence index NO.1

China 2.48

China 2.48

MT4/5 Identification

White Label

Hong Kong

Hong KongInfluence

D

Influence index NO.1

China 2.48

China 2.48Single Core

1G

40G

+61 3-86691610

More

SUN LONG GMTK INTERNATIONAL LIMITED

SLG Markets

Vanuatu

Pyramid scheme complaint

Expose

Can’t open the web for several days!!!!!!!!

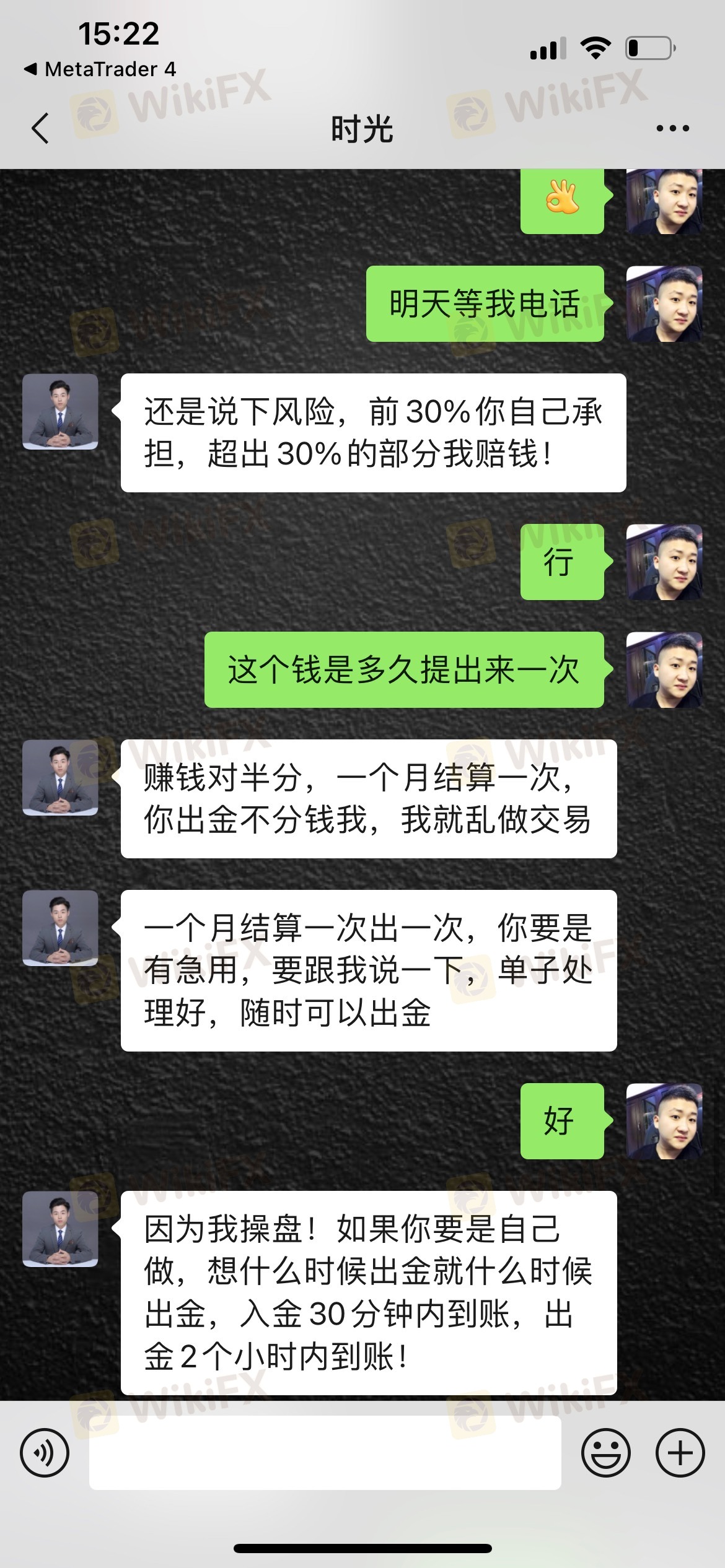

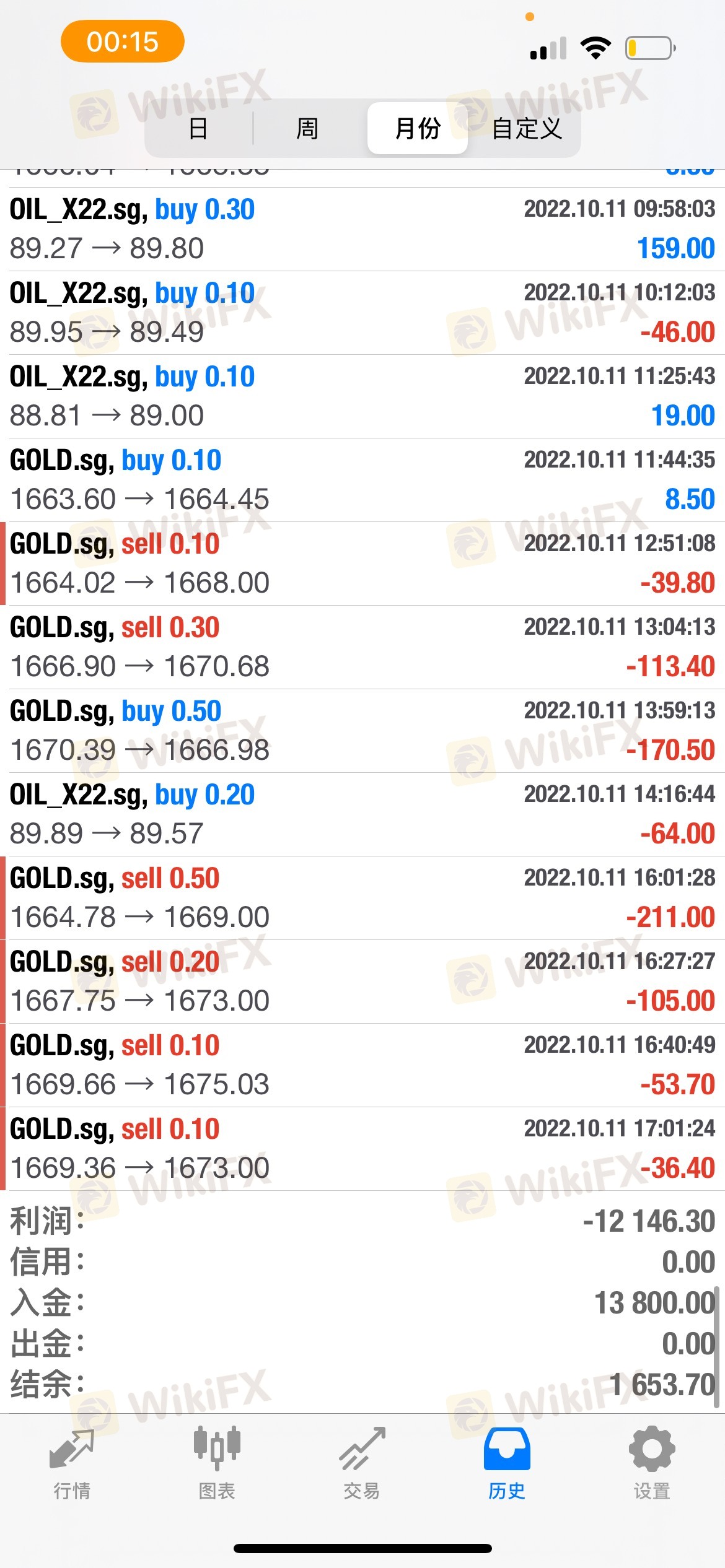

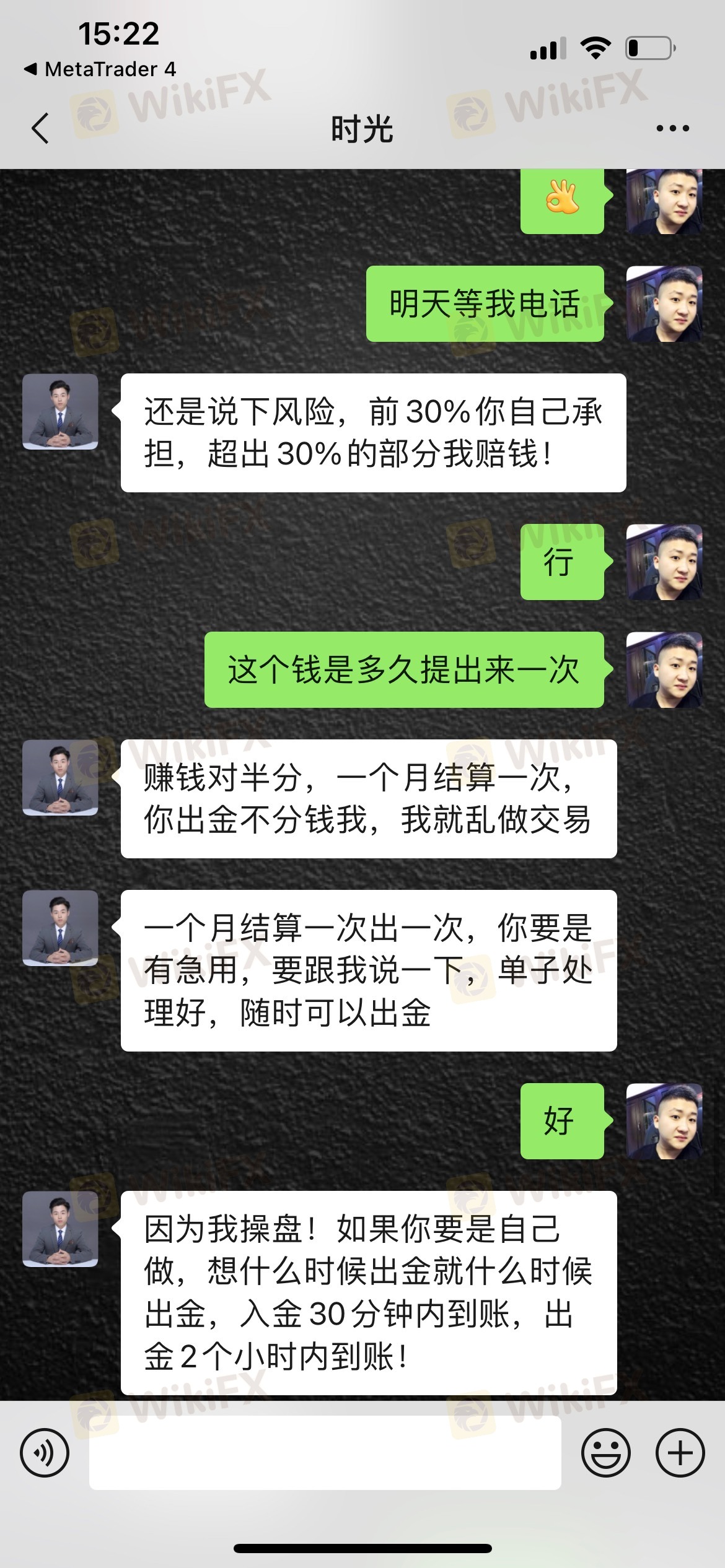

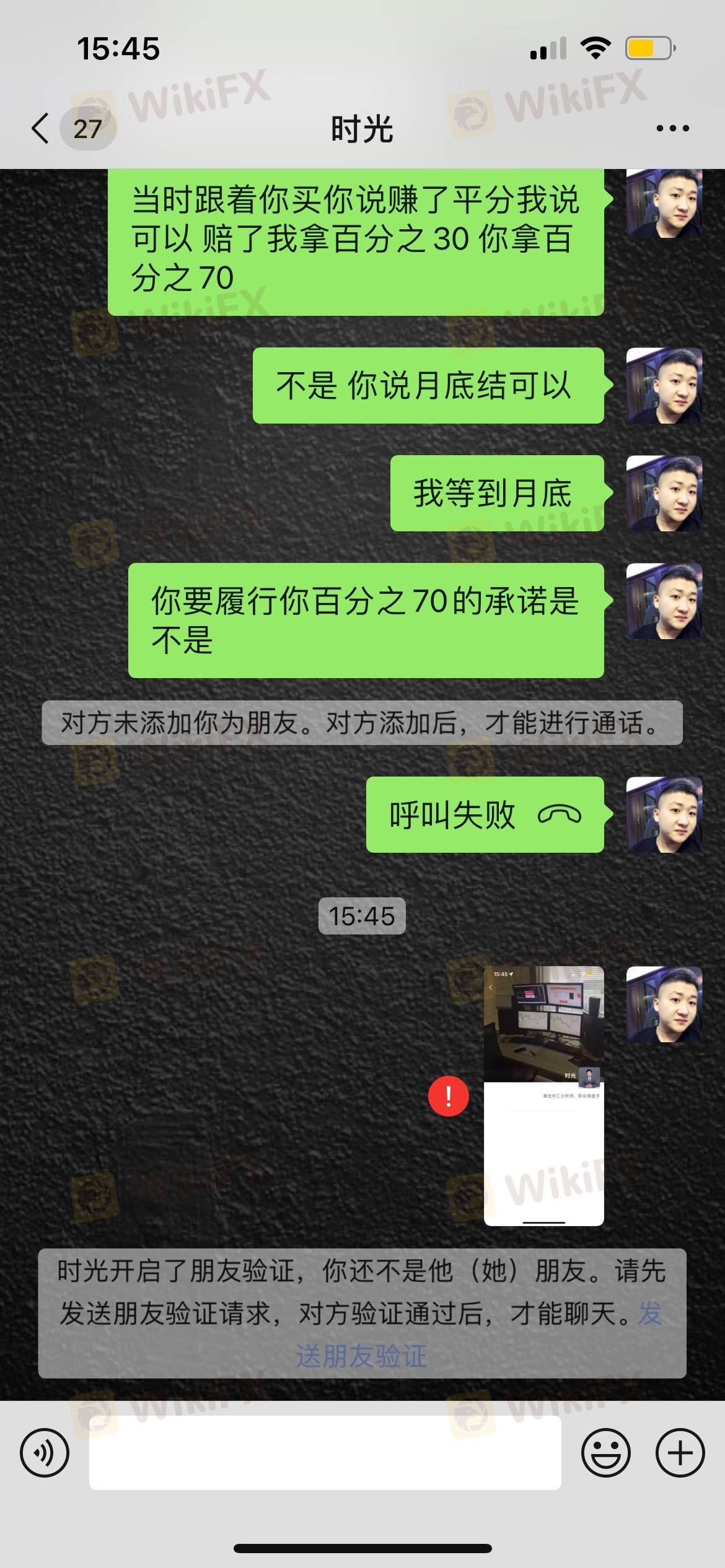

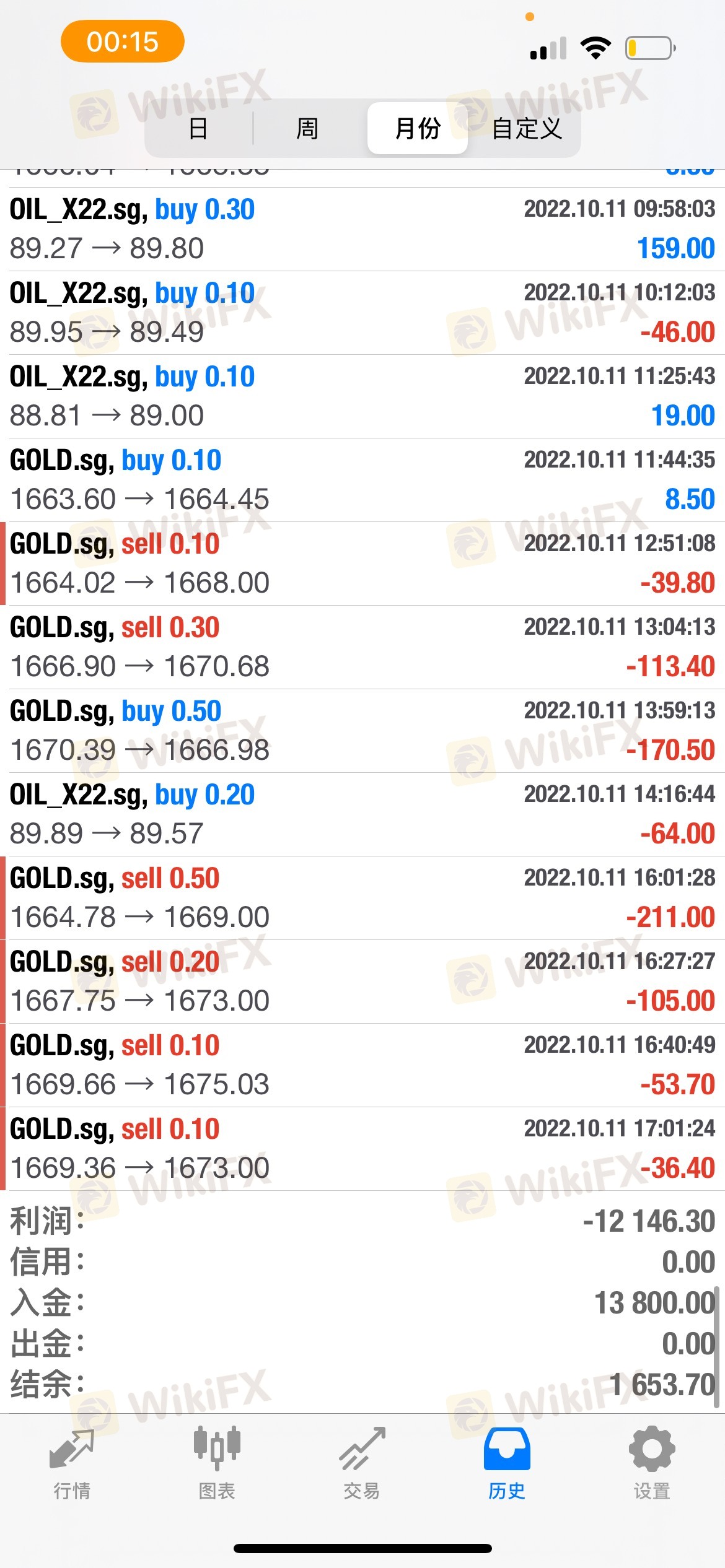

Garbage platform claims that the transaction is invalid for the profit and cancel it, and directly find out all the profit orders, but keep the loss orders for you, and let the customer bear it by themselves

This must be a fraud broker. Close positions without my permission. Can’t contact the customer service vi phone. I hope the relevant departments can strengthen their regulation

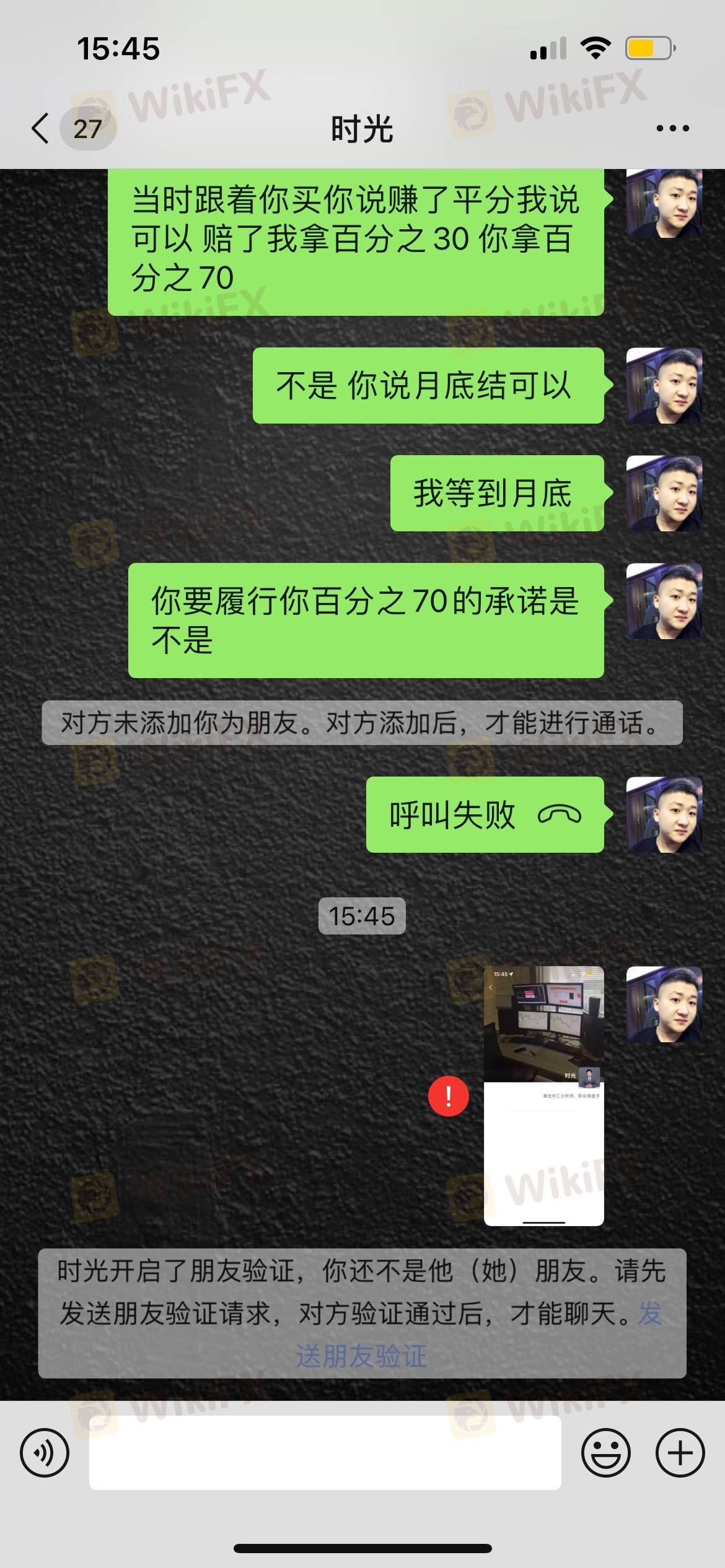

The person I knew on WeiBo, named Li Lunjindao, inveigled clients to open account and caused their accounts liquidated within 2 days.

The scam platform placed adverse orders for clients to make their accounts liquidated!

I opened an account and let the analyst manage my account while my account was wiped out. The platform closed my positions under the circumstance that my positions were locked. Financial scam. I already called the police, now the police has filed the case. Don not let the frauds stay at large.

I was induced to deposit money but the account was forced to liquidated the next day. The liar, named Laolitanjindao on Weibo now goes on his scam with the new name Lunjinzhidao.

The person on WeiBo, named Li talking on jindao, inveigled clients to open account and caused their accounts liquidated on the day. It is simply a scam.

| Key Information | Details |

| Company Name | SLG Markets / SUN LONG GMTK INTERNATIONAL LIMITED |

| Years of Establishment | 2-5 years ago |

| Headquarters | Vanuatu |

| Office Locations | Port Vila, Vanuatu |

| Regulations/Licenses | Unregulated |

| Tradable Assets | Precious Metals, Commodities, Futures, Indices, Cryptocurrencies |

| Account Types | Live Account, Demo Account |

| Minimum Deposit | N/A |

| Deposit/Withdrawal Methods | N/A |

| Trading Platforms Available | MetaTrader 4 |

| Customer Support Options | Phone Line, Email, Live Chat |

SLG Markets, operating under the name SUN LONG GMTK INTERNATIONAL LIMITED, is a financial services provider headquartered in Vanuatu. With an establishment within the last 2-5 years, they offer a range of trading services in the global market. Their services include trading in precious metals, commodities, futures, indices, and cryptocurrencies. SLG Markets provides both Live Accounts and Demo Accounts, allowing clients to engage in real-time trading or practice trading strategies with virtual funds.

They utilize the MetaTrader 4 (MT4) platform for trading, which is a widely recognized and popular trading platform in the industry. Customer support is available via email, and they provide educational resources. However, it's important to note that SLG Markets is unregulated, and specific details such as minimum deposit, leverage, spread, and deposit/withdrawal methods are not provided.

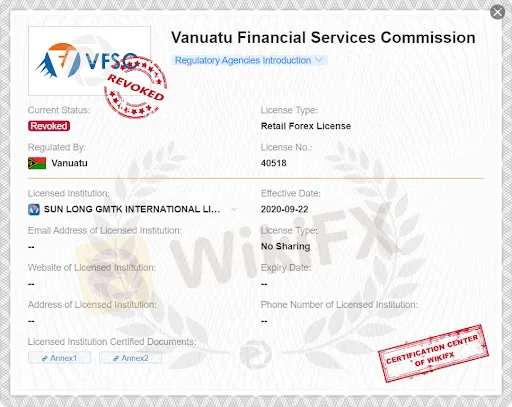

SLG lists 2 licenses from the Vanuatu Financial Services Commission (VFSC) and Australian Securities & Investment Commission (ASIC). However, neither of them are valid, meaning that SLG Markets are unregulated.

The license attempted to the Vanuatu Financial Services Commission (VFSC), issued under the license No. 40518. However, it's important to note that the regulatory status of this license is reported as “Revoked.” This implies that the license has been invalidated or canceled by the regulatory authority.

The Australian Securities & Investment Commission (ASIC) market-making (MM) license under the License No. 400364 is reported to be a “Suspicious Clone.” This suggests that the claim made by SLG Markets regarding this license is not genuine or reliable. A “Suspicious Clone” suggesting that SLG Markets is a fraudulent entity that mimics a legitimate brokerage firm. These clones imitate the branding, website, and even customer service of reputable brokers, aiming to deceive unsuspecting investors. The risks associated with such clones include potential loss of funds due to unauthorized transactions, compromised personal and financial information, and the absence of investor protection from regulatory authorities, leading to a lack of recourse in case of fraud or malpractice.

It is important to exercise caution and carefully evaluate the potential risks associated with engaging with an unregulated broker like SLG Markets. Operating without specific regulation or licensing raises concerns about the lack of formal oversight and investor protection measures typically provided by regulatory authorities. This absence of regulatory supervision may expose clients to various risks, including potential fraudulent activities, inadequate risk management practices, and potential challenges in resolving disputes. Additionally, the reported revocation of the Vanuatu retail forex license and the suspicious clone claim associated with the Australian market-making license further underscore the need for thorough due diligence. The absence of specific details regarding minimum deposit, leverage, spread, and deposit/withdrawal methods also presents limitations in terms of transparency and client information.

SLG Markets offers a diverse range of tradable assets, including precious metals, commodities, futures, indices, and cryptocurrencies. This provides clients with a variety of options to diversify their portfolios and potentially capitalize on different market opportunities. Additionally, SLG Markets offers both Live and Demo accounts, allowing traders to choose between real-time trading with actual funds or practicing strategies with virtual funds. The availability of the MetaTrader 4 (MT4) platform, a widely recognized and popular trading platform, ensures a familiar and robust trading environment.

One of the notable concerns regarding SLG Markets is the lack of specific regulation and licensing. This unregulated status raises potential risks for clients, including the absence of oversight and investor protection measures typically provided by regulatory authorities. The reported revocation of the Vanuatu retail forex license and the suspicious clone claim associated with the Australian market-making license further raise doubts about the company's credibility and compliance with industry standards. The absence of certain details such as minimum deposit, leverage, spread, and deposit/withdrawal methods also presents a limitation in terms of transparency and client information.

Here is a table listing the pros and cons:

| Pros | Cons |

| Diverse range of tradable assets | Lack of specific regulation and licensing |

| Availability of Live and Demo accounts | Reported revocation of Vanuatu license and suspicious clone claim |

| Utilization of MetaTrader 4 platform | Absence of certain details such as minimum deposit |

| Limited transparency and client information |

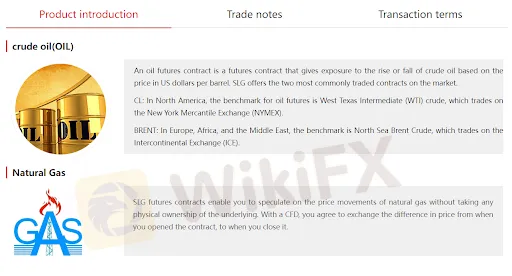

SLG Markets offers trading options including precious metals, commodities, futures contracts, indices, and cryptocurrencies, providing investors with opportunities to engage in alternative investments, speculate on price movements, and track market performance.

Precious Metals: SLG Markets allows trading in precious metals such as gold, silver, platinum, and palladium. These metals are considered as alternative investment assets and are often influenced by factors like economic conditions, inflation, and geopolitical events.

Commodities: SLG Markets provides opportunities to trade commodities, including crude oil, natural gas, agricultural products (such as wheat, corn, or soybeans), and metals. Commodities are physical goods that are widely used in industries, and their prices can be impacted by supply and demand dynamics, global events, and weather conditions.

Futures: SLG Markets enables trading in futures contracts, which are standardized agreements to buy or sell an underlying asset at a predetermined price and date in the future. Futures can cover various assets, including commodities, currencies, stock indices, and interest rates. They allow traders to speculate on price movements without owning the underlying asset.

Indices: SLG Markets offers trading opportunities in indices, which represent a basket of stocks or other assets that track the performance of specific markets or sectors. Examples of indices include the S&P 500, Dow Jones Industrial Average, and FTSE 100. Traders can speculate on the price movements of these indices, providing exposure to broader market trends.

Cryptocurrencies: SLG Markets allows trading in cryptocurrencies, which are digital or virtual currencies that utilize cryptographic technology. Popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple are available for trading. Cryptocurrency trading offers the potential for high volatility and speculative opportunities based on market demand and technological developments.

The following table is a representation of the market instruments available by SLG Markets compared to competitors:

| Broker | Market Instruments |

| SLG Markets | Precious Metals, Commodities, Futures, Indices, Cryptocurrencies |

| Alpari | Precious Metals, Commodities, Indices, Cryptocurrencies |

| HotForex | Precious Metals, Commodities, Indices, Cryptocurrencies |

| IC Markets | Precious Metals, Commodities, Futures, Indices, Cryptocurrencies |

| RoboForex | Precious Metals, Commodities, Indices, Cryptocurrencies |

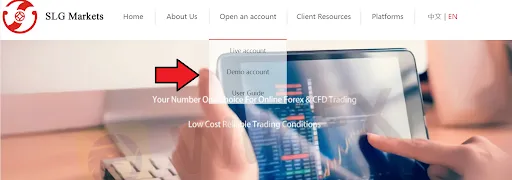

SLG Markets offers two account types for traders. Here is a summarized description of each account type:

Live Account: SLG Markets provides Live Accounts for clients who want to engage in real-time trading with actual funds. With a Live Account, traders can execute real trades and access various tradable instruments such as precious metals, commodities, futures, indices, and cryptocurrencies. The specific features, including minimum deposit, leverage, spread, and deposit/withdrawal methods, are not provided in the available information.

Demo Account: SLG Markets also offers Demo Accounts, which allow traders to practice trading strategies or explore the platform's features without risking real money. A Demo Account provides a simulated trading environment where traders can trade virtual funds using real-time market data. It allows traders to familiarize themselves with the platform, test strategies, and gain experience without financial risks.

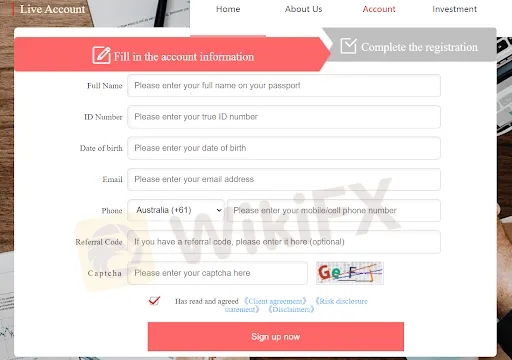

To open an account on SLG Markets' brokerage website, you can follow these general steps:

1. Visit SLG Markets' Official Website: Go to the official website of SLG Markets to ensure you are accessing the correct platform and safeguarding your personal information.

2. Account Registration: Look for the “Sign Up” or “Open an Account” button on the website and click on it to initiate the account registration process.

3. Provide Personal Information: Fill out the required fields in the registration form accurately. Enter your full name, email address, phone number, and country of residence as requested. Proceed to the next step following the instructions provided.

4. Choose Account Type: Select the desired account type, whether it's a Live Account or Demo Account, based on your trading preferences and goals.

5. Agree to Terms and Conditions: Review and understand SLG Markets' terms and conditions. If you agree to them, indicate your acceptance by ticking the checkbox or clicking the appropriate button to proceed.

6. Verification Process: Complete the verification process as required by SLG Markets. This may involve submitting scanned or photographed copies of identification documents, such as your passport or driver's license, as well as proof of address documents like utility bills or bank statements.

7. Fund Your Account: After successfully registering and verifying your account, proceed to fund it by following SLG Markets' instructions. They will provide details on available payment methods and the minimum deposit requirement.

To initiate a withdrawal, you need to access the “customer center” tab in the client portal on SLG Markets' website. From there, you can click on the “withdraw” button located at the top of the page. This will direct you to a form where you can enter the necessary details to submit your withdrawal request. Once submitted, you can track the status of your withdrawal in the “fund record” section, which allows you to view your account history and monitor pending withdrawals.

SLG Markets offers the MetaTrader 4 (MT4) trading platform for its clients. MT4 is a popular and widely recognized platform known for its comprehensive features, user-friendly interface, and advanced charting tools. It provides traders with a robust trading environment, allowing them to analyze market trends, execute trades, and manage their positions efficiently. The platform also supports automated trading through expert advisors (EAs) and offers a wide range of technical indicators for in-depth market analysis.

The following is a table which compares SLG Markets' available trading platforms to that of other competing brokerages:

| Broker | Trading Platforms |

| SLG Markets | MetaTrader 4 (MT4) |

| Alpari | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| HotForex | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| IC Markets | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| RoboForex | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

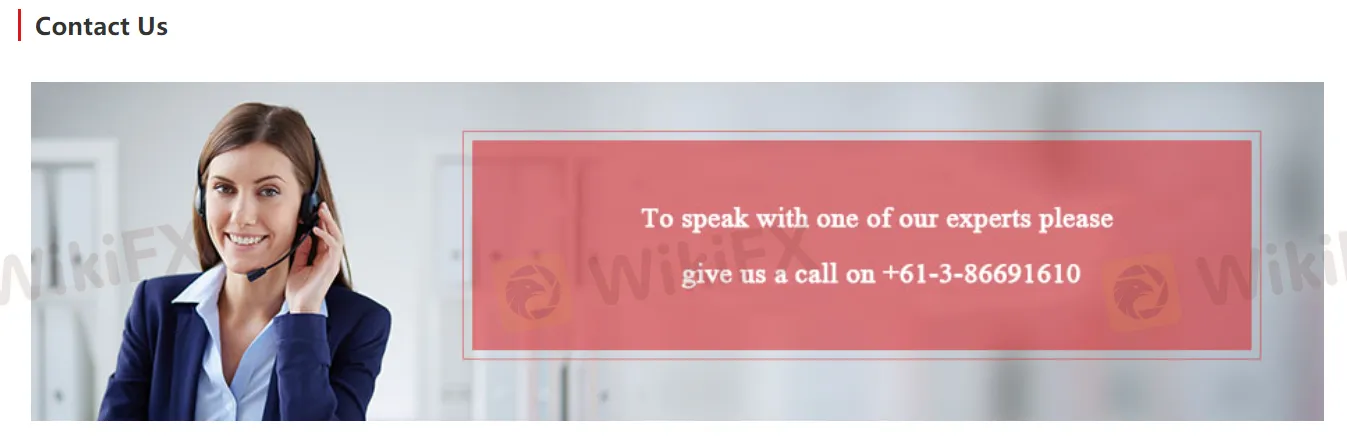

SLG Markets offers Phone Support, Email, and Live Chat support. The specifics are as follows:

Phone Support: SLG Markets provides a phone line support method, which can be contacted by calling +61-3-86691610.

Email Support: SLG Markets provides customer support through email at info@slgmtk.co.

Live Chat Support: SLG Markets offers live chat support for registered members. This feature allows customers to engage in real-time conversations with the customer support team directly on their website or trading platform.

Based on customer reviews, there are a few common concerns raised by clients of SLG Markets. One complaint mentions difficulties in closing positions after profiting, with forced liquidation occurring without permission. Another review describes a scam platform that allegedly places adverse orders to liquidate client accounts. There is also a complaint about being induced to deposit funds only to have the account forced to liquidation the following day. These reviews raise concerns about the transparency and integrity of SLG Markets' operations, highlighting potential issues with account management and customer support.

SLG Markets, operating under the name SUN LONG GMTK INTERNATIONAL LIMITED, is a financial services provider headquartered in Vanuatu. Although founded within the past 2-5 years, SLG Markets offers a range of trading services in various market instruments such as precious metals, commodities, futures, indices, and cryptocurrencies. Traders have the option to choose between Live Accounts and Demo Accounts, allowing them to engage in real-time trading or practice strategies with virtual funds. The company utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its comprehensive features and user-friendly interface.

In conclusion, SLG Markets presents potential opportunities for traders to participate in various markets with a diverse range of assets. However, the absence of specific regulation and licensing poses risks for clients, as there is no formal oversight to ensure adherence to industry standards and protect investor interests.

Q: What trading instruments are available for trading with SLG Markets?

A: SLG Markets offers a diverse range of tradable assets, including precious metals, commodities, futures, indices, and cryptocurrencies.

Q: How can I contact SLG Markets' customer support?

A: You can reach SLG Markets' customer support team through email at info@slgmtk.co.

Q: Is SLG Markets regulated?

A: Unfortunately, SLG Markets operates without specific regulation or licensing, raising concerns about investor protection.

Q: What trading platform does SLG Markets offer?

A: SLG Markets provides traders with the widely recognized MetaTrader 4 (MT4) platform for their trading activities.

Q: Can I practice trading strategies before using real funds with SLG Markets?

A: Yes, SLG Markets offers Demo Accounts where you can practice trading strategies using virtual funds.

Q: Are there any withdrawal fees associated with SLG Markets?

A: The available information does not mention specific details about withdrawal fees imposed by SLG Markets.

Sort by content

User comment

2

CommentsWrite a review

2022-12-14 17:28

2022-12-14 17:28

2022-10-12 00:17

2022-10-12 00:17