简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Surges on Escalating Middle East Tensions

摘要:Gold prices surged to near-record highs, driven by a subdued US Producer Prices Index, fueling expectations of Federal Reserve rate cuts and bolstering gold's appeal as a safe-haven asset amidst escalating geopolitical tensions, notably between Israel and Iran.

Gold Surges on Escalating Middle East Tensions

Gold Surges on Rate Cut Expectations & Geopolitical Uncertainty

US Dollar Rebounds Despite PPI Dip, Job Data Supports Recovery

Crude Oil Holds Firm Amid Middle East Tensions, Supply Disruption Risks

Market Summary

Gold prices surged to near-record highs, driven by a subdued US Producer Prices Index, fueling expectations of Federal Reserve rate cuts and bolstering gold's appeal as a safe-haven asset amidst escalating geopolitical tensions, notably between Israel and Iran. Meanwhile, the US Dollar initially stumbled following lower-than-expected PPI data but rebounded as bullish job reports alleviated concerns. Crude oil prices maintained upward momentum amidst Middle East tensions, with Iran's retaliation threats supporting prices despite tempered gains due to economic uncertainties. Conversely, the Euro faced significant downward pressure as the European Central Bank hinted at a possible interest rate cut in June to combat stagnant economic growth, signalling a dovish stance from policymakers.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

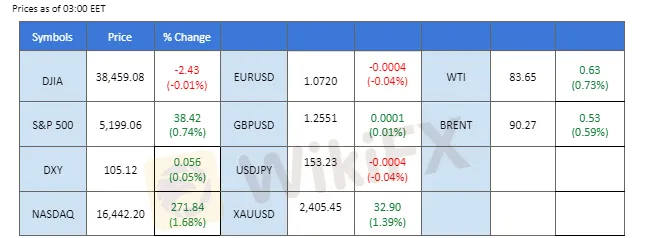

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

Initially faltering after the release of a lower-than-expected US Producer Price Index (PPI), the US Dollar rebounded amidst uncertainties surrounding interest rates. Despite the PPI slipping from 0.60% to 0.20%, indicating subdued changes in manufacturer prices and mitigating inflation risks, the Dollar's losses were tempered by a bullish jobs report. US Initial Jobless Claims performed better than expected at 211K, surpassing market forecasts of 216K, providing support to the Dollar's recovery.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 66, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 105.40, 106.00

Support level:104.95, 104.45

XAU/USD, H1

Gold prices surged to near-record highs, propelled by a downbeat US Producer Prices Index, which heightened expectations of Federal Reserve rate cuts and bolstered the allure of the safe-haven asset amidst geopolitical tensions. US President Joe Biden's pledge of unwavering support to Israel amid escalating tensions with Iran further fueled investor appetite for gold as a hedge against geopolitical risks and inflationary pressures.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 80, suggesting the commodity might enter overbought territory.

Resistance level: 2400.00, 2420.00

Support level: 2385.00, 2375.00

AUD/USD,H4

Meanwhile, the Reserve Bank of Australia (RBA) reiterated its commitment to current monetary policy in its March meeting minutes. Futures for the RBA cash rate suggest an expectation of approximately 50 basis points of policy rate cuts in 2024, with the first cut potentially occurring in December.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6585, 0.6640

Support level: 0.6500, 0.6445

EUR/USD,H4

The Euro faced significant downward pressure following the European Central Bank's dovish stance on monetary policy, signalling an imminent interest rate cut amid stagnant economic growth. While the ECB maintained its interest rate unchanged, President Christine Lagarde's announcement of considering rate cuts in June, coupled with the bank's cautious language, weighed heavily on the Euro. The ECB's shift in language and acknowledgment of downside risks underscored the need for accommodative measures to spur economic recovery.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the pair might enter oversold territory.

Resistance level: 1.0775, 1.0870

Support level: 1.0710, 1.0655

USD/JPY,H4

The Japanese yen continued to hover around record lows against the US dollar as investors monitored the potential for currency intervention from the Bank of Japan. Japanese Finance Minister Shunichi Suzuki emphasised the authorities' readiness to address excessive exchange-rate swings, signalling the possibility of intervention to stabilise currency movements. Uncertainty persists regarding the timing of such interventions, prompting investors to closely monitor developments for trading cues.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 153.10, 154.75

Support level: 151.95, 150.80

Dow Jones, H4

The US equity market edged higher as US Treasury yields retraced following the release of a downbeat inflation report, complicating the Federal Reserve's interest rate outlook. The US Producer Prices Index rose by a slightly lower-than-expected 0.20% in March, dampening investor expectations for a June rate cut after consumer inflation data for the same period surpassed forecasts. Market sentiment shifted, with the likelihood of a June rate cut now seen at only 24%, down significantly from 61.1% the previous week.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 39150.00, 39855.00

Support level: 37700.00, 36560.00

BTC/USD, H4

With the Bitcoin halving event imminent, discussions in the cryptocurrency community are rife with predictions about its impact on mining profitability and Bitcoin's price trajectory. Analysts foresee a potential 30% to 40% decline in industry-wide gross profits post-halving, prompting consolidation and closures among mining operators. Despite this, some remain optimistic, citing historical trends of post-halving price rallies.

BTC/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the crypto might extend its gains after breakout above the resistance level.

Resistance level: 71510.0, 73520.0

Support level: 64965.0, 61380.0

CL OIL, H4

Crude oil prices maintained a positive trajectory amidst heightened tensions in the Middle East, with Iran vowing retaliation for a suspected Israeli air strike on its embassy in Syria. The potential for supply disruptions from the oil-producing region supported oil prices, although gains were tempered by a pessimistic economic outlook following the European Central Bank's downgraded economic prospects.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 87.90, 90.80

Support level: 85.35, 83.05

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

热点资讯

美国国债收益率上升之际美元/瑞郎持稳于0.8650附近,可能进一步上涨

英镑/美元价格预测:跌破1.3000关口后,空头占主导

欧元/英镑小幅上涨至0.8350附近,关注德国和欧元区GDP数据

从12月1日起,旧版MetaTrader 4和5将停止支持

ATFX推出自营交易服务

受美国大选不确定性和地缘政治风险偏好影响,黄金价格再创历史新高

2024美国大选如何改变外汇市场?价差与流动性的深度解析

多平台遭拉黑,其中一平台涉嫌诈骗,AI竟成帮凶

美元/加元价格预测:迟迟无法突破至1.3900上方

中欧和东欧:波兰政府将讨论提高预算赤字问题 - 荷兰国际集团

汇率计算